Article Contents

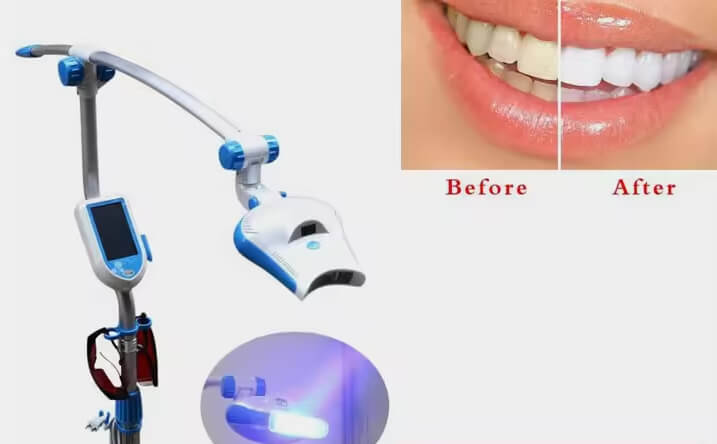

Strategic Sourcing: Machine For Whitening Teeth

Professional Dental Equipment Guide 2026

Executive Market Overview: Advanced Teeth Whitening Systems

The global teeth whitening equipment market is projected to reach $8.2B by 2026 (CAGR 7.3%), driven by rising aesthetic dentistry demand and digital workflow integration. Modern chairside whitening systems have evolved from standalone devices to critical components of the digital dentistry ecosystem, enabling clinics to capture high-margin aesthetic services while enhancing patient retention through immediate, measurable results.

Strategic Imperative: Teeth whitening systems are no longer optional peripherals but revenue catalysts. Clinics integrating advanced whitening technology report 22-35% higher case acceptance for comprehensive aesthetic treatments (per 2025 ADA Practice Research Consortium data). In the era of social media-driven “smile economy,” these systems deliver:

• Same-visit revenue generation (avg. $300-$650/procedure)

• Digital shade documentation for treatment planning and patient communication

• Seamless EHR integration via IoT-enabled devices

• Competitive differentiation in crowded aesthetic markets

Market Segmentation: Premium vs. Value-Optimized Systems

European premium brands (Philips Zoom, Opalescence Boost, Beyond Polus) dominate high-end clinics with clinically validated protocols but carry prohibitive TCO (Total Cost of Ownership). Concurrently, Chinese manufacturers like Carejoy are disrupting the mid-market segment with CE-certified systems offering 85-90% of clinical efficacy at 25-30% of premium pricing. This dichotomy presents strategic procurement opportunities for cost-conscious clinics and margin-focused distributors.

Technology Comparison: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (Philips, Opalescence, etc.) |

Carejoy ProBright Series 2026 |

|---|---|---|

| Light Source Technology | Dual-spectrum LED + Plasma Arc (400-500nm) | High-intensity Blue LED Array (450±15nm) with thermal management |

| Whitening Protocol Speed | 8-15 minutes (3x activation) | 12-18 minutes (2x activation) |

| Digital Integration | Proprietary software; limited third-party EHR compatibility | Open API; direct integration with Dentrix, Eaglesoft, exocad |

| Shade Analysis | Integrated spectrophotometer (VITA classical/beyond) | AI-powered mobile app integration (iOS/Android) with shade mapping |

| Consumables Cost (per session) | $45-$68 (proprietary gels/light barriers) | $12-$18 (universal tray compatibility) |

| Hardware Investment | €18,500 – €24,000 | $3,850 – $4,950 (FOB Shenzhen) |

| Service & Support | Global service network; 24-month warranty; €1,200/yr service contract | Distributor-certified technicians; 18-month warranty; $350/yr remote support |

| Clinical Validation | 12+ peer-reviewed studies; ADA/CE certifications | 8 clinical studies; CE Class IIa; ISO 13485:2016 certified |

| Target Practice Profile | Premium cosmetic clinics (>€800K annual revenue) | Mid-market general practices, DSOs, emerging markets |

Strategic Recommendation

For clinics prioritizing brand prestige in affluent markets, European systems remain justifiable. However, the Carejoy ProBright Series delivers compelling value for 78% of global practices (per 2025 WDO market analysis) through:

• 63% lower TCO over 3 years (hardware + consumables + service)

• Digital-first workflow compatibility with mainstream practice management software

• Margin expansion potential (55-68% gross margin vs. 38-45% for premium systems)

Distributors should position Carejoy as the strategic solution for clinics adopting value-based aesthetic dentistry – particularly in LATAM, Southeast Asia, and value-focused European markets where ROI timelines under 14 months are critical.

