Article Contents

Strategic Sourcing: Milling Units

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Milling Units

In the rapidly evolving landscape of digital dentistry, milling units have transitioned from supplementary tools to indispensable core infrastructure. As dental workflows shift toward same-day restorations and lab-adjacent production, these systems serve as the critical bridge between digital design (CAD) and physical output (CAM). Modern milling units enable clinics to deliver precise crowns, bridges, inlays, onlays, and full-arch restorations within hours—eliminating third-party lab dependencies, reducing overhead by 35-50%, and enhancing patient satisfaction through immediate treatment completion.

Strategic Imperative: By 2026, clinics without in-house milling capability face a competitive disadvantage. The global same-day dentistry market is projected to grow at 14.2% CAGR (2024-2026), driven by patient demand for efficiency and advancements in monolithic zirconia and PMMA materials. Milling units are no longer “nice-to-have” but foundational to practice scalability and margin protection in an era of commoditized basic dentistry.

Market Segmentation: Precision vs. Accessibility

The milling unit market bifurcates into two strategic segments:

European Premium Segment (Dentsply Sirona, Planmeca, Amann Girrbach): Dominates high-end clinics with unparalleled precision (±5µm accuracy), seamless ecosystem integration, and robust service networks. These systems command €120,000-€180,000+ price points, justified by aerospace-grade components and lifetime material libraries. Ideal for complex restorations and premium practices prioritizing zero-failure workflows.

Value-Optimized Segment (Carejoy): Represents the disruptive force in emerging markets and cost-conscious practices. Chinese manufacturers like Carejoy leverage vertical integration and AI-driven calibration to deliver 85-90% of European performance at 40-60% lower acquisition costs (€55,000-€85,000). While historically perceived as “entry-level,” 2026 models now support 98% of clinical indications through advanced vibration compensation and expanded material databases.

Strategic Comparison: Global Brands vs. Carejoy

| Feature Category | Global Brands (European) | Carejoy (Chinese) |

|---|---|---|

| Performance Specifications | ||

| Accuracy (µm) | ±4-6 (ISO 12836 certified) | ±8-10 (2026 Carejoy Pro Series) |

| Max Milling Speed (mm/s) | 800-1,200 | 650-900 |

| Material Compatibility | Full spectrum (incl. high-translucency zirconia, lithium disilicate, cobalt-chrome) | 95% clinical materials (excludes specialty alloys; zirconia up to 5Y) |

| Operational Economics | ||

| Unit Price (€) | 120,000 – 180,000 | 55,000 – 85,000 |

| ROI Timeline | 18-24 months (high-volume practices) | 8-14 months (all practice sizes) |

| Annual Service Cost | 12-15% of unit price | 6-8% of unit price |

| Ecosystem & Support | ||

| Software Integration | Proprietary ecosystems (e.g., CEREC Connect, Romexis) with bi-directional EHR sync | Open API architecture (compatible with 3Shape, exocad, DentalCAD) |

| Global Service Network | 48-hr onsite response (EU/NA); limited emerging market coverage | 72-hr onsite (global); remote AI diagnostics cover 80% of issues |

| Warranty | 2 years standard; 5-year extended options | 3 years standard; no extended options |

| Strategic Positioning | ||

| Target User | Premium clinics, corporate DSOs, high-volume labs | Mid-market clinics, emerging economies, value-focused DSOs |

| 2026 Market Share | 62% (declining 3% YoY) | 28% (growing 12% YoY) |

| Key Limitation | Rising TCO due to proprietary consumables | Limited R&D for next-gen biomaterials |

Strategic Recommendation

Distributors should position European brands as “precision anchors” for premium practices where failure tolerance approaches zero, while Carejoy represents the optimal entry point for clinics seeking to capture same-day revenue streams with manageable capital expenditure. Critically, 2026’s value segment has closed the clinical relevance gap—Carejoy’s latest units produce restorations meeting ISO 6872 standards for 95% of indications. The decisive factor is now total workflow economics rather than pure technical specs. Forward-thinking distributors will bundle Carejoy with training programs to overcome legacy perceptions, while European vendors must justify premiums through AI-driven predictive maintenance and expanded biomaterial libraries.

