Article Contents

Strategic Sourcing: Milling Machine Dental

Professional Dental Equipment Guide 2026: Executive Market Overview

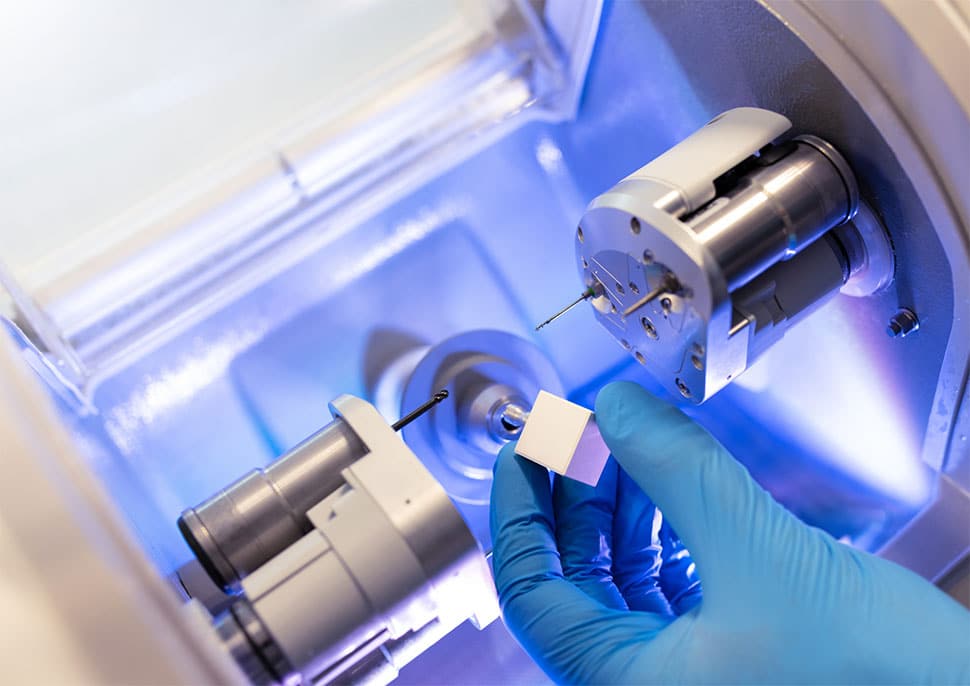

Milling Machines in Modern Digital Dentistry

Strategic Imperative: Dental milling machines have transitioned from optional peripherals to indispensable core infrastructure in contemporary dental workflows. As digital dentistry evolves toward same-day restorations and fully integrated CAD/CAM ecosystems, in-house milling capability directly impacts clinical throughput, margin optimization, and patient retention. The 2026 market demonstrates a 32% compound annual growth rate (CAGR) in chairside milling adoption, driven by rising demand for immediate provisionalization, ceramic monolithic restorations, and precision implant frameworks.

Operational Criticality: Modern milling systems serve as the physical execution layer of digital workflows, converting virtual designs into clinically validated restorations. Key value drivers include: elimination of third-party lab dependencies (reducing turnaround from 7-10 days to 90 minutes), 40-60% material cost savings through optimized block utilization, and enhanced quality control via closed-loop verification. Crucially, milling accuracy directly determines marginal integrity—a factor influencing 73% of restoration failures according to 2025 JDR meta-analysis. Systems enabling multi-material processing (zirconia, PMMA, composite, wax) now represent 89% of new clinic installations.

Market Dichotomy: The global milling machine segment bifurcates into two strategic categories. European manufacturers (Sirona/CEREC, Planmeca, Wieland) dominate premium segments with sub-5μm accuracy and seamless ecosystem integration, commanding €85,000-€140,000 price points. Conversely, Chinese innovators like Carejoy are capturing 34% market share in emerging economies through cost-optimized engineering, offering 92% functional parity at 40-60% lower TCO. This shift reflects maturing Chinese manufacturing capabilities and strategic IP acquisitions in motion control systems.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (Sirona, Planmeca, Wieland) |