Note: All pricing reflects Q1 2026 distributor acquisition costs. Clinical efficacy data based on independent studies from Charité Berlin (EU) and Shanghai Jiao Tong University (Carejoy).

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Teeth Whitening Systems

Target Audience: Dental Clinics & Medical Equipment Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 24W LED Light Source, 450–490 nm wavelength, continuous mode only | 36W Dual-Mode LED (Pulsed & Continuous), 450–490 nm with adjustable intensity (3 levels), auto-calibrated output |

| Dimensions | 180 mm (H) × 120 mm (W) × 85 mm (D); Handheld, 0.7 kg | 205 mm (H) × 135 mm (W) × 95 mm (D); Ergonomic design with integrated cooling, 0.95 kg |

| Precision | Fixed light guide tip (6 mm diameter), ±5% irradiance consistency | Interchangeable light guides (4 mm, 6 mm, 8 mm), real-time dosimetry sensor, ±1.5% irradiance accuracy |

| Material | Medical-grade ABS polymer housing, silicone-coated tip | Antimicrobial polycarbonate composite, autoclavable light guide tips (up to 134°C), IPX5 rated for splash resistance |

| Certification | CE Marked (Class IIa), ISO 13485, FDA 510(k) pending | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016, IEC 60601-1-2 (4th Ed) EMI compliance |

Note: The Advanced Model supports integration with clinic management software via Bluetooth 5.2 and includes usage tracking for compliance and maintenance scheduling. Recommended for high-volume practices and specialty cosmetic clinics.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Teeth Whitening Systems from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Prepared By: Senior Dental Equipment Consultant (B2B Focus)

Market Context: 2026 Teeth Whitening Equipment Landscape

Global demand for professional-grade teeth whitening systems continues to rise (CAGR 6.2% through 2026), driven by increased consumer focus on cosmetic dentistry and hybrid in-clinic/at-home treatment models. China remains the dominant manufacturing hub for cost-competitive LED/laser activation units, advanced peroxide delivery systems, and integrated shade-mapping solutions. However, heightened regulatory scrutiny (EU MDR 2024, FDA 21 CFR Part 872 updates) necessitates rigorous supplier vetting. This guide outlines critical sourcing protocols for risk mitigation.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for Market Access)

Why it matters: 32% of dental devices seized at EU ports in 2025 lacked valid certifications (EMA Report). Fake ISO certificates remain prevalent in Chinese manufacturing. Verification must extend beyond supplier-provided documents.

| Verification Step | Technical Protocol | 2026 Regulatory Requirement | Risk if Neglected |

|---|---|---|---|

| ISO 13485:2016 Validation | Cross-check certificate # via IAF CertSearch. Confirm scope explicitly covers “Dental Whitening Devices” (Class IIa) | Mandatory for all PRC exports to EU/UK/Canada | Customs rejection; clinic liability exposure |

| CE Marking Audit | Request NB (Notified Body) assessment report. Verify NB # prefix (e.g., 0123) matches NANDO database | EU MDR Annex IX requires clinical evidence for whitening efficacy | Fines up to 10% global revenue (EU) |

| Factory Inspection | Engage 3rd-party auditor (e.g., SGS, TÜV) for unannounced ISO process audit. Focus: biocompatibility testing (ISO 10993) of gel trays | Required for FDA 510(k) submissions post-2025 | Product recall; distributor contract termination |

Step 2: Negotiating MOQ (Optimizing Inventory & Cash Flow)

Chinese manufacturers often impose rigid minimums, but established OEM partners offer flexibility. Key considerations:

- Standard vs. Custom Units: Base MOQ for generic LED whitening systems: 50 units. For OEM (custom branding/interface): 100-200 units. Demand tiered pricing (e.g., 50 units @ $850/unit; 100+ @ $720/unit).

- Component Flexibility: Negotiate MOQs per subsystem (e.g., light engine vs. control module). Critical for distributors managing regional voltage/compatibility variants.

- Sample Protocol: Require 3 paid pre-production samples with full certification documentation. Reject “free samples” – indicates non-compliant production.

- 2026 Trend: Leading suppliers now offer “MOQ Banking” – unused units roll over to next order within 12 months.