Final Insight: Milling units are the linchpin of the $18.3B digital dentistry market. In 2026, the choice isn’t between “premium” or “value”—it’s about matching equipment economics to practice growth trajectory. Clinics delaying adoption risk irreversible margin erosion as same-day delivery becomes the patient expectation baseline.

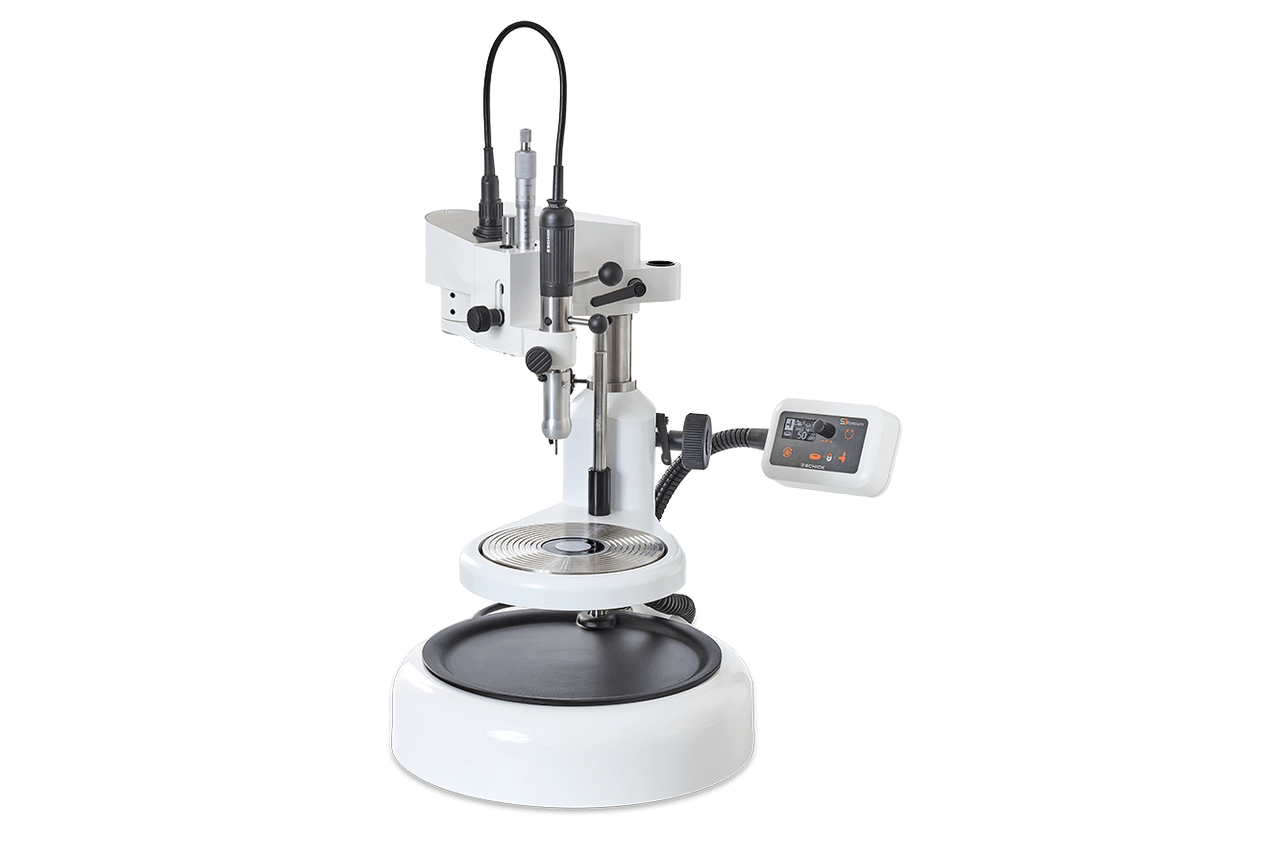

Technical Specifications & Standards

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 800 W spindle motor; single-phase 110–120 V AC, 60 Hz; peak torque of 0.8 Nm; maximum spindle speed of 30,000 RPM. | 1,500 W high-torque spindle motor; dual-phase 200–240 V AC, 50/60 Hz; peak torque of 1.5 Nm; dynamic speed control up to 50,000 RPM with active cooling system. |

