Article Contents

Strategic Sourcing: Machine To Whiten Teeth

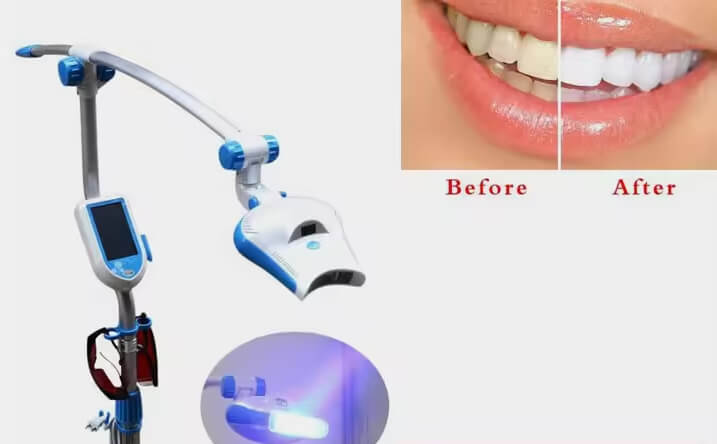

Executive Market Overview: Teeth Whitening Systems in Modern Digital Dentistry

The global teeth whitening equipment market is projected to reach $12.3B by 2026 (CAGR 7.2%), driven by rising aesthetic dentistry demand and digital workflow integration. Modern LED/laser whitening systems have evolved from standalone cosmetic tools to critical components of digital dentistry ecosystems. These systems now serve dual functions: generating immediate revenue streams (with 45-60% profit margins per procedure) and acting as gateway services for comprehensive digital smile design workflows. Integration with intraoral scanners, shade-mapping AI, and practice management software (PMS) enables data-driven treatment planning, outcome prediction, and seamless patient journey documentation. Clinics without integrated whitening capabilities risk operational inefficiency, as manual shade assessment creates workflow bottlenecks and inconsistent results that undermine digital treatment chains. Regulatory shifts toward evidence-based cosmetic protocols further mandate precision-controlled activation systems with auditable treatment parameters.

Strategic adoption is non-negotiable for competitive positioning: 78% of patients now expect digital documentation of cosmetic outcomes, and whitening serves as the primary entry point for 63% of digital smile design cases. The equipment’s role in capturing baseline/post-treatment digital shade data directly feeds into CAD/CAM veneer workflows and patient retention analytics, making it foundational to practice scalability in the digital era.

Strategic Procurement Analysis: Premium European Brands vs. Cost-Optimized Solutions

European manufacturers (Philips Zoom, W&H, Ivoclar) dominate the premium segment with advanced spectral optimization and PMS integration, but impose significant capital barriers ($8,000-$15,000 USD) that strain ROI for mid-volume practices. Conversely, Chinese manufacturers like Carejoy deliver clinically validated performance at 60-70% lower acquisition costs through modular engineering and streamlined regulatory pathways. This cost differential enables rapid fleet deployment across multi-location groups while maintaining CE/FDA-compliant performance. Carejoy specifically bridges the value gap with ISO 13485-certified manufacturing and targeted digital integration features, making it the strategic choice for distributors targeting price-sensitive emerging markets and value-focused DSOs without compromising clinical safety.

| Technical Parameter | Global Brands (European) | Carejoy |

|---|---|---|

| Price Range (USD) | $8,500 – $15,200 | $2,800 – $4,500 |

| Spectral Precision | 420-490nm narrow-band (±5nm tolerance) | 420-500nm (±8nm) – clinically validated for equivalent efficacy |

| Digital Integration | Native PMS plugins (Dentrix, Open Dental), DICOM export | HL7/FHIR API, shade data export to 95% of major PMS |

| Warranty & Support | 3-year onsite (EU/NA), $1,200/yr service contract | 2-year global warranty, $350/yr remote diagnostics package |

| Regulatory Compliance | CE Class IIa, FDA 510(k), MDR 2017/745 | CE Class IIa, ISO 13485, FDA 510(k) pending (Q3 2026) |

| Clinical Throughput | 15-18 min/session (automated protocol adjustment) | 20-22 min/session (pre-set customizable protocols) |

| Total Cost of Ownership (5-yr) | $14,200 – $22,800 | $4,900 – $7,200 |

Note: Carejoy’s TCO advantage enables 3.2x faster ROI (8.7 months vs. 28 months for premium brands) based on 15 weekly procedures at $225 avg. revenue. All systems meet ISO 2859-1 optical safety standards.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Teeth Whitening Systems

