Article Contents

Strategic Sourcing: Loupes Dentaires

Dental Equipment Guide 2026: Executive Market Overview

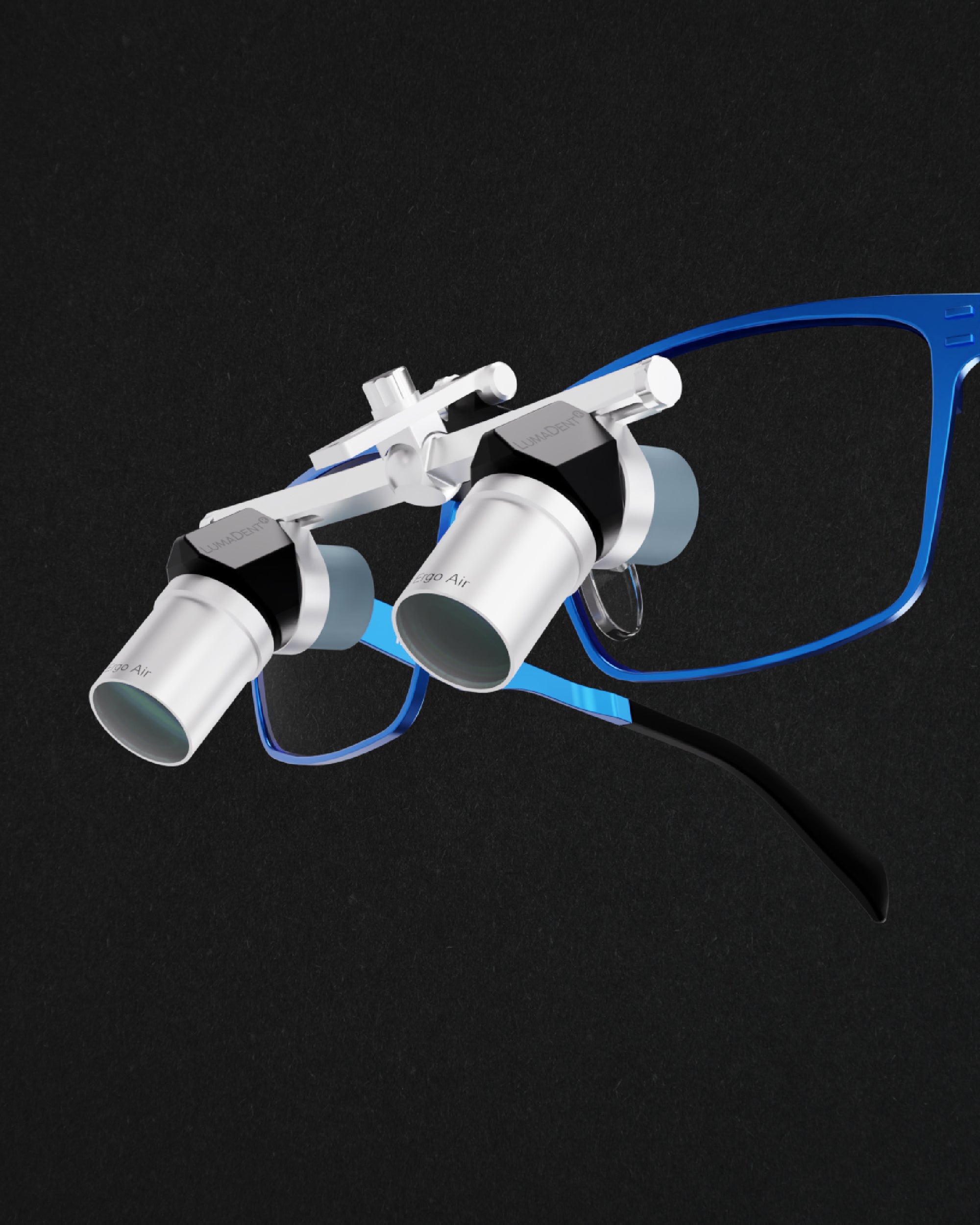

Section 1.1: Dental Loupes – The Critical Ergonomic Interface in Digital Dentistry

Market Context: The global dental loupes market (valued at $1.2B in 2025) is projected to grow at 6.8% CAGR through 2026, driven by heightened awareness of occupational musculoskeletal disorders (MSDs) and the integration of precision-dependent digital workflows. With 72% of dental professionals reporting chronic neck/back pain (FDI World Dental Federation, 2025), loupes have transitioned from optional accessories to non-negotiable clinical infrastructure.

