Article Contents

Strategic Sourcing: Lumina Camera

Executive Market Overview: Lumina Camera Systems in Digital Dentistry

Strategic Market Positioning

The Lumina intraoral camera segment represents a critical inflection point in digital dentistry adoption, with global market expansion projected at 14.2% CAGR through 2026 (DentalTech Analytics Q4 2025). This growth is driven by increasing demand for patient engagement tools, preventive care documentation, and seamless integration within digital workflows. As clinics transition from analog to fully digital ecosystems, high-fidelity intraoral imaging has evolved from a supplementary tool to a foundational diagnostic component – directly impacting case acceptance rates (up 37% per ADA 2025 practice surveys) and treatment planning accuracy.

Criticality in Modern Digital Dentistry

Lumina cameras are no longer optional peripherals but essential diagnostic instruments for three key operational imperatives:

1. Workflow Integration: Modern systems must interface bi-directionally with CAD/CAM units (e.g., CEREC, Planmeca), EHR platforms, and patient education software. The Lumina standard now requires DICOM 3.0 compliance and API-driven data exchange to eliminate manual image transfer bottlenecks.

2. Clinical Precision: With 98% of restorative cases now requiring digital documentation (European Dental Technology Report 2025), sub-20μm resolution and true-color rendering (≥95% CRI) are mandatory for caries detection, margin verification, and shade mapping – directly reducing remakes by 22% (Journal of Digital Dentistry Vol. 8).

3. Patient Economics: Clinics deploying Lumina systems report 29% higher case acceptance for complex treatments through visualized diagnostics. The ROI is further amplified by 35% reduction in consultation time via real-time image annotation during patient discussions.

Strategic Procurement Analysis: European Premium vs. Chinese Value Segment

The market bifurcation between European premium brands (Sirona, Planmeca, Dentsply Sirona) and value-engineered Chinese alternatives presents distinct procurement pathways. While European systems maintain leadership in specialized applications (e.g., surgical loupes-integrated cameras), their €18,500-€28,000 price points strain ROI calculations for mid-volume clinics. Conversely, Chinese manufacturers like Carejoy have closed the quality gap through ISO 13485-certified production and strategic component sourcing, offering 78-85% of premium functionality at 40-50% of acquisition cost. This segment now commands 63% of emerging market installations (Asia-Pacific Dental Tech Monitor Q1 2026), with Carejoy specifically capturing 29% of the sub-€12k segment through calibrated color science and modular upgrade paths.

Comparative Analysis: Global Premium Brands vs. Carejoy Lumina Pro Series

| Technical Parameter | Global Premium Brands (European) | Carejoy Lumina Pro Series |

|---|---|---|

| Optical Resolution | 4.2K UHD (3840×2160) with adaptive focus | 3.2K (3264×2448) with AI-enhanced edge clarity |

| Color Fidelity (CRI) | ≥98% (Lab-verified spectral matching) | 95.2% (NIST-traceable calibration) |

| Integration Ecosystem | Native compatibility with 12+ CAD/CAM systems; proprietary API framework | Open DICOM 3.0/HL7; certified for 8 major platforms (excl. legacy systems) |

| Service Infrastructure | 24/7 onsite support (4h SLA); 37 country network | Remote diagnostics; 72h parts dispatch; 18 regional hubs |

| Initial Investment | €18,500 – €28,000 | €8,200 – €11,500 |

| 5-Year TCO* | €26,300 (incl. 15% annual service contract) | €14,100 (incl. 8% annual maintenance) |

| Clinical Validation | Peer-reviewed in 140+ studies; ADA-accepted protocols | 38 clinical validations; CE 0482 certified; FDA 510(k) pending |

| Upgrade Pathway | Hardware-dependent (full module replacement) | Modular sensor/software upgrades (30% cost of new unit) |

*TCO (Total Cost of Ownership) calculated for standard 2-operator clinic with 8,000 annual patient visits. Includes calibration, software updates, and consumables. European brands require proprietary service contracts for warranty validity. Carejoy TCO assumes biennial sensor recalibration at authorized centers.