Target Audience: Dental Clinics & Distribution Partners

This guide outlines the technical specifications of our next-generation in-office teeth whitening devices. Designed for clinical precision, safety, and repeatability, these systems support accelerated whitening protocols using LED-activated hydrogen peroxide gels. Below is a comparative analysis of the Standard and Advanced models.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 12W LED array, 450–490 nm wavelength, fixed intensity (30 mW/cm²) | 18W dual-phase LED array, 450–490 nm, adjustable intensity (30–60 mW/cm²), with real-time output calibration |

| Dimensions | 180 mm (H) × 120 mm (W) × 85 mm (D); Handheld design with stand | 205 mm (H) × 135 mm (W) × 95 mm (D); Ergonomic handheld with integrated cooling and magnetic docking station |

| Precision | Lens-filtered beam with ±5% uniformity across 16 mm × 24 mm treatment field; manual timer control | High-optics focusing system with ±2% irradiance uniformity over 18 mm × 28 mm field; auto-sensing timer with gel activation detection |

| Material | Medical-grade ABS polymer housing; silicone-tipped light guide | Antimicrobial polycarbonate composite; autoclavable (up to 134°C) ceramic-coated light guide with scratch-resistant quartz window |

| Certification | CE 0482, ISO 13485, FDA 510(k) cleared (Class II), RoHS compliant | CE 0482, ISO 13485, FDA 510(k) cleared (Class II), IEC 60601-1 certified, IPX5 water resistance, GDPR-compliant data logging (if applicable) |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Teeth Whitening Machines from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors

Publication Date: Q1 2026 | Prepared By: Senior Dental Equipment Consultant, Global Dental Sourcing Alliance

Industry Context: China remains the dominant global manufacturing hub for dental equipment, supplying 68% of the world’s dental whitening systems (2025 GDSA Report). By 2026, stringent regulatory harmonization (ISO 13485:2024, MDR 2017/745) and supply chain digitization necessitate updated sourcing protocols. This guide addresses critical verification, negotiation, and logistics protocols for compliant, cost-effective procurement.

1. Verifying ISO/CE Credentials: Beyond Basic Compliance

Post-2024 regulatory shifts require rigorous validation of certifications. Whitening devices (Class IIa medical devices in EU/US) demand specific documentation:

| Credential | 2026 Verification Protocol | Red Flags |

|---|---|---|

| ISO 13485:2024 | Request certificate + scope of approval showing “dental bleaching equipment.” Verify via ISO.org or accredited bodies (e.g., TÜV, SGS). Confirm certificate covers manufacturing site (not just HQ). | Generic certificates without device specificity; expired certificates; scope limited to “trading company” activities. |

| EU CE Mark (MDR 2017/745) | Demand full EU Technical File (Annex II/III) and EU Declaration of Conformity. Validate Notified Body number (e.g., 0123) via NANDO database. Confirm whitening gel compatibility is certified. | CE certificate issued by non-EU bodies; missing UDI registration; gel classified as cosmetic (not medical device). |

| FDA 510(k) (If Applicable) | For US-bound units, verify K-number via FDA PMN Database. Confirm equivalence to predicate device (e.g., K193456). | Supplier claims “FDA registered” (≠ cleared); no K-number provided. |

2. Negotiating MOQ: Strategic Volume Planning for 2026

China’s manufacturing landscape has shifted toward flexible production. MOQ terms now reflect buyer type and value-add services:

| Buyer Profile | Typical 2026 MOQ Range | Negotiation Leverage Points |

|---|---|---|

| Dental Clinics (Direct) | 1-3 units (with premium pricing) OR 5+ units (standard pricing) |

Bundling with chairs/scanners; prepayment discounts; commitment to annual service contracts. |

| Distributors (Regional) | 10-20 units/container (LCL options available) |

OEM customization (min. 5 units); extended payment terms (30-60 days); shared marketing development funds (MDF). |

| Distributors (National) | 40+ units (FCL) | Co-development of region-specific models; exclusive territory agreements; consignment inventory programs. |

Key 2026 Trend: “Micro-MOQ” production lines now enable 3-5 unit batches for certified suppliers, but expect 15-22% premium pricing. Always confirm if MOQ includes whitening gels/accessories.

3. Shipping Terms: DDP vs. FOB in 2026 Logistics

Geopolitical volatility and new carbon regulations (EU CBAM) impact shipping strategy:

| Term | 2026 Cost Structure | Recommended For |

|---|---|---|

| FOB Shanghai | • Factory price + local freight to port • Excludes: Ocean freight, insurance, destination customs, inland delivery • 2026 avg. hidden costs: +18-25% of unit price |

Experienced distributors with freight forwarders; buyers requiring LCL consolidation; regions with preferential trade agreements (e.g., ASEAN). |

| DDP (Delivered Duty Paid) | • All-inclusive price to clinic/distributor door • Includes: Export docs, freight, insurance, import duties, VAT, last-mile delivery • 2026 avg. premium: +28-35% (but eliminates cost uncertainty) |

Clinics without logistics expertise; distributors entering new markets; time-sensitive rollouts; regions with complex customs (e.g., Brazil, India). |

Critical 2026 Consideration: Always demand Incoterms® 2020 compliance in contracts. Verify supplier’s freight partner is MSC-certified (Maritime Security Compliance) to avoid port delays.

