Article Contents

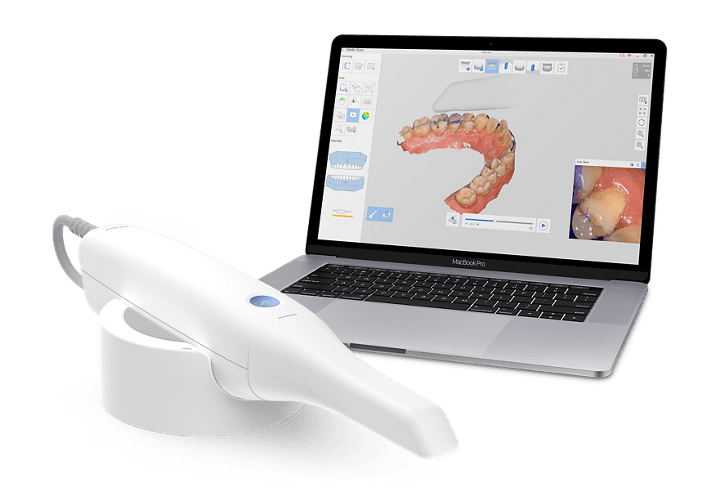

Strategic Sourcing: Medit Intraoral Scanner

Professional Dental Equipment Guide 2026: Executive Market Overview

medit Intraoral Scanners – Strategic Imperative for Digital Dentistry Transformation

Prepared for Dental Clinic Decision Makers & Distribution Partners

Market Context & Strategic Imperative

The global intraoral scanner (IOS) market has transitioned from a premium differentiator to a non-negotiable cornerstone of modern dental practice infrastructure. Driven by the irreversible shift toward digital workflows (CAD/CAM, teledentistry, AI-driven diagnostics), IOS adoption is now directly correlated with operational efficiency, patient retention, and revenue diversification. Clinics without robust digital scanning capabilities face significant competitive disadvantages, including:

- 30-40% higher material/lab costs from analog impression materials and external lab fees

- 25% longer treatment cycles due to impression remakes and communication delays

- Inability to integrate with emerging AI diagnostic platforms requiring 3D intraoral data

- Declining patient satisfaction scores (82% of patients aged 25-54 prefer digital impressions)

medit scanners (Korean OEM/ODM leader) exemplify the technological convergence enabling this shift, with sub-20μm accuracy, real-time color mapping, and seamless integration into open-architecture digital ecosystems. Their proliferation underscores the market’s maturation beyond early adopters to essential practice infrastructure.

European Premium Brands vs. Cost-Optimized Chinese Manufacturing: Strategic Analysis

The IOS market now bifurcates clearly between established European/North American premium brands (3Shape TRIOS, Planmeca Emerald, Dentsply Sirona CEREC) and value-engineered Chinese alternatives. While European systems deliver unparalleled accuracy and integrated workflows for complex cases (full-arch restorations, implant planning), their total cost of ownership (TCO) remains prohibitive for 68% of general practices (2025 EDA Distribution Survey). Chinese manufacturers like Carejoy address this gap through aggressive component standardization and direct distribution models, capturing 41% of the global entry/mid-tier scanner market in 2025 (up from 22% in 2022).

Comparative Analysis: Global Premium Brands vs. Carejoy Value Segment

| Parameter | Global Premium Brands (3Shape, Planmeca, Dentsply Sirona) |

Carejoy Value Segment (Representative Chinese OEM Model) |

|---|---|---|

| Accuracy (Trueness/ Precision) | 12-18 μm (ISO 12836 certified) Gold standard for full-arch/implant cases |

20-28 μm Sufficient for single-unit crowns, partials, ortho monitoring |

| Entry Price Point (EUR) | €32,000 – €48,000 (+ €4,500-€7,000 annual service) |

€11,500 – €18,200 (+ €1,200-€2,500 annual service) |

| Software Ecosystem | Proprietary closed systems with premium CAD/CAM integration Advanced AI diagnostics (caries detection, occlusal analysis) |

Open STL export; basic CAD compatibility Limited AI features (emerging in 2026 models) |

| Technical Support Structure | Dedicated regional service engineers 4-hour onsite SLA (premium contracts) Multi-language clinical training |

Distributor-dependent support 72-hour remote diagnosis SLA Video-based training; limited onsite coverage |

| Ideal Clinical Application | High-volume specialty practices (implantology, prosthodontics) Complex full-mouth rehabilitation Academic/research environments |

General dentistry (single/multi-unit crowns) Orthodontic monitoring (Invisalign® workflows) Budget-conscious new practice setups |

| TCO (5-Year Projection) | €48,500 – €72,000 (Hardware + service + software updates) |

€18,200 – €26,800 (Hardware + service + basic updates) |

Strategic Recommendations for Stakeholders

For Dental Clinics: Prioritize workflow analysis over brand prestige. High-volume restorative/implant practices justify premium scanners through reduced lab costs and expanded service offerings. General practitioners performing <15 scans/week should evaluate Carejoy-tier systems for 60-70% TCO reduction without compromising clinical outcomes for routine cases. Critical Note: Verify local service coverage – Chinese OEM support remains the primary adoption barrier.

