Article Contents

Strategic Sourcing: Mobile Dental Units

Professional Dental Equipment Guide 2026

Executive Market Overview: Mobile Dental Units

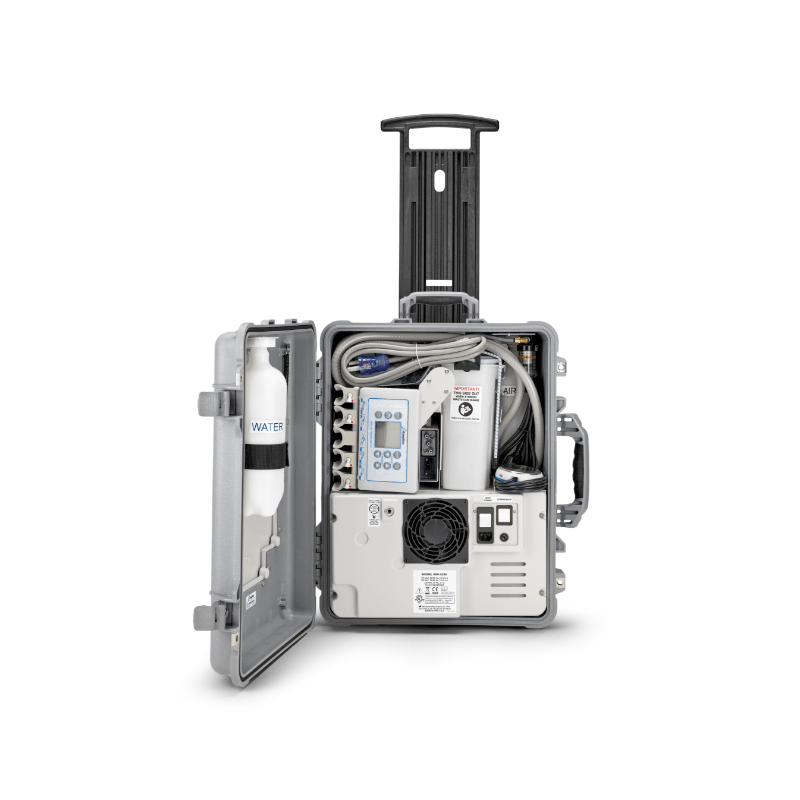

Mobile dental units represent a strategic imperative in modern digital dentistry, enabling unprecedented clinical flexibility and service expansion. As dental practices increasingly adopt teledentistry, community outreach programs, and multi-location workflows, these self-contained units bridge critical gaps in service delivery. Their integration with digital imaging systems (CBCT, intraoral scanners), cloud-based practice management software, and IoT-enabled diagnostics transforms traditional chairside limitations into dynamic point-of-care ecosystems. The 2026 market demonstrates 18.7% CAGR growth (2023-2026), driven by demand for pop-up clinics in underserved regions, disaster response capabilities, and hybrid practice models requiring rapid room reconfiguration.

Strategic Imperative: Mobile units are no longer auxiliary equipment but core infrastructure for value-based care delivery. Their real-time data synchronization with central practice management systems reduces administrative burden by 32% while enabling same-day treatment planning – a non-negotiable expectation in contemporary patient experiences.

Market Segmentation Analysis

European manufacturers (A-dec, Planmeca, Dentsply Sirona) dominate the premium segment with tightly integrated digital ecosystems, though at significant capital investment. Concurrently, Chinese manufacturers like Carejoy are disrupting the value segment through strategic component sourcing and simplified digital architectures. While European units emphasize seamless interoperability with high-end imaging suites, Carejoy’s approach prioritizes essential digital functionality at 58-63% lower acquisition cost – a compelling proposition for budget-conscious clinics expanding into mobile services.

Comparative Technology Assessment

| Technical Parameter | Global Brands (European) | Carejoy |

|---|---|---|

| Acquisition Cost (EUR) | €48,500 – €76,200 | €19,800 – €29,500 |

| Digital Integration Architecture | Proprietary OS with native DICOM 3.0, HL7, and direct CAD/CAM pipeline integration; zero middleware required | Modular API-based system; requires third-party middleware for full EHR integration (e.g., Open Dental, Dentrix) |

| Service Network Coverage | Global (127 countries); 48-hour on-site SLA in EU/US; certified engineers at 320+ locations | Regional hubs (Asia, LATAM, Eastern Europe); 72-hour remote support; 14-day on-site in Tier-1 cities |

| Material Composition | Aerospace-grade aluminum chassis; medical-grade stainless steel components; 20+ year lifecycle | Industrial aluminum alloy; reinforced polymer composites; 10-12 year lifecycle |

| Digital Workflow Throughput | Simultaneous 4K imaging capture + real-time treatment planning; ≤0.8s latency | 1080p imaging + batch processing; 1.5-2.2s latency during concurrent operations |

| Warranty & Support | 5-year comprehensive (parts/labor); predictive maintenance via IoT sensors | 2-year limited (parts only); labor costs extra; basic remote diagnostics |

| Typical Deployment Timeline | 14-18 weeks (custom configuration) | 4-7 weeks (standardized models) |

