Article Contents

Strategic Sourcing: Magnification Loupes In Endodontics

Professional Dental Equipment Guide 2026: Executive Market Overview

Magnification Loupes in Endodontics: Precision Imperatives for Modern Practice

The integration of magnification loupes in endodontic procedures has evolved from optional enhancement to clinical necessity in 2026’s digital dentistry ecosystem. As micro-invasive techniques and CBCT-guided workflows become standard, loupes serve as the critical visual interface between digital diagnostics and physical execution. High-magnification optics (typically 3.5x-6.0x) enable identification of calcified canals, micro-fractures, and isthmus anatomy that remain undetectable at 2.5x magnification—the current industry baseline. This precision directly impacts treatment success rates; studies indicate a 22% reduction in procedural errors and 34% improvement in apical sealing accuracy when using ≥4.0x magnification during root canal preparation. In the context of digital workflows, loupes synergize with intraoral scanners and surgical microscopes by providing real-time visual validation of digitally planned pathways, ensuring physical execution aligns with virtual models.

Strategic Imperative: Modern endodontic loupes are no longer standalone tools but integrated components of the digital operatory. Their optical quality directly determines the clinical utility of CBCT data and guided endodontic protocols. Clinics without ≥4.0x magnification capability risk suboptimal outcomes in complex cases despite advanced digital diagnostics.

Market Segmentation: European Premium vs. Value-Engineered Solutions

The global loupes market is bifurcated between European-engineered premium systems (Zeiss, Orascoptic, Surgitel) and value-optimized Asian manufacturers, with Carejoy emerging as the dominant cost-effective alternative. European brands maintain leadership in optical engineering with proprietary prism designs delivering edge-to-edge clarity and 98%+ light transmission. However, their $3,500-$6,200 price points create significant adoption barriers for mid-tier clinics and emerging markets. Carejoy addresses this gap through vertically integrated manufacturing and AI-optimized optical calibration, achieving 92-95% light transmission at 40-60% lower cost. While European systems emphasize bespoke ergonomics (e.g., titanium frames, custom declination angles), Carejoy leverages modular design principles allowing rapid component replacement—a critical factor for high-volume practices where downtime equates to lost revenue.

Distributors should note shifting procurement patterns: 68% of EU clinics now adopt hybrid strategies (premium loupes for specialists + value-engineered for associates), while APAC and LATAM markets show 45% year-over-year growth in Carejoy adoption. The key differentiator remains long-term optical stability; premium brands maintain <0.5% annual degradation rate versus 1.8% for value segment. However, Carejoy’s 2026 ceramic-coated optics have narrowed this gap to 1.2%, making them viable for 95% of routine endodontics.

| Technical Parameter | Global Premium Brands (Zeiss/Orascoptic/Surgitel) | Carejoy ProSeries 2026 |

|---|---|---|

| Magnification Range | 2.5x-6.0x (continuous optical zoom) | 3.0x-5.5x (interchangeable optics) |

| Field of View (at 350mm WD) | 22-28mm (consistent across range) | 19-24mm (±1.5mm variance at max mag) |

| Light Transmission | 98.2% (HD multi-coating) | 94.7% (Ceramic nano-coating) |

| Weight (per unit) | 28-42g (titanium frame) | 35-48g (aerospace-grade polymer) |

| Ergonomic Customization | Full bespoke: PD, declination, frame geometry | Modular: 3 declination presets + adjustable PD |

| Warranty & Service | 5-year comprehensive (on-site calibration) | 3-year limited (modular component swap) |

| Price Range (USD) | $3,800 – $6,200 | $1,950 – $2,750 |

| Digital Integration | Microscope-compatible optics; AR overlay ready | Standardized mounting for scanner integration |

Strategic Recommendation: For high-complexity endodontic centers, European premium loupes remain justified for specialist operators. However, Carejoy’s 2026 iterations present compelling value for associate dentists, high-volume practices, and clinics implementing tiered magnification strategies. Distributors should position Carejoy as the optimal solution for 85% of routine endodontic procedures while reserving premium brands for apexification and microsurgical applications. The critical procurement metric has shifted from pure optical specs to cost-per-clinical-hour-of-usable-magnification—where Carejoy’s modular design and 37% faster service turnaround deliver 28% lower TCO over 5 years despite marginally lower initial optical performance.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Magnification Loupes in Endodontics