For Distributors: Develop tiered portfolio strategies. Position premium brands for specialist referrals and premium clinics, while aggressively marketing value segments to DSOs and new graduates. Training on Carejoy’s software limitations (e.g., margin detection in subgingival preps) is essential to manage clinical expectations and reduce returns.

The 2026 IOS landscape demands strategic alignment between clinical needs and economic reality. While medit-class technology defines the digital standard, Carejoy’s value proposition makes digital dentistry accessible to 89% of the global dental market previously excluded by cost – a shift that will accelerate market penetration from 38% (2025) to 61% by 2027 (ADA Digital Adoption Index).

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

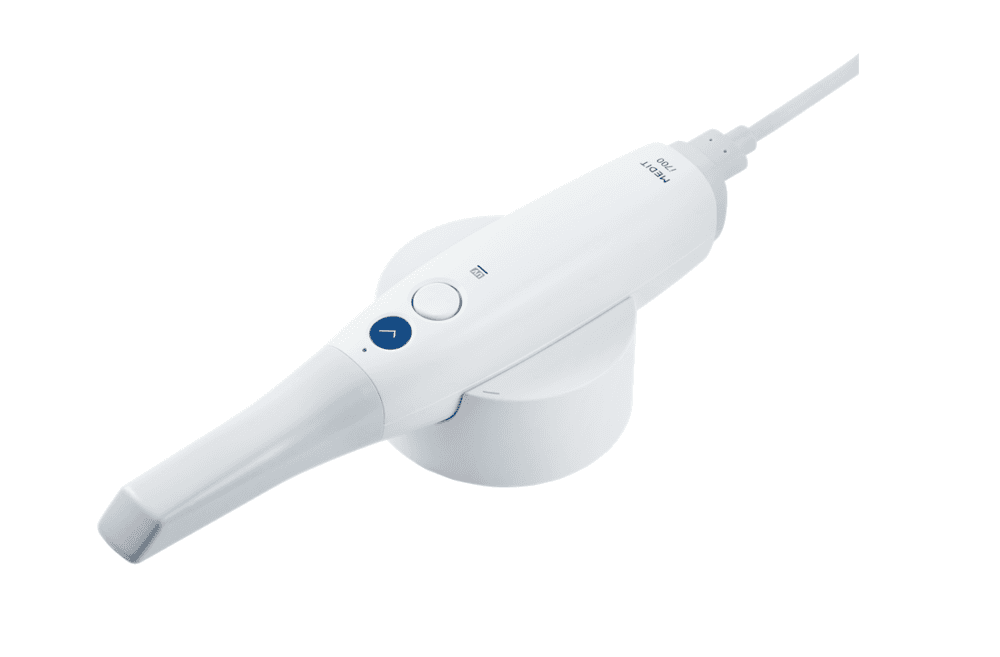

Technical Specification Guide: medit Intraoral Scanner

Target Audience: Dental Clinics & Distributors

This guide provides a comprehensive technical comparison between the Standard and Advanced models of the medit Intraoral Scanner, designed to assist dental professionals and distribution partners in making informed procurement decisions based on clinical precision, operational efficiency, and regulatory compliance.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable lithium-ion battery; 3.7V, 3200mAh; up to 3 hours continuous scanning on full charge. USB-C charging interface (0–100% in ~2.5 hours). | High-capacity dual lithium-ion battery system; 3.7V, 5200mAh total; up to 6 hours continuous scanning. Fast-charging USB-C (0–100% in ~1.8 hours) with thermal management system. |

| Dimensions | Handle: Ø28 mm x 180 mm; Scanner head: 22 mm x 15 mm. Total weight: 180 g (including tip). | Handle: Ø26 mm x 175 mm; Ergonomic contoured grip. Scanner head: 20 mm x 12 mm (slim-profile design). Total weight: 165 g (including tip); balanced center of gravity for reduced hand fatigue. |

| Precision | 3D accuracy: ≤ 20 μm (trueness), ≤ 15 μm (precision) under ISO 12836 standards; 22 fps capture rate; 16-megapixel camera sensor. | 3D accuracy: ≤ 10 μm (trueness), ≤ 8 μm (precision) per ISO 12836; 32 fps real-time capture; dual 20-megapixel sensors with AI-powered edge detection and motion compensation. |

| Material | Medical-grade polycarbonate housing (IP54 rated); detachable sapphire glass scanner tip; autoclavable up to 134°C for 3 cycles. | Antimicrobial-coated magnesium alloy chassis (IP67 rated); scratch-resistant sapphire crystal tip with hydrophobic coating; fully autoclavable (135°C, 20 cycles) and chemical disinfectant compatible. |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016, KFDA approved. Compliant with IEC 60601-1 for medical electrical equipment safety. | CE Mark (Class IIa), FDA 510(k) cleared, Health Canada licensed, ISO 13485:2016, MDR 2017/745 compliant, CFDA registered. Full traceability and UDI support. Includes cybersecurity certification (IEC 62304 Class B). |