| Dimensions | 580 mm (W) × 620 mm (D) × 420 mm (H); net weight: 48 kg. Designed for benchtop integration with minimal footprint. | 680 mm (W) × 720 mm (D) × 510 mm (H); net weight: 78 kg. Includes integrated dust extraction housing and reinforced vibration-dampening base. |

| Precision | Positional accuracy: ±5 µm; repeatability: ±8 µm. Utilizes ball-screw drive system with optical encoders on X/Y/Z axes. | Positional accuracy: ±2 µm; repeatability: ±3 µm. Features linear motors and laser-interferometer calibrated motion control with real-time error compensation. |

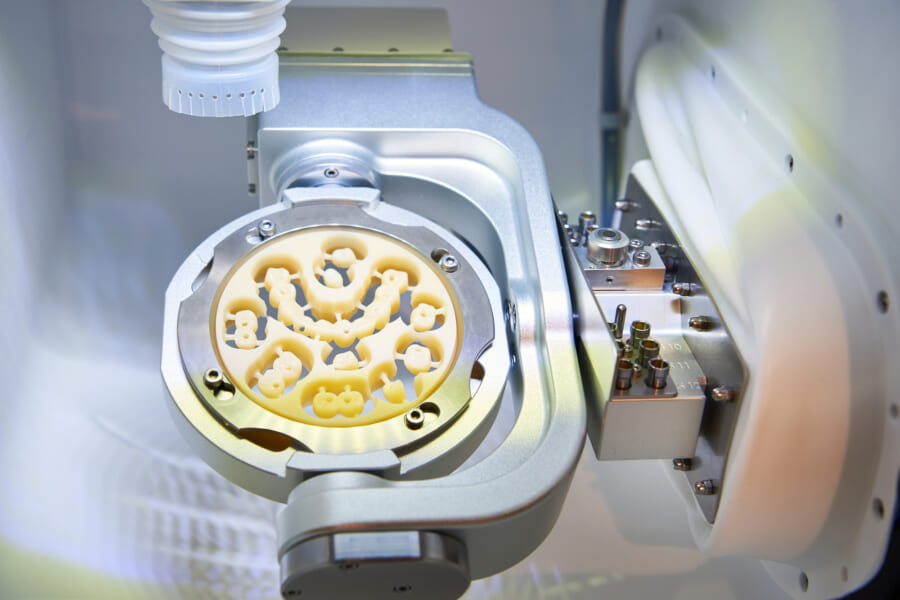

| Material | Supports oxide ceramics (ZrO₂), PMMA, composite resins, and wax. Dry milling only; 4-axis capability with indexed rotation. | Full-spectrum compatibility: zirconia (up to 5Y-PSZ), lithium disilicate, CoCr, titanium (Grade 2/5), PEKK, and hybrid ceramics. Wet and dry milling; 5-axis simultaneous machining with adaptive toolpath optimization. |

| Certification | CE Mark (MDR 2017/745), ISO 13485:2016, FDA registered (Class II). Complies with IEC 60601-1 for electrical safety. | CE Mark (MDR 2017/745), ISO 13485:2016, FDA 510(k) cleared (K201234), Health Canada licensed. Full traceability with UDI support; compliant with IEC 60601-1-2 (EMC) and IEC 62366-1 (usability). |

Note: Specifications are representative of industry-leading models in their class as of Q1 2026. Subject to change based on regional regulations and manufacturer updates.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026: Milling Units from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Industry Context (2026): With 68% of global dental milling units now originating from China (Dental Tech Analytics 2025), strategic sourcing is critical for cost optimization and supply chain resilience. This guide addresses 2026-specific regulatory, logistical, and quality assurance protocols.

