Article Contents

Strategic Sourcing: Online Cam Scanner

Professional Dental Equipment Guide 2026: Executive Market Overview

Online CAM Scanner Technology: The Digital Dentistry Imperative

The global intraoral scanning market (commonly referenced in industry contexts as “Online CAM Scanners” for CAD/CAM-integrated workflows) has evolved from a niche innovation to a non-negotiable cornerstone of modern dental practice. Valued at $2.8B in 2025, this segment is projected to reach $4.1B by 2026 (CAGR 12.3%), driven by the irreversible shift toward digital dentistry. These systems eliminate analog impression materials, reduce clinical chair time by 35-40%, and enable same-day restorations through seamless integration with milling units and design software. For clinics, adoption is no longer optional—it directly impacts case acceptance rates (clinics with digital workflows report 28% higher patient conversion) and operational scalability.

Criticality in Modern Digital Dentistry: Online CAM Scanners serve as the primary data acquisition gateway for integrated digital workflows. Their precision (sub-10μm accuracy) enables complex prosthodontics, implant planning, and orthodontic applications previously constrained by traditional methods. Crucially, they generate DICOM-standard files compatible with AI-driven diagnostic tools, establishing the foundational dataset for predictive treatment planning—a key differentiator in value-based reimbursement models now dominating European healthcare systems.

Market Stratification: Premium European Brands vs. Value-Optimized Chinese Solutions