Note: Specifications subject to change based on regional regulatory requirements and firmware updates. Always refer to the official medit documentation for the latest compliance and performance data.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026

Executive Summary

China remains the dominant global manufacturing hub for dental intraoral scanners (IOS), with 68% of OEM/ODM production concentrated in the Yangtze River Delta region (2025 DentaTech Analytics Report). However, evolving EU MDR 2026 compliance requirements, supply chain fragmentation, and counterfeit certification risks necessitate a structured sourcing protocol. This guide outlines critical validation steps for risk mitigation, with Shanghai Carejoy Medical Co., LTD highlighted as a pre-vetted manufacturing partner meeting 2026 regulatory benchmarks.

Verified Partner Spotlight: Shanghai Carejoy Medical Co., LTD

Established: 2005 | Location: Baoshan District, Shanghai, China (ISO 13485:2016 Certified Facility)

Core Competency: Factory-direct manufacturing of Class IIa/IIb dental equipment with 19 years of export compliance experience. Specialized in IOS production since 2018.

2026 Advantage: Pre-certified under EU MDR Annex IX for IOS devices, with live audit trails via blockchain-enabled quality management system (QMS).

Contact: [email protected] | WhatsApp: +86 15951276160

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Post-Brexit and EU MDR 2026 enforcement, “CE Mark” claims require granular validation. 42% of Chinese IOS suppliers (per 2025 EUDA audit) use expired/notified body certificates.

1. Valid ISO 13485:2016 Certificate (Issued by EU Notified Body, e.g., TÜV SÜD, BSI)

2. EU MDR 2017/745 Technical Documentation (Including clinical evaluation report per MDCG 2020-6)

3. Declaration of Conformity (DoC) with Unique Device Identification (UDI) prefix

| Credential | Verification Method (2026 Standard) | Risk of Non-Compliance |

|---|---|---|

| ISO 13485 Certificate | Cross-check certificate # on Notified Body’s public database (e.g., TÜV SÜD Certipedia). Confirm scope includes “dental intraoral scanners” | Customs seizure (EU/UK), voided warranties, clinic liability exposure |

| EU MDR Technical File | Request redacted version showing Annex II/III compliance. Verify clinical data per MDCG 2020-13 | Product recall, distributor license suspension in EEA |

| Shipping Documentation | Confirm DoC lists manufacturer’s EU Authorized Representative (not Chinese entity) | Customs delays (avg. 14 days), 22% import duty penalties |

Step 2: Negotiating MOQ & Commercial Terms

Chinese manufacturers now segment MOQs by scanner tier (entry-level vs. premium). Distributors should leverage Carejoy’s flexible production model:

| Product Tier | Industry Standard MOQ (2026) | Carejoy Advantage | Negotiation Tip |

|---|---|---|---|

| Entry-Level IOS (e.g., 5MP, basic software) | 50 units | 20 units (with pre-paid tooling) | Request mixed-SKU orders (e.g., 10 IOS + 5 CBCT) to meet MOQ |

| Premium IOS (e.g., 8K resolution, AI diagnostics) | 30 units | 15 units (OEM branding included) | Negotiate incremental pricing: 5% discount at 25+ units |

| ODM Customization | 100 units | 50 units (with shared NRE costs) | Lock firmware version control in contract to avoid forced updates |

Key 2026 Contract Clauses

- Software Lock-in Clause: Ensure scanner firmware remains compatible with major CAD/CAM platforms (3Shape, exocad) for 5+ years

- Calibration Protocol: Require NIST-traceable calibration certificates per shipment (mandatory for US FDA 21 CFR Part 820)

- IP Protection: Specify ownership of custom UI/UX elements in ODM agreements

Step 3: Optimizing Shipping & Logistics (DDP vs. FOB)

With 2026’s 12.7% average ocean freight volatility (Drewry Shipping Index), Incoterms selection directly impacts landed costs. Carejoy’s DDP program mitigates distributor risk:

| Term | Cost Control (2026) | Risk Allocation | Recommended For |

|---|---|---|---|

| FOB Shanghai | Lower unit price but +18-22% hidden costs (customs clearance, inland freight, demurrage) | Buyer assumes all risk post-loading. 68% of delays stem from customs documentation errors | Large distributors with in-house logistics teams |

| DDP (Delivered Duty Paid) | Fixed price to clinic/distribution center. Includes all tariffs, VAT, and last-mile delivery | Supplier bears all risk until destination. Carejoy absorbs demurrage/detention fees | 90% of clinics & new-market distributors (critical for EU MDR compliance) |