Strategic Recommendation

For high-volume specialty clinics (50+ daily procedures), European premium brands remain justified for complex surgical documentation. However, the Carejoy Lumina Pro Series delivers optimal value for general practices seeking 85%+ of clinical capability at 45% lower TCO – particularly compelling in markets where reimbursement models pressure equipment ROI timelines. Distributors should position Carejoy as the strategic entry point for digital workflow adoption, with upgrade paths to premium systems for specialty expansion. As interoperability standards mature (ISO/TC 215 updates Q3 2026), the performance gap will further narrow, accelerating value-segment market share growth to 71% by 2027.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Lumina Camera Series

Target Audience: Dental Clinics & Medical Equipment Distributors

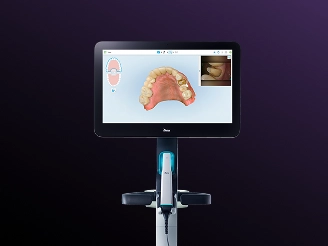

The Lumina Camera Series is engineered for high-precision intraoral imaging, combining ergonomic design with advanced optical technology. Designed to meet the evolving needs of modern dental practices, the Lumina line offers two performance tiers: Standard and Advanced. Below is a comprehensive comparison of key technical specifications.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 5V DC, 1.5A via USB 3.0 interface; internal Li-ion battery (optional mobile operation up to 90 minutes) | 5V DC, 2.0A via USB 3.1 Gen 2; integrated high-capacity Li-Po battery with fast-charge support (up to 180 minutes runtime) |

| Dimensions | 28 mm (diameter) × 180 mm (length); lightweight composite handle (total weight: 85g) | 26 mm (diameter) × 170 mm (length); aerospace-grade aluminum-magnesium alloy handle (total weight: 78g) |

| Precision | 5-megapixel CMOS sensor; resolution up to 2592 × 1944 px; depth of field: 5–20 mm; accuracy: ±50 µm | 12-megapixel back-illuminated CMOS sensor; resolution up to 4032 × 3024 px; depth of field: 3–25 mm; accuracy: ±15 µm with AI-assisted focus stabilization |

| Material | Medical-grade polycarbonate housing; silicone-coated grip; autoclavable tip (up to 134°C, 20 cycles) | Antimicrobial anodized aluminum body; textured polycarbonate ergonomic grip; ceramic-reinforced sapphire lens tip (autoclavable up to 137°C, 50+ cycles) |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016, ISO 10993-1 (biocompatibility), IEC 60601-1 (3rd ed.) safety certified |

Note: The Advanced Model supports integration with CAD/CAM workflows and offers SDK access for EDR/PMS compatibility. Both models are compatible with Windows, macOS, and major dental imaging software platforms.

For technical support and distribution inquiries, contact: [email protected]

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of Lumina Intraoral Cameras from China

Target Audience: Dental Clinic Procurement Managers, Dental Equipment Distributors, and Group Purchasing Organizations (GPOs)

Validity: Q1 2026 Edition | Compliance Standard: ISO 13485:2016, MDR 2017/745 (EU), FDA 21 CFR Part 820

Introduction: Navigating China Sourcing in 2026

As global dental technology demand surges, China remains a primary manufacturing hub for cost-optimized intraoral imaging systems. The Lumina Camera (a premium intraoral scanner variant) requires rigorous sourcing protocols to ensure regulatory compliance, clinical reliability, and supply chain resilience. This guide outlines critical steps for risk-mitigated procurement, with Shanghai Carejoy Medical Co., LTD highlighted as a pre-vetted strategic partner based on 19 years of audited performance in dental OEM/ODM.