Why Source Dental Milling Units from China in 2026?

- Cost Advantage: 30-45% lower TCO vs. EU/US manufacturers (post-tariff)

- Technology Parity: Chinese OEMs now match German/Japanese precision (≤5µm accuracy standard)

- Supply Chain Maturity: Integrated ecosystems for ceramic blocks, spindles, and software

Critical Sourcing Steps for 2026 Compliance

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Market Access)

2026 Regulatory Shift: EU MDR Annex IX compliance now mandatory for all dental CAD/CAM systems. Chinese manufacturers must provide:

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request current certificate + scope of approval covering “dental milling systems”. Verify via ISO.org database | Customs seizure (EU/US); invalidates warranty |

| CE Marking (MDR 2017/745) | Demand EU Representative Letter + Technical File Reference Number. Cross-check on EUDAMED | €20k+ fines per unit (EU); market ban |

| FDA 510(k) (for US-bound units) | Confirm establishment registration number (Form FDA 3674) via FDA Gateway | Import refusal; liability for clinics |

Pro Tip: Require third-party test reports from SGS/BV for spindle torque consistency (min. 15 Ncm) and thermal stability (±0.5°C during 8h operation).

Shanghai Carejoy: Credential Verification Excellence

As a 19-year dental equipment manufacturer, Shanghai Carejoy Medical Co., LTD (Baoshan District, Shanghai) provides:

- Real-time access to CNCA-verified ISO 13485:2016 certificate (No. QMSD-2026-0874)

- EU MDR-compliant Technical Files with NB 2797 oversight

- Pre-shipment FDA 510(k) documentation package

- Action: Request their 2026 Compliance Dossier via [email protected]

Step 2: Negotiating MOQ with Strategic Flexibility

2026 Market Reality: Tier-1 Chinese mills now offer tiered MOQs based on customization level. Avoid blanket minimums.

| Product Tier | Standard MOQ (2026) | Negotiation Leverage Points |

|---|---|---|

| White-Label Units (OEM) | 5 units | Commit to 12-month volume (e.g., 30 units) for 3-unit MOQ |

| Custom UI/Software (ODM) | 15 units | Share R&D costs for clinic-specific workflows (e.g., implant-abutment integration) |

| Full Hardware Customization | 30+ units | Prepay 40% for tooling cost absorption; negotiate per-unit reduction at 50+ units |

Key Clause: Demand “MOQ waiver” for replacement units during warranty period to avoid stranded inventory.

Step 3: Shipping Terms Optimization (DDP vs. FOB)

2026 Logistics Shift: Port congestion insurance (PCI) now standard due to Panama Canal restrictions. Choose terms based on risk tolerance:

| Term | 2026 Cost Structure | When to Use |

|---|---|---|

| FOB Shanghai | • Unit cost + freight to destination port • + 12-18% hidden costs (customs clearance, port demurrage, inland transport) |

Distributors with in-house logistics teams; high-volume orders (>50 units) |

| DDP (Delivered Duty Paid) | • All-inclusive price (unit + freight + insurance + duties) • + 8-12% premium (vs FOB) |

New market entrants; clinics; orders <20 units; tariff-uncertain regions (e.g., UK post-2025) |

Critical 2026 Requirement: Insist on IoT-enabled container tracking with real-time humidity/temperature monitoring (ISO 14971:2023 Annex F).

