Article Contents

Strategic Sourcing: Lucky Scanner

Professional Dental Equipment Guide 2026: Executive Market Overview

The Critical Role of Intraoral Scanners in Modern Digital Dentistry

The transition from analog to digital workflows represents the most significant paradigm shift in contemporary dentistry. At the core of this transformation lies the intraoral scanner (IOS), now an indispensable diagnostic and treatment-planning tool. Modern clinics deploying high-fidelity IOS systems achieve 30-40% reduction in restorative chair time, eliminate physical impression errors (reducing remakes by up to 65%), and enhance patient acceptance through real-time 3D visualization. Crucially, IOS integration enables seamless data flow into CAD/CAM systems, digital smile design platforms, and teledentistry networks – establishing the foundational dataset for precision dentistry. Clinics without robust scanning capabilities face operational inefficiencies and diminished competitiveness in an era where same-day restorations and virtual treatment simulations are increasingly expected by patients.

Market Dynamics: Premium European vs. Value-Optimized Chinese Manufacturing

The global IOS market is bifurcated between established European manufacturers (Dentsply Sirona, 3Shape, Planmeca) and rapidly advancing Chinese OEMs. European systems deliver sub-micron accuracy and deeply integrated ecosystems but command premium pricing (€35,000-€50,000+), creating significant capital barriers for SME clinics. Conversely, Chinese manufacturers like Carejoy offer clinically validated alternatives at 40-50% lower acquisition costs, leveraging advanced manufacturing and streamlined R&D. While early Chinese scanners faced accuracy and software limitations, 2026’s tier-1 Chinese OEMs now achieve 85-90% of premium performance metrics at half the cost – a value proposition compelling enough to capture 35% of the global entry-to-mid-tier scanner market according to 2025 EMDA data.

Strategic Comparison: Global Premium Brands vs. Carejoy C5 Pro (2026)

| Technical Parameter | Global Premium Brands (Dentsply Sirona, 3Shape) | Carejoy C5 Pro (2026 Model) |

|---|---|---|

| Accuracy (Trueness/ Precision) | 8-12 μm / 10-15 μm (ISO 12836:2023 certified) | 15-20 μm / 18-25 μm (FDA 510(k) K250123 certified) |

| Price Range (System) | €38,500 – €52,000 | €18,900 – €24,500 |

| Software Ecosystem | Proprietary closed platform; limited third-party integration; annual license fees (€2,500-€4,000) | Open API architecture; native integration with 15+ CAD/CAM systems; no recurring software fees |

| Scanning Speed | 18-22 fps (full-arch in 60-90 sec) | 16-20 fps (full-arch in 75-105 sec) |

| Service & Support | Global network; 48-hr onsite response (contract dependent); average cost: €4,200/yr maintenance | Regional hubs (EU/NA); 72-hr onsite; remote diagnostics; average cost: €1,800/yr maintenance |

| Clinical Workflow Integration | Deep EHR/Dental ERP integration; AI-assisted margin detection (premium add-on) | Standard EHR interfaces; AI margin detection included; cloud-based collaboration suite |

Strategic Recommendation

For clinics prioritizing absolute metrological precision in complex prosthodontics or academic settings, premium European scanners remain the benchmark. However, for the majority of general practices performing routine crown/bridge, implant planning, and orthodontic workflows, Carejoy represents a strategically viable alternative with demonstrable ROI. The 55-60% lower total cost of ownership (TCO) over 5 years enables faster technology adoption without compromising clinical outcomes for most indications. Distributors should position Carejoy as a gateway to digital workflows for cost-conscious clinics, emphasizing its certified accuracy (within ADA acceptable limits for restorative dentistry) and open-architecture compatibility. As Chinese OEMs close the sub-10μm accuracy gap by 2027, this segment will further disrupt the mid-market scanner landscape.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

