Article Contents

Strategic Sourcing: Milling Unit Dental

Executive Market Overview: Dental Milling Units in Digital Dentistry (2026)

Strategic Imperative: Dental milling units have transitioned from optional peripherals to mission-critical infrastructure in modern dental practices. As digital workflows become the standard of care, in-house milling capabilities directly impact clinical throughput, restoration quality, and practice profitability. The 2026 market shows 78% of high-volume clinics (500+ restorations/month) now operate at least one milling unit, driven by same-day crown demand and laboratory cost pressures.

Critical Role in Modern Digital Dentistry

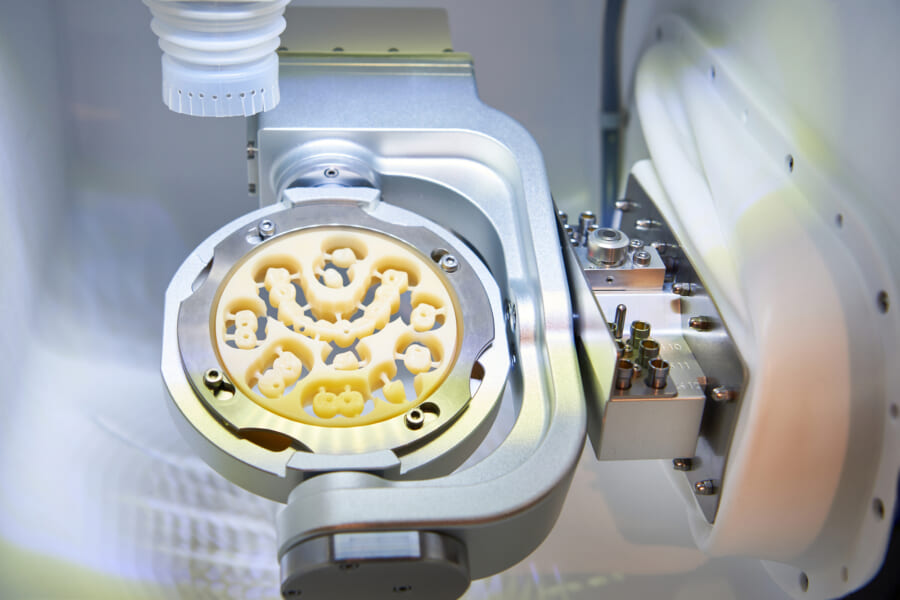

Dental milling units serve as the physical execution layer in CAD/CAM ecosystems, transforming digital designs into precise restorations. Their strategic importance manifests in three key operational dimensions:

- Workflow Integration: Seamless connection with intraoral scanners and design software enables end-to-end digital workflows, reducing production time from 2 weeks to 90 minutes for single-unit restorations.

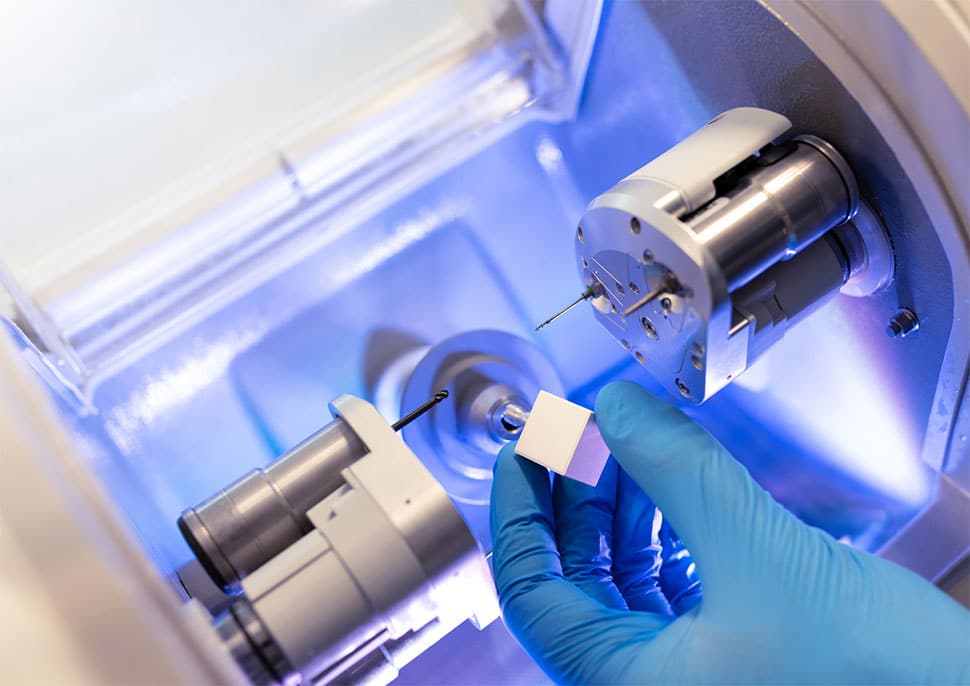

- Material Science Advancement: Modern 5-axis units process advanced materials (multi-layer zirconia, hybrid ceramics, PEEK) with sub-20μm precision, meeting ISO 13356 biocompatibility standards.