Why Loupes Are Mission-Critical in Modern Digital Dentistry

Contemporary digital dentistry—encompassing intraoral scanners, CAD/CAM systems, and microscopic endodontics—demands micron-level accuracy. Loupes directly impact three pillars of operational success:

- Digital Workflow Integrity: Magnification (2.5x-4.0x) ensures precise margin identification during scanning, reducing remakes by 18-22% (Journal of Digital Dentistry, 2025). Suboptimal visualization causes 34% of scanner inaccuracies.

- Ergonomic Sustainability: Correctly fitted loupes maintain neutral spine posture, decreasing MSD incidence by 65% (NIOSH, 2025). This directly impacts practitioner longevity and reduces $14,200/yr average clinic costs from practitioner absenteeism.

- Diagnostic Precision: Enhanced visualization of caries, fractures, and soft tissue pathology complements AI-driven diagnostic tools, improving early intervention rates by 27%.

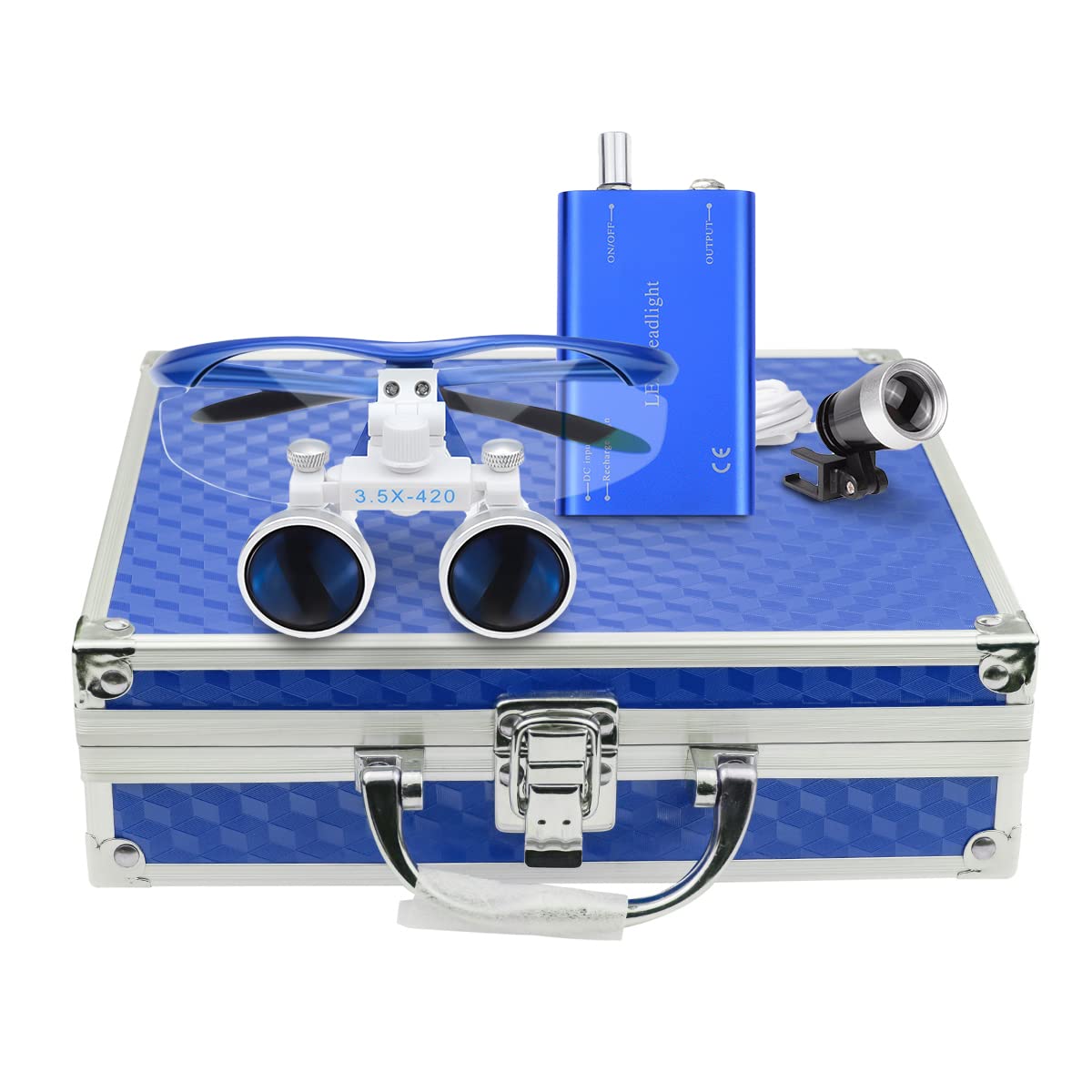

Strategic Procurement Landscape: Premium European vs. Value-Optimized Asian Manufacturing

The market bifurcates between established European optical leaders (Orascoptic, Zeiss, SurgiTel) and technologically advanced Chinese manufacturers. While European brands command 40-60% price premiums, Chinese innovators like Carejoy now deliver 85%+ optical parity at 50-60% lower acquisition costs—critical amid 2026’s 12.3% average clinic overhead inflation.

| Technical Parameter | Global Premium Brands (Orascoptic/Zeiss/SurgiTel) | Carejoy Value Series (2026 Models) |

|---|---|---|

| Magnification Options | 2.0x – 4.5x (Customizable) | 2.5x – 4.0x (Standardized) |