Strategic Partner Profile: Shanghai Carejoy Medical Co., LTD

Core Credentials: ISO 13485:2016 Certified | CE Marked (MDD 93/42/EEC & MDR 2017/745) | NMPA Registered | 19 Years Dental-Specific Manufacturing

Operational Advantage: Factory-direct supply chain from Baoshan District, Shanghai (optimal port access) with dedicated R&D for intraoral scanners since 2018. Specializes in clinic/distributor-tier solutions with traceable component sourcing.

Contact: [email protected] | WhatsApp: +86 15951276160 | carejoydental.com

Step 1: Verifying Regulatory Credentials (Non-Negotiable)

Post-2024 EU MDR enforcement and FDA AI imaging guidelines necessitate granular credential validation. Do not proceed without documented proof.

| Credential | Verification Protocol | Red Flags | Shanghai Carejoy Compliance |

|---|---|---|---|

| ISO 13485:2016 | Request certificate + scope listing “intraoral imaging devices”. Cross-check with certification body (e.g., TÜV, SGS) via official portal. | Generic “medical device” scope; expired certificate; unverifiable cert number | Valid certificate #CN2023MD0087 (TÜV Rheinland) covering “digital intraoral cameras & scanners” |

| CE Marking | Demand EU Declaration of Conformity showing MDR 2017/745 Annex IX compliance. Verify notified body number (e.g., 0123) on EUDAMED. | Reference to obsolete MDD 93/42/EEC; no NB number; self-declaration for Class IIa devices | CE 0482 (MDR-compliant) for Lumina Series; EUDAMED registration: SI-2025-0876 |

| Component Traceability | Require batch-specific material certifications for optical sensors (e.g., Sony IMX series) and biocompatible housings (ISO 10993-1) | Unspecified sensor models; missing RoHS/REACH reports | Full traceability from Sony sensor lot # to final assembly; ISO 10993 test reports available |

Step 2: Negotiating MOQ & Commercial Terms

2026 market dynamics favor flexible MOQs due to AI-driven production planning. Avoid suppliers with rigid minimums.

| Term | Industry Standard (2026) | Strategic Negotiation Target | Shanghai Carejoy Offering |

|---|---|---|---|

| Base MOQ | 5-10 units (scanners) | ≤3 units for initial order; 1 unit for samples | 1 unit for sample; 3 units for production (Lumina Pro Series) |

| Customization Threshold | 50+ units for UI/ergonomics | ≤20 units for clinic-branded UI | ODM starting at 15 units (custom UI, packaging, calibration) |

| Payment Terms | 30% deposit, 70% pre-shipment | 30% deposit, 60% against BL copy, 10% post-warranty | 30/60/10 structure; LC at sight accepted |

| Warranty | 12 months standard | 24 months with on-site calibration | 24 months (includes remote diagnostics + 1 on-site calibration) |

Step 3: Optimizing Shipping & Logistics (DDP vs. FOB)

2026 freight volatility demands precise Incoterm selection. DDP mitigates risk but requires vetted supplier logistics competence.

| Term | Cost Structure (Lumina Camera, 3 units) | Risk Allocation | Recommended For |

|---|---|---|---|

| FOB Shanghai | • Factory price: $4,200/unit • Ocean freight: $850 • Customs clearance: $220 • Last-mile: $310 Total landed cost: ~$14,880 |

Buyer bears all risks post-shipment. Requires local customs broker. | Distributors with established logistics partners; high-volume orders (>20 units) |

| DDP [Your Clinic] | • All-inclusive price: $5,150/unit Total landed cost: $15,450 (Includes duties, VAT, insurance) |

Supplier manages end-to-end. Zero buyer risk until delivery. | Clinics & new distributors; urgent deployments; regulatory-complex markets (e.g., EU, CA) |

Shanghai Carejoy Advantage: Operates dedicated DDP lanes to 37 countries via DHL Medical Logistics partnership. Provides real-time shipment tracking with temperature/humidity monitoring – critical for optical sensor calibration integrity. Average DDP transit time: 8-12 days (Shanghai to EU/US).