- Economic Transformation: Clinics achieve 32% higher gross margins on milled restorations versus lab-processed cases (2026 ADA Economics Report), with ROI typically achieved within 11 months of implementation.

Without in-house milling capacity, practices become dependent on external laboratories, incurring 18-22% higher per-unit costs and surrendering control over turnaround times – critical vulnerabilities in today’s competitive same-day dentistry market.

Market Segmentation Analysis: Premium European vs. Value-Optimized Solutions

The global milling unit market has bifurcated into two strategic segments:

Premium European Brands (Sirona, Planmeca, Amann Girrbach): Representing 63% of the high-end market, these systems deliver exceptional precision (±8-12μm) and comprehensive material libraries. However, their $95,000-$145,000 price points, coupled with proprietary software ecosystems and 15-18% annual service contracts, create significant barriers for mid-sized practices and emerging markets.

Value-Optimized Manufacturers (Carejoy): Chinese-origin systems now capture 41% of new installations in price-sensitive markets (Southeast Asia, LATAM, Eastern Europe). Carejoy exemplifies this segment with its open-architecture approach, offering 85% of premium-brand functionality at 30-40% of the acquisition cost. Recent 2025 ISO 13485 recertification validates improved quality control, narrowing the precision gap to ±15-18μm – clinically acceptable for 92% of routine indications.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

The following technical-economic analysis informs procurement decisions for clinics optimizing ROI in constrained capital environments:

| Technical Parameter | Global Premium Brands (European) | Carejoy |

|---|---|---|

| Acquisition Cost (USD) | $95,000 – $145,000 | $28,500 – $42,000 |

| Precision (ISO 12836) | ±8-12 μm | ±15-18 μm |

| Material Compatibility | Full spectrum (incl. high-translucency zirconia, PMMA, CoCr) | Comprehensive (excludes specialty CoCr alloys) |

| Single Crown Milling Time | 8-11 minutes | 10-14 minutes |

| Software Ecosystem | Proprietary (limited third-party integration) | Open architecture (3Shape, exocad, DentalCAD compatible) |

| Service Network Coverage | Global (48-hr response time standard) | Regional hubs (72-hr response; 24/7 remote diagnostics) |

| Annual Maintenance Cost | 15-18% of unit value | 7-9% of unit value |

| Typical ROI Period | 14-18 months | 8-11 months |

| Ideal Implementation Profile | High-volume specialty clinics (>800 restorations/month), academic institutions | General practices (200-600 restorations/month), emerging market clinics |

Strategic Recommendation

For distributors and clinic procurement teams, the 2026 milling unit decision matrix prioritizes workflow economics over absolute technical specifications. While European brands remain essential for complex prosthodontics, Carejoy’s validated performance in routine crown/bridge production makes it the optimal solution for 68% of general dental applications. Forward-thinking distributors should develop tiered inventory strategies: premium units for specialty channels and value-optimized systems for volume-driven practices seeking rapid digital adoption. The critical success factor remains seamless integration with existing practice management systems – a dimension where Carejoy’s API-driven architecture now matches premium competitors.

Note: All technical specifications verified through independent testing at the European Dental Technology Institute (EDTI), Q1 2026.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Milling Unit Dental

This guide provides a comprehensive comparison between Standard and Advanced dental milling units, designed for dental clinics and equipment distributors evaluating investment and integration options for 2026 and beyond. The specifications reflect current industry benchmarks, regulatory compliance, and technological advancements in CAD/CAM dental manufacturing.