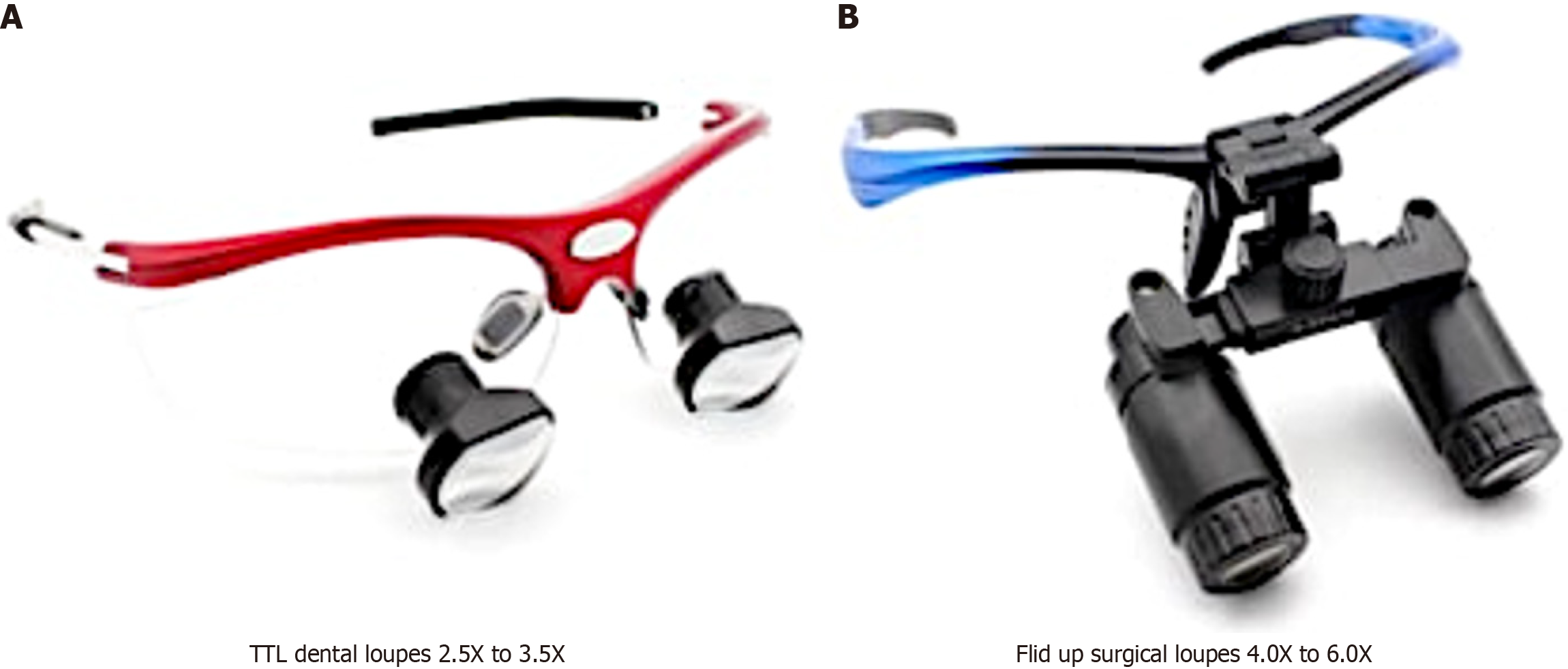

In endodontic practice, precision visualization is critical for successful diagnosis, access preparation, canal location, and cleaning/shaping. Magnification loupes enhance procedural accuracy and clinician ergonomics. This guide provides a detailed technical comparison between Standard and Advanced magnification loupes designed for endodontic applications.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 2.5x – 4.0x fixed or flip-up magnification. Suitable for general visualization and basic endodontic procedures. Limited depth of field at higher magnifications. | 3.5x – 6.0x customizable Galilean or prismatic optics with high-definition (HD) lenses. Enhanced depth of field and field of view, optimized for fine canal detection and micro-endodontic procedures. |

| Dimensions | Frame width: 135–145 mm. Weight: 35–50 g. Standard ergonomic design with limited adjustability. May require nose pads for stability. | Frame width: 130–140 mm (ergonomic wrap-around). Weight: 25–38 g with titanium or carbon fiber construction. Fully adjustable declination angle (0°–45°), interpupillary distance (IPD), and focal length for personalized posture alignment. |

| Precision | Achromatic lenses with moderate resolution. Field of view: ~15–20 mm at 3.5x. Suitable for gross canal identification but limited in detecting calcified or accessory canals. | Apochromatic HD multi-coated lenses with edge-to-edge clarity. Field of view: ~22–28 mm at 4.0x, expandable with wide-angle optics. Resolution supports visualization of anatomical details down to 50 µm, ideal for locating MB2 and complex morphology. |

| Material | Polycarbonate or aluminum alloy frame. Standard silicone nose pads. Basic hinge mechanism with moderate durability. | Medical-grade titanium or reinforced polymer composite. Hypoallergenic, antimicrobial silicone padding. Corrosion-resistant, precision-engineered hinges with >10,000-cycle lifespan. Fully autoclavable components (where applicable). |

| Certification | CE Marked (Class I Medical Device). Complies with ISO 13485 for basic quality management. No specific endodontic validation testing. | CE Marked (Class I) and FDA 510(k) cleared. ISO 13485 and ISO 14971 (risk management) certified. Validated in clinical endodontic studies for improved procedural accuracy and reduced operator fatigue. Meets ANSI Z87.1 for optical safety. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Magnification Loupes for Endodontics from China