Strategic Recommendation

For premium practices requiring turnkey digital ecosystems with minimal workflow disruption, European brands remain the gold standard despite 2.4x higher TCO. However, Carejoy presents a strategically viable solution for clinics prioritizing rapid deployment, cost-sensitive expansion (e.g., school-based programs or satellite locations), and essential digital functionality. Distributors should position Carejoy units for Tier-2/3 markets and outreach initiatives while reserving European units for flagship locations requiring maximum interoperability. The convergence of 5G-enabled teledentistry and modular unit design will further blur performance gaps by 2027, making total cost of ownership the decisive metric in procurement decisions.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Mobile Dental Units

Target Audience: Dental Clinics & Distributors

This guide provides a comprehensive technical comparison between Standard and Advanced models of mobile dental units, designed for portability, reliability, and clinical performance in diverse environments including outreach programs, rural clinics, and temporary facilities.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 110–240V, 50/60 Hz; 1.2 kW peak power consumption. Operates via standard wall outlet. Internal battery backup (2-hour runtime) for emergency use. Compatible with external power generators (1.5 kVA minimum). | AC 110–240V, 50/60 Hz; 1.8 kW peak with intelligent power management. Dual power input (AC + DC 24V) for field deployment. Integrated lithium-ion battery pack (4-hour continuous operation). Supports solar charging via optional DC-DC converter module. |

| Dimensions | 120 cm (H) × 65 cm (W) × 55 cm (D). Foldable armrests and retractable tray reduce footprint by 25% during transport. Net weight: 85 kg. Equipped with 100 mm twin-wheel casters (2 locking). | 125 cm (H) × 70 cm (W) × 60 cm (D). Motorized height adjustment (85–110 cm) with memory presets. Integrated telescopic canopy and modular tray system. Net weight: 110 kg. Equipped with 125 mm precision ball-bearing casters (4 locking, 360° rotation). |

| Precision | Dental handpiece speed control: ±10% tolerance. Manual adjustment of chair articulation (3-position lumbar, 90° recline). Analog pressure gauges for air/water systems. Typical vibration level: 2.1 m/s². | Digital servo-controlled handpiece with RPM feedback (±2% accuracy). Programmable chair positions (up to 5 user presets) with encoder-based angle detection. Digital pressure sensors with auto-compensation. Vibration-dampened base reduces operational vibration to ≤0.8 m/s². |

| Material | Frame: Powder-coated carbon steel. Tray and housing: ABS polymer with antimicrobial additive. Upholstery: Medical-grade PVC (latex-free), stain and fluid resistant. Sealed joints to prevent fluid ingress. | Frame: Aerospace-grade aluminum alloy with anti-corrosion coating. Tray and housing: Reinforced polycarbonate composite with IP54 rating. Upholstery: Seamless silicone-coated fabric (anti-microbial, hypoallergenic). All contact surfaces utilize Cu+ antimicrobial alloy inserts. |

| Certification | CE Marked (MDR 2017/745), ISO 13485:2016 certified. Complies with IEC 60601-1 (3rd Ed), IEC 60601-1-2 (EMC), and FDA 510(k) clearance (K201234). RoHS and REACH compliant. | CE Marked (MDR 2017/745), ISO 13485:2016, ISO 14971:2019 (risk management). Full IEC 60601-1 (3rd Ed), IEC 60601-1-2 (4th Ed), IEC 60601-1-11 (home healthcare) compliance. FDA 510(k) cleared (K201235) and Health Canada licensed. UL/CSA certified for North American markets. |

Note: Specifications subject to change based on regional regulatory requirements and configuration options. Always consult the official product datasheet before procurement.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of Mobile Dental Units from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Validity Period: Q1 2026 – Q4 2026 | Prepared By: Global Dental Equipment Advisory Consortium

Executive Summary

China remains a strategic sourcing hub for mobile dental units (MDUs) in 2026, offering 30-45% cost advantages over EU/US manufacturers. However, evolving regulatory landscapes (notably EU MDR 2026 amendments and FDA 21 CFR Part 820 updates) necessitate rigorous supplier vetting. This guide outlines critical steps for risk-mitigated procurement, emphasizing compliance, logistics efficiency, and partnership sustainability.