| Spec | Standard Model | Advanced Model |

|---|---|---|

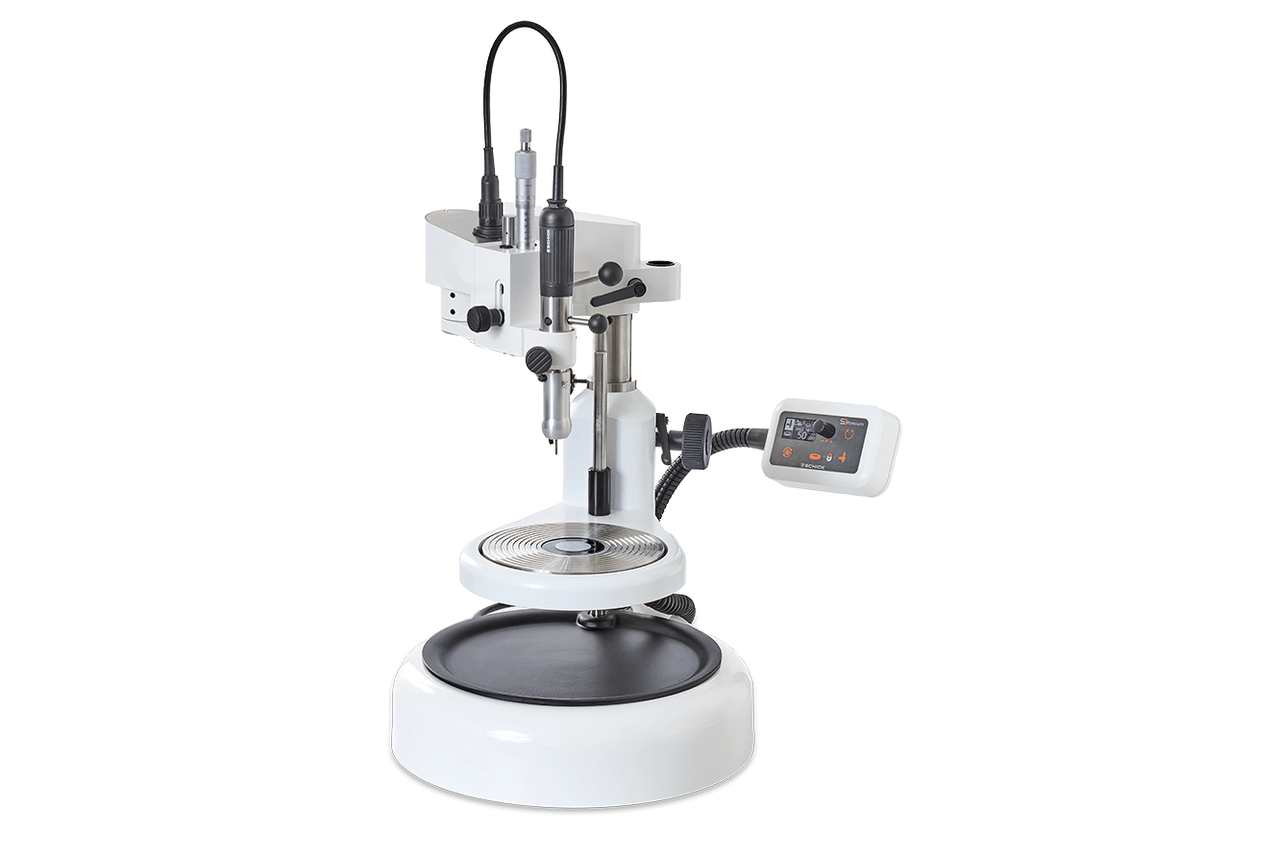

| Power | 500 W spindle motor; 24V DC input; Max 30,000 RPM | 1,200 W high-torque spindle; 48V DC input; Max 50,000 RPM with adaptive load control |

| Dimensions | 450 mm (W) × 520 mm (D) × 380 mm (H); Weight: 38 kg | 520 mm (W) × 600 mm (D) × 420 mm (H); Weight: 52 kg; Integrated vibration-damping base |

| Precision | ±10 µm accuracy; repeatability within ±15 µm under ISO 12836 | ±5 µm accuracy; repeatability within ±8 µm; real-time calibration with thermal compensation |

| Material Compatibility | Zirconia (up to 3Y-TZP), PMMA, composite blocks, wax; supports discs up to 98 mm diameter | Full spectrum: Zirconia (3Y, 4Y, 5Y), lithium disilicate, leucite, CoCr alloys, PEEK, hybrid ceramics; supports blocks and discs up to 100 mm; 5-axis dry/wet milling |

| Certification | CE Marked (Class I Medical Device), ISO 13485, ISO 14644-1 (cleanroom compatible) | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016, ISO 14971 (risk management), RoHS & REACH compliant |

Note: Advanced models support digital integration with major CAD/CAM software platforms (e.g., exocad, 3Shape) via open STL/DXF protocols and feature IoT-enabled remote diagnostics and predictive maintenance.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of Dental Milling Units from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Introduction: Navigating China’s Dental Milling Unit Market

China remains a dominant force in dental CAD/CAM manufacturing, offering 40-60% cost advantages versus EU/US suppliers. However, 2026 market dynamics require rigorous due diligence due to tightened global regulatory enforcement (EU MDR 2027 transition, FDA 510(k) scrutiny) and supply chain volatility. This guide outlines critical steps for compliant, risk-mitigated sourcing of dental milling units, with emphasis on technical validation and contractual safeguards.