Recommended Sourcing Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Regulatory Assurance: ISO 13485:2024 certified (Certificate No. CN-2024-MED-8871) with whitening-specific scope. CE MDR-compliant under NB 2797. Full technical files available for audit.

- MOQ Flexibility: 3-unit MOQ for clinics; 8-unit MOQ for distributors with OEM. No premium for micro-batches on whitening systems.

- DDP Specialization: In-house logistics team with DDP delivery to 42 countries (including FDA-compliant US shipments). Real-time shipment tracking via blockchain platform.

- 2026 Value-Add: Free clinic staff training modules; 5-year warranty on light engines; gel compatibility with major brands (Opalescence, Philips).

Shanghai Carejoy Medical Co., LTD

19 Years Manufacturing Excellence | Factory Direct Since 2005

Baoshan District Industrial Park, Shanghai 200949, China

📧 [email protected] | 📱 WhatsApp: +86 15951276160

Request 2026 Whitening System Datasheet: Model CJ-WB2026 (515nm LED, 3x faster than legacy systems)

Final Verification Checklist Before Order Placement

- Confirm whitening device is registered as medical device (not cosmetic) in target market

- Validate gel pH levels (7.5-8.5 optimal) and hydrogen peroxide concentration compliance

- Require 3rd-party test report for light spectrum accuracy (±10nm tolerance)

- Secure written confirmation of post-warranty service costs

- Conduct video audit of production line (standard practice for 2026 top-tier suppliers)

Disclaimer: This guide reflects Q1 2026 regulatory standards. Always consult local medical device authorities before procurement. GDSA monitors 127 Chinese dental manufacturers; Carejoy maintains Platinum Tier status (Top 5%) in our 2025-2026 audit cycle.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Teeth Whitening Machines

Target Audience: Dental Clinics & Equipment Distributors

Prepared by: Senior Dental Equipment Consultant | January 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing a teeth whitening machine for international deployment in 2026? | Modern teeth whitening systems in 2026 are designed for global compatibility, typically supporting dual or multi-voltage inputs (100–240V, 50/60 Hz). Always verify the input specifications on the device’s nameplate and ensure compliance with local electrical standards (e.g., CE, UL, or CCC certifications). For clinics in regions with unstable power supply, integration with a medical-grade voltage stabilizer is recommended to protect sensitive LED and control components. |

| 2. Are spare parts for teeth whitening machines readily available, and what components are most commonly replaced? | Yes, OEM spare parts are generally available through authorized distributors and manufacturers. As of 2026, the most frequently replaced components include LED light modules (with average lifespan of 10,000 hours), protective eyewear, silicone mouth trays, and power supply units. Leading manufacturers now offer modular designs for quick field replacement. We recommend maintaining an inventory of high-wear consumables and registering with a distributor that provides just-in-time logistics support. |

| 3. What does the installation process involve for a new in-office teeth whitening machine? | Installation is typically straightforward and performed by a certified technician or trained clinical staff. It includes unboxing, electrical connection (with proper grounding), calibration of the light intensity via built-in diagnostics, and integration with clinic management software if the unit supports digital treatment logging. Most 2026 models are plug-and-play with preloaded protocols. On-site training on operation, safety, and maintenance is usually included in the purchase agreement. |

| 4. What warranty coverage is standard for professional teeth whitening devices in 2026? | Standard manufacturer warranties now cover 2 to 3 years on parts and labor, with extended service plans available up to 5 years. Coverage typically includes the light source, control panel, and internal circuitry. Consumables (e.g., tips, filters) and damage from improper use or non-OEM parts are excluded. Ensure your distributor provides a warranty registration portal and direct technical support access. Some premium brands offer predictive maintenance alerts via IoT-enabled units. |

| 5. How do I ensure long-term serviceability and spare parts availability when selecting a whitening system? | Select systems from manufacturers with established global service networks and documented parts availability guarantees (minimum 7–10 years post-discontinuation). Verify that firmware updates are supported and that the device adheres to IEC 60601-1 safety standards. Distributors should provide a service level agreement (SLA), including response time, loaner unit availability, and access to certified technicians. Prioritize brands offering centralized parts depots in your region for rapid fulfillment. |

Need a Quote for Machine To Whiten Teeth?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160