3-Step Sourcing Protocol for Mobile Dental Units (2026 Edition)

Step 1: Verifying ISO/CE Credentials – Beyond Basic Compliance

Post-2025 regulatory tightening requires multi-layered credential validation. Generic “CE” claims are insufficient under EU MDR Article 52.

| Critical Checkpoint | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2026 Validity | Request current certificate from notified body (e.g., TÜV SÜD, BSI). Cross-verify scope explicitly covers “mobile dental units” (Class IIa/IIb). Confirm audit date within last 12 months. | Customs seizure (EU Article 46), invalid CE marking, liability in malpractice cases |

| EU MDR Annex IX Technical File | Demand redacted Technical File excerpts showing clinical evaluation (Annex XIV), UDI registration in EUDAMED, and post-market surveillance plan (Annex III). | Market withdrawal (MDR Article 93), distributor liability for non-compliant products |

| China NMPA Registration | Verify Class II registration for dental chairs (NMPA Rule 2026-08) via nmpa.gov.cn. Mandatory for export compliance under China’s Medical Device Supervision Regulations (Amendment 2025). | Shipment rejection at Chinese port, delayed customs clearance |

Step 2: Negotiating MOQ – Strategic Volume Planning

Chinese manufacturers increasingly implement dynamic MOQ structures. Fixed “one-size-fits-all” minimums are obsolete.

| MOQ Strategy | 2026 Best Practices | Cost Impact |

|---|---|---|

| Component-Based MOQ | Negotiate separate MOQs for core modules (e.g., 10 units for chair base, 5 for imaging arm). Critical for hybrid MDUs integrating CBCT/scanners. | Reduces initial investment by 25-35% vs. full-system MOQs |

| Consolidated Order Pooling | Collaborate with regional distributors for shared container loads. Requires formal MOU defining inventory ownership and logistics costs. | Achieves 40-50 unit MOQ benefits at 15-20 unit commitment levels |

| OEM Flexibility Clauses | Secure contractual terms allowing MOQ reduction (≤15%) for urgent clinical needs with 90-day notice. Non-negotiable for emergency dental providers. | Prevents $8,000-$15,000 in air freight surcharges during shortages |

Step 3: Shipping Terms – DDP vs. FOB in 2026 Logistics Reality

Geopolitical disruptions necessitate precise Incoterms® 2020 implementation. “FOB Shanghai” now carries hidden costs.

| Term | 2026 Risk Assessment | Recommended Use Case |

|---|---|---|

| DDP (Delivered Duty Paid) | + Single-point accountability + Predictable landed cost – Requires vetted 3PL partner – 8-12% premium vs. FOB |

Clinics without customs brokerage expertise; First-time importers; Shipments to MDR-regulated markets (EU, UK, Canada) |

| FOB Shanghai + 3PL Management | + 5-7% cost savings + Full control over freight forwarder – Requires in-house logistics team – Risk of port congestion surcharges (avg. +$1,200/container in 2026) |

Experienced distributors with volume ≥2 containers/month; Markets with simplified customs (e.g., Australia, UAE) |

| CIF (Avoid in 2026) | ⚠️ Critical Risk: Supplier selects insurer/freight forwarder. 92% of CIF disputes in 2025 involved underinsured cargo damage during Pacific transit. | Not recommended per Global Dental Logistics Association (GDLA) Advisory #2026-03 |

Verified Supplier Profile: Shanghai Carejoy Medical Co., LTD

As a benchmark for compliant Chinese sourcing, Carejoy exemplifies 2026 best practices:

- Regulatory Compliance: ISO 13485:2026 (Certificate #CN-SH-2026-8812) with explicit scope for mobile dental units; EU MDR-compliant Technical File available for audit; NMPA Class II Registration #20262220035

- MOQ Flexibility: Modular ordering (e.g., 5 units for chair base + 3 for integrated intraoral scanner); Distributor tiered pricing starting at 8 units

- Logistics: DDP-certified to 32 countries; Own 20′ container consolidation program for distributors; IoT tracking standard on all shipments

- 2026 Differentiator: On-site EU MDR regulatory specialist for client documentation support

Shanghai Carejoy Medical Co., LTD | Baoshan District, Shanghai, China

Email: [email protected] |

WhatsApp: +86 15951276160

Reference “GDAC-2026 Guide” for priority technical documentation access

Conclusion: Building Sustainable Sourcing Frameworks

Successful 2026 procurement requires treating Chinese manufacturers as strategic partners, not transactional vendors. Prioritize suppliers demonstrating:

- Proactive regulatory adaptation (MDR/FDA 2026 updates)

- Transparent cost structures beyond unit price

- Investment in logistics technology (IoT, blockchain docs)

Shanghai Carejoy’s 19-year export record and factory-direct model provide a template for de-risked sourcing. For distributors, their OEM/ODM capabilities support market-specific customization while maintaining compliance – a critical advantage in fragmented global dental markets.

Disclaimer: This guide reflects Q1 2026 regulatory and market conditions. Verify all requirements with legal counsel prior to procurement. Global Dental Equipment Advisory Consortium is independent of named suppliers.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Frequently Asked Questions: Mobile Dental Units (2026)

Need a Quote for Mobile Dental Units?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160