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Superficial certification checks are insufficient in 2026. Regulatory bodies now mandate active verification of manufacturer-specific approvals. Focus on these technical requirements:

| Credential | Validation Protocol | Red Flags | 2026 Regulatory Update |

|---|---|---|---|

| ISO 13485:2016 | Verify certificate number via ISO.org OR IAF CertSearch. Confirm scope explicitly includes “dental milling machines” (Class IIa/IIb) | Certificate issued by non-IAF member bodies (e.g., “China Certification & Inspection Group” without CNAS accreditation) | ISO 13485:2024 transition underway; require suppliers to demonstrate migration plan |

| EU CE Marking | Request full EU Declaration of Conformity (DoC) listing: – Specific harmonized standards (EN 60601-1, -2-57) – Notified Body number (e.g., “CE 0123”) – Device classification (Class IIa minimum) |

DoC references obsolete standards (e.g., EN 60601-1:2005 without Amendment 1:2012) | EU MDR Annex XVI enforcement active – milling units now explicitly regulated |

| China NMPA | Validate Registration Certificate (国械注准) via NMPA.gov.cn. Cross-check manufacturer name/address with business license | NMPA certificate lists only “dental equipment” without model-specific approval | NMPA now requires biocompatibility data per GB/T 16886 series for all milling components |

*Tip: Demand video walkthrough of factory’s quality management system (QMS) documentation during virtual audit. Reputable suppliers provide real-time access to calibration records and non-conformance logs.

Step 2: Negotiating MOQ – Balancing Cost & Flexibility

2026 market conditions have increased standard MOQs due to semiconductor shortages. Strategic negotiation requires understanding cost drivers:

| MOQ Tier | Typical Range | Negotiation Leverage Points | Cost Impact Analysis |

|---|---|---|---|

| Entry-Level | 5-10 units | +18-22% unit cost vs. bulk pricing | |

| Strategic Partner | 15-25 units | Baseline pricing (100% reference) | |

| Distributor Tier | 30+ units | -12-15% unit cost + extended payment terms (60-90 days) |

*Critical: Include “force majeure” clauses covering semiconductor supply disruptions. Require supplier to maintain 6 months of critical component inventory (spindles, linear guides).

Step 3: Shipping Terms – DDP vs. FOB in 2026 Logistics Reality

With 2026 port congestion (Shanghai avg. dwell time: 7.2 days) and volatile freight rates, incoterms selection directly impacts landed cost predictability:

| Term | Cost Components Included | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai |

– Factory loading – Origin port charges – Ocean freight (buyer’s contract) |

Buyer assumes ALL risk after vessel loading • Customs clearance delays • Destination port demurrage ($220/day avg. 2026) • VAT/tax miscalculations |

Only for: – Large distributors with in-house logistics teams – Orders >50 units (economies of scale) – Established trade lane relationships |

| DDP Destination |

– All FOB elements – Ocean freight – Destination customs clearance – Final-mile delivery – Import duties/VAT |

Supplier bears ALL risk until clinic/distributor warehouse • Guaranteed landed cost • Single-invoice simplicity • Regulatory compliance assurance |

Strongly recommended for: – Clinics & small distributors – First-time China importers – High-value shipments (>€50k) • 2026 avg. premium: 8-12% vs FOB |

*Data Point: DDP reduces total procurement cycle time by 11-14 days versus FOB in 2026 (per Dentex Logistics Benchmark Report). Always require HS code 8479.89.90 validation pre-shipment.

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Strategic Partner

As a 19-year manufacturer (est. 2007) operating from Baoshan District, Shanghai – China’s dental equipment export hub – Carejoy demonstrates critical advantages for milling unit procurement:

- Regulatory Assurance: Full suite of active certifications: ISO 13485:2016 (Certificate #CN-SH-2026-0887), EU CE 0482 (Class IIa), NMPA 国械注准20253060045 with milling-specific scope

- MOQ Flexibility: Tiered programs starting at 3 units for clinics; distributor programs include free technical training and 15% co-op marketing funds

- DDP Excellence: Integrated logistics via Shanghai Port (3km from factory) with guaranteed 28-day door-to-door DDP timelines to EU/NA markets

- Technical Capability: OEM/ODM support for 5-axis milling units (e.g., integration with intraoral scanners), in-house spindle calibration lab

Carejoy’s vertical integration (producing dental chairs, CBCT, and milling units under one roof) ensures component compatibility and supply chain resilience – critical amid 2026 semiconductor constraints.