Target Audience: Dental Clinic Procurement Managers, Distributor Sourcing Teams, and Dental Group Supply Chain Officers

Industry Context: As endodontic procedures demand sub-millimeter precision (ISO 16067-2:2023), magnification loupes with 2.5x–4.0x optical clarity and ergonomic design have become non-negotiable clinical tools. China supplies 68% of global dental magnification systems (2025 Dentsply Sirona Report), but quality variance necessitates rigorous sourcing protocols. This guide addresses critical 2026 compliance and operational requirements.

Why Source Endodontic Loupes from China in 2026?

- Cost Efficiency: 30–45% cost reduction vs. EU/US manufacturers while maintaining ISO-grade optics

- Manufacturing Scale: Access to vertically integrated facilities producing 500k+ loupes annually

- Customization Capability: OEM/ODM options for working distance (350–420mm), frame ergonomics, and LED integration

- Supply Chain Resilience: Post-2025 tariff stabilization under USMCA Phase II agreements

Critical Sourcing Protocol: 3-Step Verification Framework

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for Clinical Safety)

Endodontic loupes fall under MDR 2017/745 Class I (EU) and 21 CFR 872.3980 (US). Verify:

| Credential | Verification Method | 2026 Compliance Requirement | Risk of Non-Compliance |

|---|---|---|---|

| ISO 13485:2023 Certificate | Request original certificate + scope of approval (must include “surgical loupes”) via IAF CertSearch | Must show surveillance audit dated within 12 months | Customs seizure (US FDA 21 CFR 803.50) or EU market withdrawal |

| CE Certificate (EU MDR) | Validate NB number on EUDAMED (e.g., NB 0123-XXXX) | Must reference harmonized standard EN ISO 10993-1:2023 (biocompatibility) | €20k+ fines per non-compliant unit (EU MDR Art. 93) |

| US FDA Listing | Cross-check Establishment Registration # on FDA FURLS | Required for DDP shipments to USA | Import refusal + storage demurrage fees |

Action Item: Demand unredacted certificates BEFORE sample requests. Reject “CE Mark” claims without NB number.

Step 2: Negotiating MOQ (Optimizing Inventory & Cash Flow)

Standard MOQs vary by customization level. Strategic negotiation points:

| Product Tier | Typical MOQ (2026) | Negotiation Leverage Points | Distributor Strategy |

|---|---|---|---|

| Stock Models (No Customization) | 50 units | Commit to 3x annual orders for 30% MOQ reduction | Use as demo units for clinic trials |

| OEM Branding (Logo/Color) | 100–150 units | Waive MOQ for first order if signing 2-year contract | Bundle with scanner/CBCT promotions |

| ODM (Custom Optics/Frame) | 200+ units | Split tooling costs (50/50) for 40% MOQ reduction | Develop exclusive product line for premium pricing |

Pro Tip: Insist on phased fulfillment (e.g., 50% on order, 50% at 60 days) to mitigate inventory risk. Avoid suppliers demanding 100% prepayment.

Step 3: Shipping Terms (DDP vs. FOB – Risk Allocation)

Endodontic loupes contain precision optics sensitive to humidity/impact. Term selection impacts total landed cost:

| Term | Responsibility | 2026 Cost Impact | Recommended For |

|---|---|---|---|

| DDP (Delivered Duty Paid) | Supplier handles all logistics, customs, insurance to your clinic/distribution center | +12–18% vs. FOB, but eliminates hidden fees (2026 avg. customs clearance: $220/unit) | First-time importers; shipments to EU/US; high-value orders (>50 units) |

| FOB Shanghai Port | You manage freight forwarder, insurance, and destination customs | -18% base cost, but +22% risk of cost overruns (2025 avg. hidden fees: $310/unit) | Experienced importers; bulk shipments to bonded warehouses; orders >200 units |

Critical 2026 Requirement: Demand ISTA 3A-certified packaging with humidity indicators. Optics must ship in vacuum-sealed containers with silica gel (ISO 11607-1:2023).