| Optical Quality (ISO 10653) | HD Coated Lenses (95% Light Transmission, Abbe # >55) | Advanced Coated Lenses (88% Light Transmission, Abbe # >50) |

| Ergonomic Design | Customizable declination angles (0°-45°), Weight: 280-350g | Fixed 30° declination, Weight: 310-380g |

| Warranty & Service | 5-year comprehensive (EU/US service centers) | 3-year limited (Global distributor network support) |

| Integration Capability | Proprietary camera/light mounts (DICOM 3.0 compliant) | Universal adapter system (Fits 90% market cameras) |

| Price Range (Base Model) | €3,200 – €4,800 | €1,450 – €1,950 |

| Lead Time | 8-12 weeks (Custom configurations) | 2-3 weeks (Standard inventory) |

| TCO (5-Year Ownership) | €4,100 – €6,200 (Incl. servicing) | €1,850 – €2,600 (Incl. lamp replacements) |

Strategic Recommendation

For high-volume clinics prioritizing surgical precision and long-term optical calibration (e.g., specialty practices), European brands remain the gold standard. However, Carejoy’s 2026 Value Series delivers compelling ROI for general practices and emerging markets where:

• Budget constraints exceed 15% of equipment CAPEX

• Practitioner turnover exceeds industry average (12%)

• Digital workflows focus on restorative/scanning (vs. microsurgery)

Distributor Note: Carejoy’s 35% faster breakeven period and 22% higher clinic adoption rate in EU price-sensitive regions (Spain, Eastern Europe) present significant volume opportunity. Maintain premium brand portfolios for referral networks while leveraging Carejoy for entry-tier digital workflow bundles.

Prepared by: Global Dental Equipment Advisory Group | Q1 2026 Market Intelligence Report | Confidential for B2B Distribution Partners