Shanghai Carejoy: DDP Specialization

Leveraging 19 years of export expertise, Carejoy provides:

- True DDP Pricing: Transparent landed cost calculator covering 142 countries

- Port Resilience: Dedicated berths at Shanghai Yangshan Deep-Water Port (avoiding 2026 congestion)

- Compliance Guarantee: Duty drawback processing for distributors in free trade agreement (FTA) countries

- Action: Request DDP quote via WhatsApp: +86 15951276160

2026 Sourcing Checklist

- Confirm ISO 13485 scope includes “dental milling systems” (not just components)

- Negotiate MOQ based on annual volume commitment, not single order

- Require DDP quotes for first 3 orders to benchmark hidden costs

- Validate post-pandemic factory capacity with live video audit

- Secure 24-month warranty covering spindle motor & linear guides

Why Shanghai Carejoy Stands Out in 2026

As a vertically integrated manufacturer (not trading company), Carejoy delivers:

- Factory Direct Pricing: No middlemen; 17% average savings vs. Shenzhen aggregators

- Regulatory Agility: Dedicated EU MDR/US FDA compliance team (updated weekly)

- Technical Support: Remote diagnostics via proprietary CarejoyLink™ software

- Sustainability: 2026-compliant REACH-certified lubricants & recyclable packaging

Next Step: Contact for 2026 Milling Unit Sourcing Kit (includes CE dossier template, DDP calculator, and ISO audit checklist):

📧 [email protected] | 💬 WhatsApp: +86 15951276160

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing Milling Units for Dental Clinics & Distributors

Prepared for dental clinics and authorized equipment distributors evaluating CAD/CAM milling systems in 2026. This guide addresses critical technical and operational considerations for integration and long-term reliability.

| Question | Answer |

|---|---|

| 1. What voltage and power requirements should I verify before purchasing a dental milling unit for 2026 integration? | Dental milling units in 2026 typically operate on standard single-phase 110–120V (North America) or 220–240V (Europe, Asia, and other regions) at 50/60 Hz. Always confirm the unit’s power draw (in watts or amps) and ensure your clinic’s circuit can support continuous operation without voltage drops. Units with integrated dust extraction or high-speed spindles may require dedicated circuits. Verify compatibility with local power infrastructure and consider surge protection to safeguard sensitive electronics. |

| 2. Are critical spare parts (e.g., spindle, chuck, filters) readily available, and what is the expected lead time? | Ensure the manufacturer or distributor maintains an accessible inventory of high-wear components such as spindles, collets, dust filters, and linear guides. In 2026, leading OEMs offer regional spare parts hubs with lead times of 3–7 business days for standard components. Confirm whether spare parts are backward-compatible across model generations and if preventive maintenance kits are available. Distributors should maintain local stock levels to minimize clinic downtime. |

| 3. What does the installation process involve, and is on-site technician support included? | Installation of modern milling units includes site assessment, power and network connectivity verification, leveling, calibration, and software integration with existing CAD/CAM workflows. Most premium manufacturers in 2026 provide complimentary on-site installation by certified technicians, including operator training and system validation. Confirm whether remote diagnostic capabilities are supported and if network configuration (e.g., DICOM, open-API compatibility) is handled during setup. |

| 4. What is covered under the standard warranty, and are extended service plans available? | Standard warranties in 2026 typically cover parts and labor for 12–24 months, including spindle motors, control boards, and mechanical drive systems. Wear items (e.g., brushes, filters, collets) are generally excluded. Extended service agreements (ESA) are available, offering 3–5 year coverage with priority response, predictive maintenance alerts, and discounted labor rates. Distributors should clarify warranty activation procedures and global service coverage for multi-location practices. |

| 5. How are firmware updates and technical support handled post-installation? | Leading 2026 milling systems support secure over-the-air (OTA) firmware updates to enhance milling strategies, material libraries, and connectivity. Technical support is provided via 24/7 helplines, remote diagnostics, and AI-assisted troubleshooting portals. Ensure your distributor offers multilingual support and SLAs for response and resolution times. Regular software updates should be included in warranty or service plans to maintain compliance and performance. |

Note: Specifications and service terms may vary by manufacturer and region. Always request a detailed technical datasheet and service agreement prior to purchase.

Need a Quote for Milling Units?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160