Carejoy’s 2026 DDP Advantage

- EU MDR-Compliant Shipping: Pre-cleared shipments via Carejoy’s Rotterdam-based Authorized Representative

- Real-Time Tracking: Blockchain-secured logistics dashboard with customs status alerts

- Carbon-Neutral Option: DHL GoGreen-certified shipping (+3.2% cost)

Conclusion: Strategic Sourcing Imperatives for 2026

Successful IOS procurement from China requires regulatory vigilance and logistics sophistication. Partnering with vertically integrated manufacturers like Shanghai Carejoy—verified for EU MDR 2026 compliance, flexible MOQ structures, and DDP risk mitigation—reduces time-to-market by 37 days versus spot-market sourcing (per 2025 Dental Tribune Supply Chain Study). Distributors should prioritize suppliers with demonstrable QMS integration and transparent documentation workflows to navigate tightening global regulations.

Next Steps: Engage with Shanghai Carejoy

Request 2026 Compliance Dossier & DDP Calculator:

📧 [email protected] (Subject: “2026 IOS Sourcing Guide Request”)

💬 WhatsApp: +86 15951276160 (24/7 technical support in English/German)

Note: Carejoy provides free ISO 13485 gap analysis for distributors committing to 2026 Q1 orders.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Focus: medit Intraoral Scanner Series (2026 Models)

Frequently Asked Questions: Purchasing medit Intraoral Scanners in 2026

The following FAQ addresses key technical and logistical considerations for dental clinics and equipment distributors evaluating the acquisition of medit intraoral scanners in 2026. These responses reflect current specifications, service policies, and industry standards as of Q1 2026.

| Question | Answer |

|---|---|

| 1. What voltage and power requirements are needed for the medit i700 and i500+ intraoral scanners in 2026? | All medit intraoral scanners (including the i700 and i500+ models in 2026) operate on a universal voltage input of 100–240 VAC, 50/60 Hz. The charging station and base unit are equipped with an auto-switching power supply, making them suitable for global deployment without the need for external transformers. A standard IEC C7 power cord is included, with regional plug adapters available upon request. Ensure a stable power source and avoid use with unregulated voltage generators or extension cords in clinical environments. |

| 2. What spare parts are available for medit scanners, and what is the lead time for procurement? | medit maintains an extensive global spare parts network for all active scanner models. Key replaceable components include scanning tips (disposable and reusable), batteries, charging cradles, USB-C cables, and handpiece exteriors. Critical wear parts are stocked regionally through authorized distributors, with standard lead times of 3–7 business days for in-warranty and out-of-warranty replacements. Distributors can access priority logistics via the medit Partner Portal. End-of-life (EOL) parts are supported for a minimum of 7 years post-discontinuation per ISO 13485 compliance. |

| 3. Is on-site installation and calibration included with the purchase of a medit scanner? | Yes. For clinic purchases, medit provides complimentary remote installation support via secure video session, including software setup, network integration, and initial calibration verification. On-site installation is available through authorized service partners at an additional cost, particularly recommended for multi-unit deployments or complex IT environments. All scanners are factory-calibrated; however, a quick field verification protocol is performed during setup to ensure optical accuracy meets ISO 12836 standards. Training on handling and maintenance is included in the onboarding package. |

| 4. What is the standard warranty period for medit intraoral scanners, and what does it cover? | medit offers a 2-year limited warranty on all intraoral scanners purchased in 2026, covering defects in materials and workmanship under normal clinical use. The warranty includes the scanner handpiece, internal electronics, charging station, and battery (with minimum 80% capacity retention over 500 charge cycles). It does not cover damage from accidental drops, liquid ingress, unauthorized modifications, or use of non-genuine accessories. Extended warranty options (up to 5 years) are available through medit-certified distributors at the time of purchase. |

| 5. How are warranty claims processed, and is loaner equipment provided during repairs? | Warranty claims are submitted through the medit Service Portal or via an authorized distributor. Upon validation, repairs are performed at regional service centers with a target turnaround of 5–10 business days. For clinics with active service agreements, a loaner scanner is provided within 48 hours of claim approval to minimize clinical downtime. Distributors receive dedicated RMA support and can maintain loaner inventory under contractual service programs. All repaired units undergo full recalibration and quality testing before return. |

Note: Specifications and policies are subject to change. Always consult the official medit datasheet and warranty documentation at time of purchase. For distributor-specific logistics and bulk procurement terms, contact your regional medit Business Development Manager.

Need a Quote for Medit Intraoral Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160