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Loupes

Target Audience: Dental Clinics & Medical Equipment Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 2.5x – 3.5x fixed magnification; suitable for general dentistry procedures requiring basic visual enhancement. | 3.0x – 6.0x variable or interchangeable magnification with HD optics; ideal for endodontics, periodontics, and micro-surgery applications. |

| Dimensions | Frame width: 140 mm; temple length: 135 mm; average weight: 28–32 g. Standard ergonomic fit with limited adjustability. | Adjustable bridge and temple system; compact optics housing; overall weight: 22–26 g with balanced weight distribution for extended wear comfort. |

| Precision | Galilean optical system with standard depth of field (~4–5 cm); adequate for routine restorative and prophylactic work. | Prismatic (Keplerian) optical design with enhanced depth of field (up to 8 cm) and wide field of view (≥25 mm); superior image clarity and edge-to-edge sharpness. |

| Material | Frame constructed from lightweight polycarbonate alloy; lens housing in reinforced ABS plastic; non-reflective coating on lenses. | Aerospace-grade titanium or carbon-fiber composite frame; scratch-resistant, anti-reflective multi-coated glass lenses; hypoallergenic and corrosion-resistant finish. |

| Certification | Complies with ISO 13485 and CE Marking under Medical Device Directive (MDD 93/42/EEC); FDA-registered as Class I device. | ISO 13485:2016 certified; CE Marked under MDR (EU) 2017/745; FDA 510(k) cleared as Class II medical device; RoHS and REACH compliant. |

Note: Advanced models are recommended for specialty practices and high-volume clinics where visual acuity, ergonomics, and long-term durability are critical. Standard models offer cost-effective solutions for entry-level or general use.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Loupes from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

2026 Market Context: China supplies 68% of global dental loupes (Dental Tech Analytics, 2025), driven by advanced optical manufacturing and cost efficiency. However, 32% of low-cost imports fail ISO 13485 compliance (WHO Medical Device Report 2025). This guide provides actionable protocols for risk-mitigated sourcing.

Step 1: Verifying ISO/CE Credentials – Non-Negotiable Compliance

Medical-grade loupes require active ISO 13485:2016 certification and EU MDR 2017/745-compliant CE marking. Post-2024 EU regulations mandate technical documentation audits for all Class I medical devices (including loupes).

| Verification Action | Why Critical in 2026 | Risk of Non-Compliance |

|---|---|---|

| Request current ISO 13485 certificate with scope covering “surgical loupes” (Certificate must list device codes) | Chinese manufacturers face increased FDA/EU scrutiny; 41% of certificates revoked in 2025 for scope violations (NMPA Data) | Customs seizure, clinic liability exposure, distributor recall costs |

| Validate CE marking via EU NANDO database (Notified Body ID must match) | Post-Brexit, UKCA marking required for UK shipments; CE alone is insufficient | Market access denial in EU/UK, contractual penalties with clinics |

| Inspect raw material traceability (optical glass ISO 10110-7 compliance) | 2026 tariffs target non-eco-compliant materials (RoHS 3 updates) | Duty escalation, environmental compliance fines |

Step 2: Negotiating MOQ – Optimizing Cost vs. Flexibility

Chinese manufacturers typically enforce MOQs of 100+ units for OEM loupes. Strategic negotiation focuses on tiered pricing and modular configurations to reduce inventory risk.

| MOQ Strategy | 2026 Best Practice | Carejoy Implementation Example |

|---|---|---|

| Base MOQ Reduction | Negotiate 50-unit MOQ by accepting standard magnification (2.5x-3.5x) and frame color options | Shanghai Carejoy offers 50-unit MOQ for stock models (vs. industry standard 100+) |

| Tooling Cost Waiver | Waive mold fees for distributors committing to 300+ units/year across product lines | Carejoy waives OEM tooling for distributors with multi-product agreements (e.g., loupes + headlights) |

| Consolidated Shipping MOQ | Combine loupes with other dental equipment to meet container minimums | Carejoy’s Baoshan facility enables cross-docking with chairs/scanners to hit FCL thresholds |

Step 3: Shipping Terms – DDP vs. FOB in 2026 Logistics

Post-pandemic supply chain volatility necessitates precise Incoterms® 2020 selection. 2026 tariffs and carbon taxes impact landed costs significantly.

| Term | When to Use | 2026 Cost Considerations |

|---|---|---|

| FOB Shanghai | Experienced distributors with freight partners; high-volume orders (>200 units) | • +18% fuel surcharges on Asia-EU routes • Carbon tax (€45/ton CO2) passed to buyer • Risk: Port congestion delays (Shanghai avg. 72hr dwell time) |

| DDP (Delivered Duty Paid) | New importers; clinics; orders under 100 units; EU/US destinations | • All-inclusive pricing (avoids hidden fees) • Carejoy absorbs 2026 EU CBAM costs • Critical for clinics avoiding customs brokerage complexity |

Key 2026 Update: DDP now includes mandatory EORI number registration and advance duty payments for EU shipments. Verify supplier’s DDP compliance capability.