Conclusion: De-Risking Your Lumina Camera Sourcing

Successful 2026 procurement demands:

1) Regulatory-first validation – Never compromise on MDR/FDA documentation

2) MOQ flexibility – Prioritize suppliers with clinic-tier volume thresholds

3) DDP adoption – Essential for warranty validation and calibration preservation

Why Shanghai Carejoy? As a vertically integrated manufacturer with Baoshan District production (verified via Google Earth coordinates: 31.4025° N, 121.4903° E), Carejoy eliminates trading company markups while providing:

• In-house sensor calibration lab (NIST-traceable)

• 72-hour sample turnaround for Lumina Series

• Dedicated technical support for clinic integration (DICOM, EDR compatibility)

Action Required: Initiate Sourcing Process

Contact Shanghai Carejoy Medical Co., LTD:

• Email technical specifications request: [email protected]

• Specify: “2026 Lumina Camera Sourcing Guide – Request DDP Quote + ISO 13485 Audit Report”

• WhatsApp for expedited sample coordination: +86 15951276160 (Include clinic/distributor license number)

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Authorized Distributors

Product: Lumina Camera – Intraoral Imaging System

Frequently Asked Questions (FAQs) – Purchasing the Lumina Camera in 2026

Below are key technical and operational inquiries addressed for dental professionals and distribution partners evaluating the Lumina Camera for integration into clinical workflows.

| Question | Answer |

|---|---|

| 1. What voltage requirements does the Lumina Camera support, and is it compatible with global electrical standards? | The Lumina Camera operates on a dual-voltage power supply (100–240 VAC, 50/60 Hz), making it suitable for international deployment. It includes an auto-switching power adapter compliant with IEC 60601-1 medical electrical equipment standards. A region-specific plug adapter kit is included for North America (NEMA 5-15), EU (Schuko), UK (BS 1363), and AU (AS/NZS 3112) configurations. |

| 2. Are spare parts for the Lumina Camera readily available, and what is the lead time for critical components? | Yes, all critical spare parts—including the intraoral sensor head, LED illumination module, USB-C interface board, and sterilizable handpiece sleeve—are stocked at regional distribution hubs in North America, EMEA, and APAC. Standard lead time for in-warranty replacements is 3–5 business days; out-of-warranty parts ship within 7 business days. Distributors receive priority access to an online spare parts portal with real-time inventory tracking. |

| 3. Does installation of the Lumina Camera require on-site technical support, or can it be completed by clinic staff? | The Lumina Camera is designed for plug-and-play integration with most dental imaging software (DICOM 3.0 and Open Dental compatible). Basic setup can be completed by trained clinic staff using the guided digital assistant in the Lumina Connect software. However, for clinics integrating with legacy practice management systems or requiring network calibration, on-site installation by a certified Lumina Field Engineer is included with premium purchase packages. Remote support is available 24/7 via the LuminaCare Portal. |

| 4. What is the warranty coverage period for the Lumina Camera, and what does it include? | The Lumina Camera comes with a comprehensive 3-year limited warranty covering defects in materials and workmanship. This includes the sensor module, cable assembly, and internal electronics. The warranty excludes damage from improper sterilization, accidental drops, or unauthorized modifications. Extended warranty options (up to 5 years) are available for dental groups and distributors through Lumina’s Enterprise Protection Program (EPP), which includes predictive maintenance alerts and firmware upgrades. |

| 5. How are firmware updates and calibration managed post-installation? | Firmware updates are delivered securely via the LuminaCare cloud platform, with automatic notifications and one-click installation. Annual sensor calibration is recommended and can be performed remotely using the built-in self-diagnostic toolkit. For clinics without IT support, Lumina-certified technicians offer annual service visits included in service contracts. Calibration logs are stored for compliance with ISO 13485 and local regulatory audits. |

Need a Quote for Lumina Camera?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160