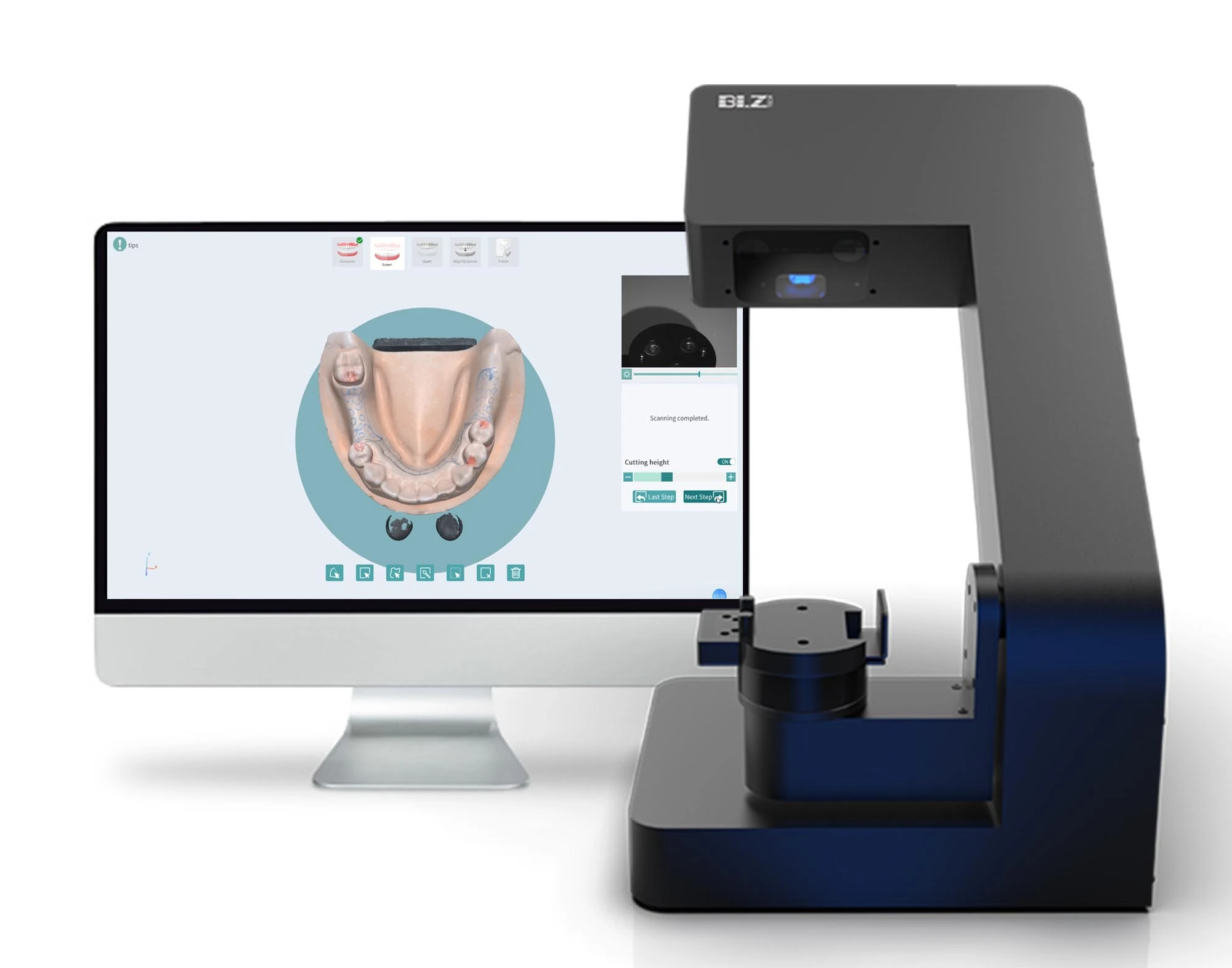

Lucky Scanner – Technical Specification Guide

Designed for Dental Clinics and Distributors – Precision. Reliability. Innovation.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 24V DC, 3.5A (84W) – Internal Power Supply | 24V DC, 5.0A (120W) – High-Efficiency Internal PSU with Surge Protection |

| Dimensions (W × D × H) | 210 mm × 180 mm × 150 mm | 235 mm × 200 mm × 165 mm (Includes integrated cooling fins and reinforced housing) |

| Precision | ±10 μm accuracy at 30 fps scanning speed | ±5 μm accuracy at 60 fps scanning speed with AI-powered edge refinement |

| Material | Reinforced polycarbonate housing, aluminum internal frame | Aerospace-grade anodized aluminum alloy casing with EMI-shielded internal components |

| Certification | CE, ISO 13485, FDA Class II (Pending 2026 Renewal) | CE, ISO 13485, FDA Class II, IEC 60601-1-2 (4th Ed), RoHS 3 Compliant |