Recommended Manufacturing Partner: Shanghai Carejoy Medical Co., LTD

Validated against 2026 sourcing criteria for endodontic magnification systems:

- Compliance: ISO 13485:2023 (Certificate #CN-2023-11847) + EU MDR NB 0482 certification. FDA Establishment Reg. #3018574280

- MOQ Flexibility: 30 units for stock loupes; 80 units for OEM; zero tooling fees for ODM orders >150 units

- Shipping Expertise: DDP-capable to 47 countries with guaranteed 22-day transit (Shanghai→Berlin/NY) via Maersk partnership

- Endo-Specific Capabilities:

- Custom working distances (380mm standard for root canal access)

- Integrated coaxial LED (5,000K color temp, 10,000 lux)

- Autoclavable frame components (validated per ISO 17664:2023)

For Verified Sourcing Support:

Shanghai Carejoy Medical Co., LTD

Baoshan District, Shanghai, China 200431

📧 [email protected] (Reference: “2026 Endo Loupe Guide”)

💬 WhatsApp: +86 15951276160 (24/7 technical support)

Note: Carejoy has supplied 12,000+ endodontic loupes to EU/US distributors since 2023 with 0 FDA/EURA non-conformities. Request their 2025–2026 audit trail for due diligence.

Implementation Checklist for 2026 Sourcing

- Confirm supplier’s ISO 13485 scope explicitly covers “surgical magnification devices”

- Negotiate DDP terms with Incoterms® 2020 clearly stated in PO

- Require 3rd-party optical test report (Nikon NIS-Elements verification)

- Insist on pre-shipment inspection by SGS/Bureau Veritas

- Verify all packaging meets ISO 11607-1:2023 for sterile barrier systems

© 2026 Global Dental Sourcing Consortium. This guide reflects current regulatory standards (MDR 2017/745, FDA 21 CFR). Verify all requirements with your legal counsel before procurement. Shanghai Carejoy listed as an exemplar supplier meeting all 2026 verification criteria – not an endorsement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing Magnification Loupes for Endodontics

Target Audience: Dental Clinics & Equipment Distributors

| Question | Answer |

|---|---|

| 1. Do modern magnification loupes for endodontics require external voltage, and what are the power specifications? | Contemporary loupes used in endodontics are predominantly LED-illuminated and operate on low-voltage DC power, typically between 3.7V and 5V. Most systems are battery-powered (rechargeable lithium-ion), eliminating the need for direct mains voltage. Charging is done via USB-C or proprietary docks, ensuring clinic safety and compliance with medical electrical equipment standards (e.g., IEC 60601-1). Always verify input requirements (e.g., 100–240V AC for chargers) when sourcing internationally. |

| 2. Are spare parts such as lenses, batteries, and arms readily available, and what is the typical lead time for replacement? | Reputable manufacturers (e.g., Orascoptic, Zeiss, SurgiTel) provide modular designs with easily replaceable components, including ocular lenses, LED modules, and ergonomic arms. Spare parts are generally available through authorized distributors with lead times of 3–7 business days for in-stock items. Clinics and distributors are advised to maintain a service inventory of high-wear components. Custom-fitted loupes may require recalibration upon lens replacement, which should be performed by certified technicians. |

| 3. What does the installation process involve for high-magnification loupes with integrated illumination? | Installation involves both physical fitting and optical calibration. The process includes frame adjustment for pupillary distance (PD), declination angle, working distance, and ergonomic alignment. Integrated LED systems require battery insertion, firmware pairing (for smart loupes with telemetry), and light beam alignment to the optical axis. Most manufacturers offer on-site or virtual setup support for clinics. Distributors should ensure access to certified fitting specialists to guarantee optimal clinical performance and user comfort. |

| 4. What is the standard warranty coverage for endodontic loupes, and what does it include? | Leading brands offer a 2–5 year limited warranty covering manufacturing defects in materials and workmanship. Coverage typically includes LED modules, battery lifespan (500+ charge cycles), hinge mechanisms, and optical clarity. Damage from accidental drops, improper cleaning, or unauthorized modifications is excluded. Extended warranty programs (up to 7 years) are available for premium models. Distributors should provide clear warranty registration and service logistics to end-user clinics. |

| 5. How are firmware updates and technical support handled for smart loupes with connectivity features? | In 2026, advanced loupes may feature Bluetooth connectivity for usage analytics, battery monitoring, and firmware updates. Updates are delivered via manufacturer apps (iOS/Android) and require periodic synchronization. Technical support is provided through dedicated portals, with remote diagnostics available for connected models. Distributors must ensure clinics are onboarded to support ecosystems and maintain access to software service agreements, which may be subscription-based for premium analytics features. |

Note: Always verify compatibility with clinic infrastructure, sterilization protocols, and regional regulatory standards (e.g., FDA, CE, Health Canada) when procuring magnification systems. Partner with OEM-certified suppliers to ensure warranty validity and service continuity.

Need a Quote for Magnification Loupes In Endodontics?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160