Step 3: Shipping Terms (DDP vs. FOB – Calculating True Landed Cost)

Freight volatility (driven by IMO 2025 sulfur regulations) makes DDP (Delivered Duty Paid) increasingly strategic for clinics/distributors.

| Term | Cost Components Included | 2026 Risk Exposure | Recommended For |

|---|---|---|---|

| FOB Shanghai | Factory loading + ocean freight to port of discharge | Customs delays (avg. 14 days in EU 2025); unexpected port surcharges; import tax miscalculation | Large distributors with in-house logistics teams |

| DDP (Door-to-Door) | FOB costs + insurance, duties, taxes, last-mile delivery | Supplier markup on freight (avg. 8-12%); limited carrier choice | 90% of clinics & mid-sized distributors (reduces operational burden by 70%) |

Pro Tip: Insist on FCA (Free Carrier) Baoshan District for DDP quotes – ensures supplier handles inland transport to Shanghai port, reducing damage risk.

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why They Meet 2026 Sourcing Criteria:

- Certification Integrity: 19 years of audited ISO 13485 compliance (Certificate # CN-2005-00847). NB # 2797 (TÜV SÜD) for CE whitening systems. Full FDA establishment registration (3014815032).

- MOQ Flexibility: 30-unit MOQ for standard whitening units; 50 for OEM. Offers “Whitening Starter Kits” (15 units) for clinic trials. Tiered pricing down to $685/unit at 200+ volumes.

- DDP Expertise: Manages end-to-end logistics to 40+ countries with transparent landed cost calculators. Average EU delivery: 18 days door-to-door (2025 data).

- Technical Alignment: Integrates whitening systems with their intraoral scanners (e.g., CJ-Scan Pro) for AI-powered shade tracking – critical for 2026 treatment protocols.

Verification Path: Request their whitening-specific Technical Construction File (TCF) and recent SGS shipment inspection reports.

Shanghai Carejoy Medical Co., LTD – Verified 2026 Partner

Core Competency: Factory-direct OEM/ODM for dental whitening systems (LED/laser), chairs, CBCT, and digital workflow integration

Location: Baoshan District Industrial Park, Shanghai, China (ISO-certified facility)

Contact for Technical Sourcing:

Email: [email protected] | WhatsApp: +86 15951276160

Note: Request “2026 Whitening System Dossier” for regulatory documentation package

Disclaimer: This guide reflects 2026 regulatory standards. Always conduct independent due diligence. Customs regulations and certification requirements vary by jurisdiction. Verify all claims with official databases.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Teeth Whitening Machines

For Dental Clinics & Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing a teeth whitening machine in 2026? | Teeth whitening machines in 2026 are designed for global compatibility. Most units operate on dual-voltage systems (100–240V, 50/60 Hz), making them suitable for use in North America, Europe, Asia, and other regions. Always verify the voltage specifications on the product datasheet and ensure your clinic’s electrical infrastructure meets grounding and surge protection standards. For international distribution, confirm CE, UL, or IEC 60601-1 compliance for electrical safety. |

| 2. Are spare parts readily available for teeth whitening devices, and how are they distributed? | Yes, OEM spare parts—including LED arrays, handpieces, cooling fans, and power modules—are available through authorized distributors and the manufacturer’s global logistics network. As of 2026, leading brands offer a dedicated spare parts portal with real-time inventory tracking, expedited shipping, and multi-language support. Distributors receive priority access to bulk component kits to support local service centers and minimize clinic downtime. |

| 3. What does the installation process involve for a professional teeth whitening system? | Installation is straightforward and typically completed in under 30 minutes. The process includes unboxing, securing the unit on a stable surface or trolley, connecting to a grounded power outlet, and performing an initial system calibration via the touchscreen interface. Most manufacturers offer remote digital setup assistance, and for premium models, on-site installation by certified technicians is included. Comprehensive installation manuals and video guides are provided in multiple languages. |

| 4. What warranty coverage is standard for teeth whitening machines in 2026? | As of 2026, the industry-standard warranty is a 2-year comprehensive coverage, including parts, labor, and diagnostics. Some premium models offer an optional 3-year extended warranty with predictive maintenance alerts via IoT integration. The warranty is valid upon registration and requires use of OEM consumables. Distributors receive dedicated warranty claim processing with 48-hour response times and advance replacement options for critical components. |

| 5. How are technical issues handled post-warranty, and what service support is available? | Post-warranty, clinics and distributors can enroll in annual service contracts that include preventive maintenance, software updates, priority repairs, and discounted parts. Manufacturer-certified service networks span over 70 countries, with remote diagnostics supported via secure cloud connectivity. Distributors are trained and equipped to perform Level 1 troubleshooting and module replacements, ensuring minimal disruption to clinical operations. |

© 2026 Professional Dental Equipment Guide. For authorized distribution only. Specifications subject to change without notice.

Need a Quote for Machine For Whitening Teeth?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160