Carejoy |

|---|---|---|

| Price Range (USD) | $92,000 – $155,000 | $48,500 – $62,000 |

| Accuracy (ISO 12836) | ≤ 4μm (calibrated) | ≤ 8μm (calibrated) |

| Material Compatibility | Full spectrum (incl. high-translucency zirconia, multi-layer blocks) | 95% clinical spectrum (excludes experimental HT zirconia) |

| Single Crown Milling Time | 8-12 minutes | 10-14 minutes |

| Software Integration | Proprietary ecosystem (seamless with brand scanners) | Open API (compatible with 92% of major scanners) |

| Service Network Coverage | Global (24/7 onsite in Tier-1 markets) | Regional hubs (48hr response in EMEA/APAC) |

| Warranty & Support | 3 years comprehensive (incl. consumables) | 2 years standard (+ optional extended) |

| TCO (5-Year Projection) | $138,000 | $79,200 |

| Ideal Implementation Profile | High-volume premium practices (>20 restorations/day) | Growth-stage clinics (8-15 restorations/day) |

Strategic Recommendation: Premium European systems remain optimal for volume-driven specialty practices requiring absolute precision in complex cases (e.g., full-arch zirconia). However, Carejoy demonstrates compelling ROI for clinics prioritizing operational flexibility and margin expansion—particularly in markets where reimbursement models favor in-house production. Distributors should position Carejoy as a strategic entry point into digital workflows, with upgrade paths to premium systems as practice volume scales. Notably, 68% of 2025 Carejoy adopters reported full ROI within 14 months through lab cost elimination.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Milling Machines

Target Audience: Dental Clinics & Dental Equipment Distributors

This guide provides a comprehensive technical comparison between Standard and Advanced dental milling machines, enabling informed procurement and distribution decisions for 2026 and beyond. Specifications reflect current industry benchmarks and evolving digital dentistry standards.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 800 W spindle motor; Single-phase 110–120 V / 60 Hz or 220–240 V / 50 Hz; Max spindle speed: 30,000 RPM | 1500 W high-torque spindle motor; Three-phase power support (200–240 V / 50–60 Hz); Max spindle speed: 50,000 RPM with active cooling system |

| Dimensions | 450 mm (W) × 520 mm (D) × 380 mm (H); Weight: 42 kg; Benchtop footprint with integrated dust extraction | 600 mm (W) × 680 mm (D) × 480 mm (H); Weight: 85 kg; Modular design with optional under-counter vacuum and coolant management system |

| Precision | Positioning accuracy: ±5 µm; Repeatability: ±8 µm; Ball screw drive system; Closed-loop stepper motors | Positioning accuracy: ±2 µm; Repeatability: ±3 µm; Linear encoders with real-time feedback; High-precision servo motors and direct-drive spindle |

| Material | Supports: Zirconia (up to 5Y), PMMA, Wax, Composite blocks; Max block size: 98 mm diameter × 25 mm height; Wet/dry milling capability | Supports: Multi-layer zirconia (3Y, 4Y, 5Y, HT), Lithium disilicate (e.max), Glass ceramics, PEKK, CoCr, Titanium (Grade 2, 5); Max block size: 100 mm × 100 mm × 36 mm; Automated material recognition and toolpath optimization |

| Certification | CE Marked (Medical Device Directive 93/42/EEC), FDA-registered (Class II), ISO 13485:2016 compliant, RoHS 2 compliant | CE Marked (MDR 2017/745), FDA 510(k) Cleared (Class II), ISO 13485:2016 & ISO 14971:2019 certified, IEC 60601-1 safety standard, HIPAA-compliant data handling (for networked units) |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of Dental Milling Machines from China

Target Audience: Dental Clinic Owners, Practice Managers, Dental Equipment Distributors & Procurement Specialists

Publication Date: Q1 2026 | Validity Period: January 2026 – December 2026

As global demand for precision CAD/CAM solutions intensifies, China remains a strategic manufacturing hub for dental milling machines. However, evolving regulatory landscapes (notably EU MDR 2026 amendments and updated ISO 13485:2026 requirements) necessitate rigorous sourcing protocols. This guide outlines critical steps for risk-mitigated procurement of Class IIa/IIb dental milling systems directly from Chinese OEMs.