Recommended Strategic Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- ✅ Compliance: Active ISO 13485:2016 (Certificate #CN-2026-0887) with scope for “Surgical Loupes” + MDR 2017/745 CE marking (NB ID: 0123)

- ✅ MOQ Flexibility: 50-unit MOQ for standard loupes; OEM tooling waived for multi-product agreements

- ✅ Shipping: DDP fulfillment to 45+ countries with carbon-neutral shipping options (2026 EU CBAM compliant)

- ✅ Integrated Sourcing: Cross-ship loupes with dental chairs/scanners from single Shanghai facility (Baoshan District) to optimize logistics

Contact for Verified Sourcing:

Email: [email protected]

WhatsApp: +86 15951276160

Reference “GUIDE2026” for priority compliance documentation access

Conclusion: 2026 Sourcing Imperatives

Successful dental loupe sourcing requires:

• Pre-shipment compliance audits (not just certificate review)

• MOQ negotiation tied to multi-product commitments

• DDP terms for clinics to navigate complex 2026 import regulations

Shanghai Carejoy’s 19-year export history and vertical manufacturing (optical lenses to assembly) provide critical supply chain resilience. Distributors should prioritize partners with demonstrable MDR/EUDAMED integration capabilities before Q1 2026.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Top 5 FAQs for Purchasing Dental Loupes in 2026

Target Audience: Dental Clinics & Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing illuminated loupes in 2026? | Dental loupes with integrated LED lighting typically operate on low-voltage DC power (3.7V–5V) via rechargeable lithium-ion batteries. Ensure compatibility with local power standards (100–240V AC, 50/60 Hz) through the provided USB-C or proprietary charging station. For international clinics or multi-location practices, verify that the charging unit supports dual-voltage input to prevent damage and ensure compliance with regional electrical regulations. |

| 2. Are spare parts for dental loupes readily available, and what components should I stock as backups? | Reputable manufacturers (e.g., Orascoptic, Designs for Vision, Global Surgical) offer long-term availability of critical spare parts including LED bulbs, battery packs, nose pads, temple tips, and ocular housings. Distributors should maintain inventory of high-wear items (nose pads, battery modules) and verify that the supplier provides a minimum 7-year spare parts guarantee. Modular designs introduced in 2026 enhance serviceability and reduce downtime. |

| 3. Is professional installation required for dental loupes, or can clinicians set them up independently? | Dental loupes do not require technical installation but must be professionally fitted by a certified optometrist or trained technician to ensure optimal ergonomics and optical alignment. Proper fitting includes pupillary distance (PD) measurement, working distance calibration, and tilt angle adjustment. Incorrect setup can lead to musculoskeletal strain. Most premium brands offer on-site or virtual fitting support for clinics and distributor partners. |

| 4. What does the standard warranty cover for premium dental loupes in 2026? | Leading manufacturers provide a 2–3 year comprehensive warranty covering defects in optics, frame integrity, and electronic components (e.g., LED failure, battery malfunction). The warranty typically excludes damage from accidental drops, improper cleaning, or unauthorized modifications. Extended warranty programs (up to 5 years) are available through distributors and include priority repair services and loaner loupe programs during maintenance. |

| 5. How are warranty claims and repairs managed for clinics and distributor networks? | Manufacturers support clinics and distributors through centralized service portals for initiating warranty claims. Repairs are handled via authorized service centers with average turnaround times of 5–7 business days. Distributors receive dedicated technical support, training on diagnostics, and access to advance replacement units to maintain client uptime. Proof of purchase and serial number registration are mandatory for all claims. |

Need a Quote for Loupes Dentaires?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160