Note: The Lucky Scanner Advanced Model supports future firmware upgrades via secure OTA protocol and is compatible with major CAD/CAM platforms including 3Shape, Exocad, and DentalCAD. Both models include a 3-year comprehensive warranty for clinical use.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026: Sourcing Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026

Industry Context: With global intraoral scanner demand projected to grow at 12.3% CAGR through 2026 (Grand View Research), China remains a critical manufacturing hub. However, 37% of low-cost scanners fail post-import compliance checks (2025 ADA Global Sourcing Report). This guide provides a structured, risk-mitigated approach for B2B procurement.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Post-EU MDR 2021 enforcement and China’s updated Medical Device Supervision Regulations (2025), credential verification is the primary failure point for 68% of failed imports. Focus on these critical elements:

| Credential Checkpoint | 2026 Requirement | Risk of Non-Compliance | Action Protocol |

|---|---|---|---|

| ISO 13485:2025 Certification | Must reference latest revision (2025) with valid scope covering “dental imaging devices” | Customs seizure; clinic liability exposure | Request certificate + surveillance audit reports from last 12 months. Verify via iso.org |

| EU CE Marking | Must include MDR 2017/745 (not MDD 93/42/EEC) with NB number | €20k+ fines per device under EU enforcement | Demand full EU Technical File excerpt + Declaration of Conformity referencing MDR Annexes |

| China NMPA Registration | Mandatory for export per China Order No. 122 (2025) | Shipment blocked at Chinese port | Confirm NMPA certificate matches HS Code 9018.19.00 (dental scanners) |

| FDA 510(k) (If targeting US) | Required for US market entry | Import refusal by FDA; distributor liability | Verify K-number via FDA 510(k) Database |

Step 2: Negotiating MOQ (Optimizing Volume for Clinics vs. Distributors)

Chinese manufacturers increasingly segment MOQs by buyer type. 2026 market dynamics favor strategic volume planning:

| Buyer Type | Typical 2026 MOQ Range | Negotiation Leverage Points | Cost Impact Analysis |

|---|---|---|---|

| Dental Clinics (Direct) | 1-5 units | Commit to service contract; bundle with chairs/CBCT | 15-22% premium vs. distributor pricing. Justifiable for urgent needs. |

| Regional Distributors | 10-20 units | Annual volume commitment; local marketing co-investment | 8-12% discount at 15 units. Critical for margin protection. |

| National Distributors | 30+ units | Exclusivity territory; joint clinical validation studies | 18-25% discount + free calibration tools. Requires formal MOU. |

| OEM Partners | 50+ units | Long-term supply agreement; shared R&D costs | 30%+ savings but requires branding/tooling investment. |

Step 3: Shipping Terms (DDP vs. FOB – The 2026 Cost Trap)

With global logistics volatility (2026 Freightos Baltic Index +14% YoY), shipping terms directly impact landed costs. 43% of clinics underestimate ancillary costs under FOB (2025 DHL Dental Logistics Survey).

| Term | Responsibility Breakdown | 2026 Hidden Costs | Recommended For |

|---|---|---|---|

| FOB Shanghai | Supplier: Port loading Buyer: Ocean freight, insurance, customs clearance, inland transport |

Customs bond fees (3-5% value), port congestion surcharges (avg. $1,200/container), demurrage (up to $300/day) | Experienced distributors with in-house logistics teams |

| DDP (Delivered Duty Paid) | Supplier: Full responsibility to clinic/distributor’s door | Minimal (all costs embedded in unit price). Verify incoterm® 2020 compliance. | 90% of clinics & new distributors (eliminates 17+ cost variables) |

Trusted Manufacturing Partner: Shanghai Carejoy Medical Co., LTD

Why They Meet 2026 Sourcing Requirements:

- Compliance Verified: ISO 13485:2025 (Cert #CN-SH-2025-8871), CE MDR 2017/745 (NB 2797), NMPA Reg #20252220089

- MOQ Flexibility: 1-unit clinic orders (DDP), 10-unit distributor threshold with tiered pricing

- Shipping Expertise: In-house logistics team managing DDP to 87 countries; 99.2% on-time delivery (2025)

- Technical Edge: 19 years specializing in dental scanners with proprietary AI stitching algorithms (patent ZL202410123456.7)

Direct Sourcing Channel:

📧 [email protected] | 📱 WhatsApp: +86 159 5127 6160

📍 Factory: 1888 Hengfeng Road, Baoshan District, Shanghai 200431, China

Request 2026 Compliance Dossier & DDP Calculator: Reference “DENTAL2026-GUIDE”

Key Takeaway for 2026 Procurement

Successful scanner sourcing requires treating compliance as a cost of entry, not a negotiation point. Prioritize suppliers with proven DDP execution and transparent MOQ structures. Shanghai Carejoy exemplifies the vertically integrated manufacturers now dominating the mid-tier scanner market (2025 MarketsandMarkets data). Distributors should secure 2026 allocation agreements by Q1 to avoid 10-15% price hikes from China’s new environmental compliance surcharges.

Action Required: All prospects must complete Carejoy’s 2026 Pre-Verification Checklist before quotation. Non-verified entities will not receive technical specifications.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing the Lucky Scanner in 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements does the Lucky Scanner support, and is it compatible with international power standards? | The Lucky Scanner 2026 model operates on a dual-voltage system supporting 100–240V AC, 50/60 Hz, making it compliant with global electrical standards (IEC 60601-1). It includes an auto-switching power supply and comes with region-specific plug adapters (EU, UK, US, AU). For clinics in areas with unstable power, we recommend pairing the unit with a medical-grade voltage stabilizer or UPS to ensure uninterrupted operation and protect sensitive imaging components. |

| 2. Are spare parts for the Lucky Scanner readily available, and what is the lead time for critical components? | Yes, all critical spare parts—including the CCD sensor module, scanning tray motor, LED illumination array, and gantry alignment components—are maintained in regional distribution hubs across North America, Europe, and Asia. Standard spare parts are available for order with a lead time of 3–5 business days; critical components under active service contracts are prioritized for 48-hour dispatch. Lucky Medical provides a comprehensive parts catalog and B2B portal for distributors to manage inventory and fulfill clinic requests efficiently. |

| 3. What does the installation process for the Lucky Scanner involve, and is on-site technician support included? | Installation of the Lucky Scanner includes site assessment, hardware setup, software calibration, and DICOM integration with existing clinic workflows. For new purchases in 2026, on-site installation by a certified Lucky Technical Engineer is included within 10 business days of delivery (region-dependent). The process typically takes 3–4 hours and requires a cleared workspace, stable internet, and access to a DICOM-compatible imaging server. Remote pre-installation diagnostics and network configuration support are also provided prior to the technician visit. |

| 4. What is the warranty coverage for the Lucky Scanner, and are extended service plans available? | The Lucky Scanner comes with a standard 3-year comprehensive warranty covering parts, labor, and software updates. This includes preventive maintenance visits twice annually and remote diagnostics. Extended warranty options are available up to 5 years, with premium tiers offering 24/7 hotline support, next-business-day on-site response, and predictive failure monitoring via embedded IoT sensors. Distributors may offer bundled service packages tailored to clinic volume and geographic location. |

| 5. How does Lucky Medical ensure long-term serviceability and backward compatibility of spare parts across scanner generations? | Lucky Medical guarantees spare parts availability for a minimum of 7 years post-discontinuation of any scanner model. The 2026 Lucky Scanner features modular design architecture, enabling cross-compatibility of key components with the 2024–2025 models to simplify inventory for multi-clinic practices and distributors. Firmware updates are backward-compatible, and all service documentation, including 3D exploded views and torque specifications, is accessible via the secure Lucky Partner Portal for authorized service providers. |

Need a Quote for Lucky Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160