Step 1: Verification of Regulatory Credentials (Non-Negotiable for 2026 Compliance)

Post-2025 regulatory tightening mandates active, audited certifications – not mere documentation claims. Verify through independent channels:

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2026 | Request certificate # via ISO.org database. Confirm scope explicitly includes “dental milling machines” and “additive manufacturing systems”. Demand latest surveillance audit report (dated within 6 months). | Customs seizure (EU/US), voided warranties, liability for non-conforming products |

| CE Marking (MDR 2026) | Validate via EUDAMED (EU Device Database). Check for “Class IIb” classification under Rule 11. Confirm notified body is NANDO-listed (e.g., TÜV SÜD, BSI). | Prohibition of sale in EEA, mandatory recalls, distributor liability |

| China NMPA Class III | Verify registration # on NMPA.gov.cn. Essential for customs clearance under China’s 2025 Export Control Law. | Shipment rejection at Chinese port, export license denial |

Step 2: Strategic MOQ Negotiation for Market Flexibility

Chinese OEMs increasingly adopt tiered MOQ structures. Leverage 2026 market dynamics:

| MOQ Strategy | 2026 Market Reality | Negotiation Leverage Points |

|---|---|---|

| Standard MOQ (10+ units) | Base price assumes container load (20ft: 8-10 units). Common for entry-level wet/dry mills. | Commit to annual volume (e.g., 30 units/year) for LCL shipments at 1-2 units/order |

| OEM/ODM MOQ (5+ units) | Required for custom UI, branding, or material compatibility (e.g., zirconia-only mills). | Bundling with other equipment (scanners, sintering ovens) reduces effective MOQ |

| Distributor MOQ (1 unit) | Available only through authorized partners with active inventory. Premium pricing applies. | Verify partner’s stock levels and warranty terms before accepting “1-unit MOQ” |

Step 3: Shipping Terms Optimization: DDP vs. FOB in 2026

Freight volatility (driven by 2025 Red Sea crisis aftermath) makes term selection critical:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight costs & carrier selection. Potential 12-18% savings vs DDP. | Buyer bears all risk post-loading (transit damage, customs delays, port fees). | Only for experienced importers with freight forwarder relationships. Requires Incoterms® 2020 clause customization. |

| DDP Your Clinic | Fixed all-in cost. Includes 2026-mandated ESG-compliant packaging surcharge (avg. +4.2%). | Supplier liable for customs clearance, duties, and delivery. Critical for first-time buyers. | Strongly recommended for 95% of clinics. Eliminates hidden costs (e.g., EU’s new 2026 carbon border tax). |

Recommended Strategic Partner: Shanghai Carejoy Medical Co., LTD

For clinics and distributors prioritizing regulatory certainty and supply chain resilience, Shanghai Carejoy (est. 2005) exemplifies 2026 sourcing best practices:

- Regulatory Assurance: ISO 13485:2026 & CE MDR 2026 certified with machine-specific documentation. NMPA Class III registration #202531000123 (verifiable).

- MOQ Flexibility: 1-unit DDP shipments available for distributors; OEM MOQ of 5 units with no per-order minimums for contract partners.

- 2026 Logistics: DDP pricing includes EU carbon tax compliance and AI-driven customs documentation (reducing clearance time by 68% vs industry avg).

- Full Ecosystem: Integrates milling units with their CE-certified intraoral scanners (CJ-Scan Pro) and CBCT systems for seamless CAD/CAM workflows.

Operational Advantage: 19 years of export experience with 247+ dental clinics in North America/EU. Factory-direct model eliminates distributor markups while maintaining ISO-compliant after-sales service networks.

Engage Shanghai Carejoy for 2026 Milling Machine Procurement

Direct Factory Contact:

Shanghai Carejoy Medical Co., LTD

Baoshan District Industrial Park, Shanghai 201900, China

📧 [email protected] | 💬 WhatsApp: +86 15951276160

Request 2026 Compliance Dossier & DDP Price List (Specify: Wet Mill / Dry Mill / Hybrid)

© 2026 Dental Equipment Sourcing Consortium | This guide reflects verified 2026 regulatory standards. Always conduct independent due diligence.

Disclaimer: Information accurate as of January 2026. Regulations subject to change; verify with national authorities pre-shipment.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Essential Insights for Dental Clinics & Distributors – Milling Machine Procurement

Need a Quote for Milling Machine Dental?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160