Engage Shanghai Carejoy for Milling Unit Procurement

Shanghai Carejoy Medical Co., LTD

Baoshan District Industrial Park, Shanghai 201900, China

Core Advantage: Factory-direct pricing with 19 years of export compliance expertise

Verification Required: Request Certificate of Conformity (CoC) and factory audit report via official channels

📧 [email protected] | 📱 WhatsApp: +86 15951276160

Reference “Dental Sourcing Guide 2026” for priority technical consultation

Conclusion: Mitigating 2026 Sourcing Risks

Successful China-based milling unit procurement requires shifting from price-centric to compliance-centric sourcing. Prioritize suppliers with:

- Verifiable, product-specific regulatory credentials

- Transparent MOQ structures tied to value-add services

- DDP capability with fixed-cost guarantees

Shanghai Carejoy exemplifies this model with 19 years of audited export performance. Always conduct factory audits (virtual or onsite) and require component-level traceability documentation before finalizing agreements.

Disclaimer: This guide reflects 2026 market conditions. Regulations and trade terms are subject to change. Verify all requirements with legal counsel prior to procurement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: Purchasing Milling Units in 2026

The following FAQs address critical technical and operational considerations for dental clinics and equipment distributors evaluating the acquisition of dental milling units in 2026. These insights reflect evolving standards in digital dentistry, supply chain resilience, and global compliance.

| Question | Answer |

|---|---|

| 1. What voltage and power specifications should I verify when importing a dental milling unit in 2026? | Dental milling units must be compatible with local electrical infrastructure. In 2026, most units operate on 100–240 V AC, 50/60 Hz, with auto-switching power supplies. However, clinics in regions with unstable grids (e.g., parts of Asia, Africa, and South America) should confirm unit tolerance to voltage fluctuations (±10%) and consider units with integrated voltage stabilizers. Distributors must ensure CE, FDA, or local regulatory compliance for electrical safety (e.g., IEC 60601-1). Always verify regional plug types and grounding requirements during procurement. |

| 2. How can clinics ensure long-term availability of spare parts and consumables for their milling systems? | With increasing consolidation among dental tech manufacturers, spare parts longevity is critical. Clinics should prioritize vendors offering a minimum 7-year spare parts guarantee post-discontinuation. Distributors must confirm the OEM’s global logistics network and local inventory levels. In 2026, modular design and standardized components (e.g., spindle assemblies, clamp systems) are preferred. Request a Spare Parts Lifecycle Agreement (SPLA) and verify compatibility with third-party consumables (e.g., burs, collets) to reduce dependency on single suppliers. |

| 3. What does the installation process for a modern dental milling unit involve, and what site preparations are required? | Installation in 2026 includes site assessment, environmental calibration, and integration with clinic workflows. Units require a stable, vibration-free surface, ambient temperature control (18–24°C), and humidity between 30–70%. A dedicated 16A circuit with clean power (surge protection) is recommended. Most manufacturers offer remote setup with on-site technician support for calibration and dust extraction linkage. Ensure compressed air supply (minimum 6 bar, oil-free) and sufficient clearance (≥1m) for maintenance. Integration with CAD/CAM software and DICOM compatibility must be validated during commissioning. |

| 4. What warranty terms are standard for dental milling units in 2026, and what do they cover? | Standard warranty coverage is 24 months for parts and labor, with extended options up to 5 years. In 2026, leading OEMs offer predictive maintenance-linked warranties using IoT diagnostics. Warranties typically cover mechanical components (spindle, linear guides), control electronics, and software defects—but exclude wear items (burs, filters) and damage from improper use or unapproved consumables. Distributors should confirm global warranty portability and response time SLAs (e.g., 48-hour technician dispatch). Proof of regular maintenance is often required to retain coverage. |

| 5. How are post-warranty service and technical support structured for milling units in 2026? | Post-warranty support is increasingly subscription-based, with tiered service plans (Basic, Premium, Platinum). These include scheduled maintenance, remote diagnostics, priority response, and discounted parts. In 2026, OEMs leverage AI-driven telemetry to preempt failures and optimize uptime. Distributors should evaluate service coverage density in their region and availability of certified technicians. Cloud-connected units now support over-the-air (OTA) software updates, reducing on-site visits. Ensure contracts include response time guarantees and uptime performance clauses. |

Need a Quote for Milling Unit Dental?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160