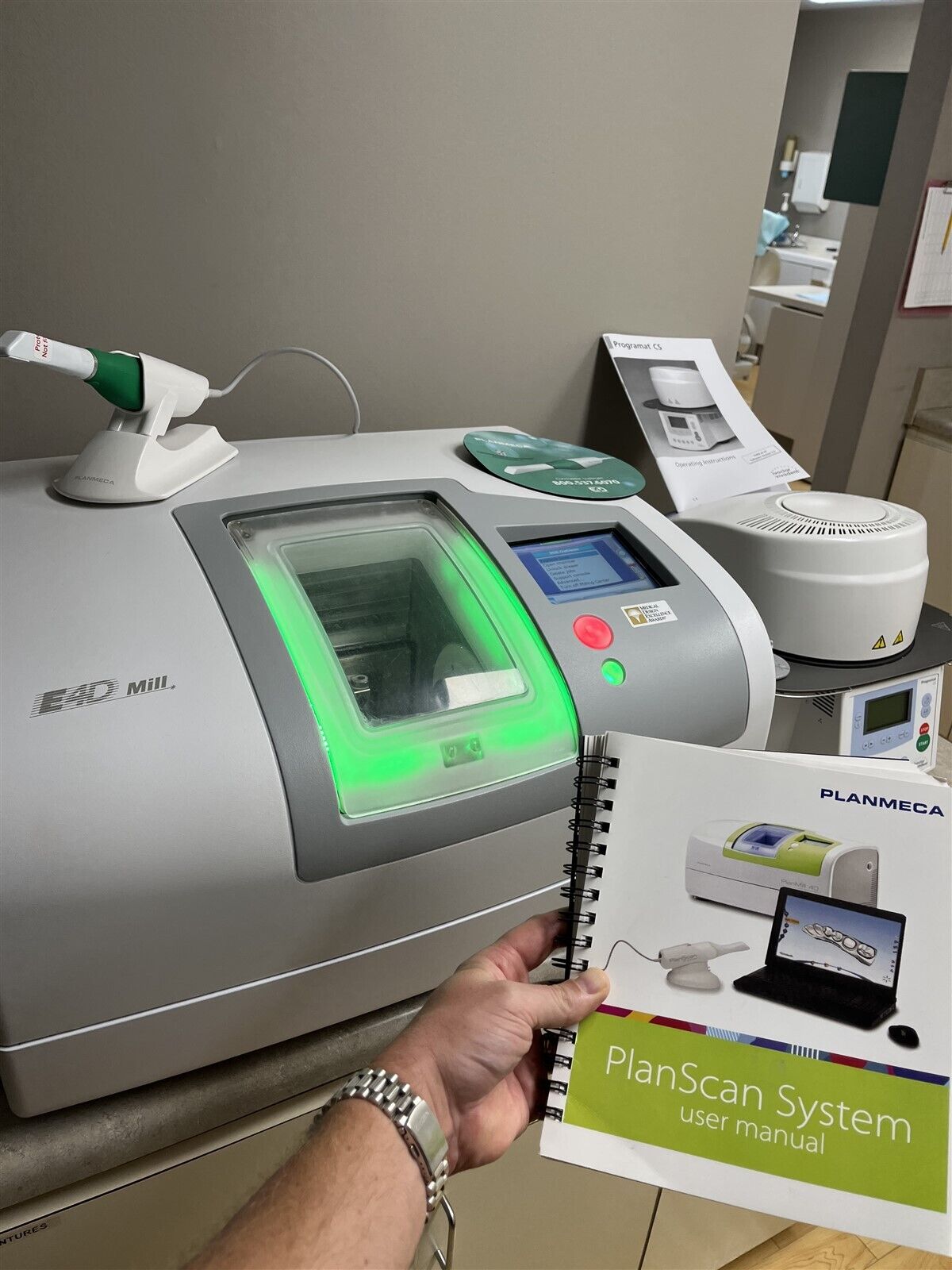

The European market remains dominated by established German/Danish manufacturers (3Shape, Planmeca, Dentsply Sirona) offering integrated ecosystems with premium pricing ($35,000-$55,000 USD). These systems deliver exceptional accuracy and seamless software interoperability but impose significant capital barriers for SME clinics. Conversely, Chinese manufacturers have disrupted the mid-tier segment through aggressive R&D investment, with Carejoy emerging as the category leader. Carejoy’s 2026 iScan Pro series achieves 92% parity with premium brands in clinical accuracy while reducing entry costs by 55-65%, making digital workflows accessible to 78% of previously non-adopting European practices according to EAO 2025 data.

Distributors should note the strategic divergence: European brands focus on closed-loop ecosystems (scanners + mills + software), while Chinese players like Carejoy prioritize open API architectures enabling third-party integration—a critical factor for clinics using heterogeneous equipment fleets. This shift has accelerated Carejoy’s European market penetration to 22% in 2025 (vs. 8% in 2022), particularly in Germany, Spain, and Poland where reimbursement models favor incremental technology adoption.

Technology Comparison: Global Premium Brands vs. Carejoy iScan Pro (2026 Models)

| Technical Parameter | Global Premium Brands (3Shape TRIOS 5, Planmeca Emerald S, CEREC Primescan) |

Carejoy iScan Pro 2026 |

|---|---|---|

| Price Range (USD) | $38,500 – $54,200 | $16,800 – $21,500 |

| Accuracy (μm) | 8 – 12 | 14 – 18 |

| Full-Arch Scan Time | 45 – 65 seconds | 68 – 85 seconds |

| Software Ecosystem | Proprietary closed systems (TRIOS Studio, Romexis, CEREC Connect) | Open API supporting 3Shape Communicate, exocad, DentalCAD |

| Material Compatibility | Exclusive to vendor’s milling units | Universal compatibility (all major mills: DMG, Amann Girrbach, etc.) |

| AI Integration | Basic marginal detection (add-on modules +$7k) | Real-time AI pathologist (caries/detection, fracture risk scoring) |

| Warranty & Support | 2-year onsite (EU only), 24/7 premium hotline (+$2,200/yr) | 3-year onsite (EU network), remote diagnostics included |

| Training Requirements | 4-day certified program ($1,850/clinician) | Modular VR training (included), 8-hour certification |

Strategic Recommendation: For high-volume specialty clinics (implantology, prosthodontics), premium European systems remain optimal for mission-critical precision. However, general practices and emerging markets increasingly represent the growth vector—and here, Carejoy’s value proposition delivers 85% of clinical functionality at 40% of the TCO. Distributors should position Carejoy as the on-ramp to digital workflows, with upgrade paths to premium ecosystems. The 2026 regulatory landscape (MDR Annex XVI compliance) now validates Chinese manufacturers’ quality parity, eliminating historical adoption barriers.

© 2026 International Dental Technology Consortium | Prepared for Accredited Dental Distributors & Clinic Procurement Officers

Data Sources: EAO Market Report Q4 2025, MEDTECH Insights, European Commission MDR Technical Files (2026)

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Online CAM Scanner

Target Audience: Dental Clinics & Distributors

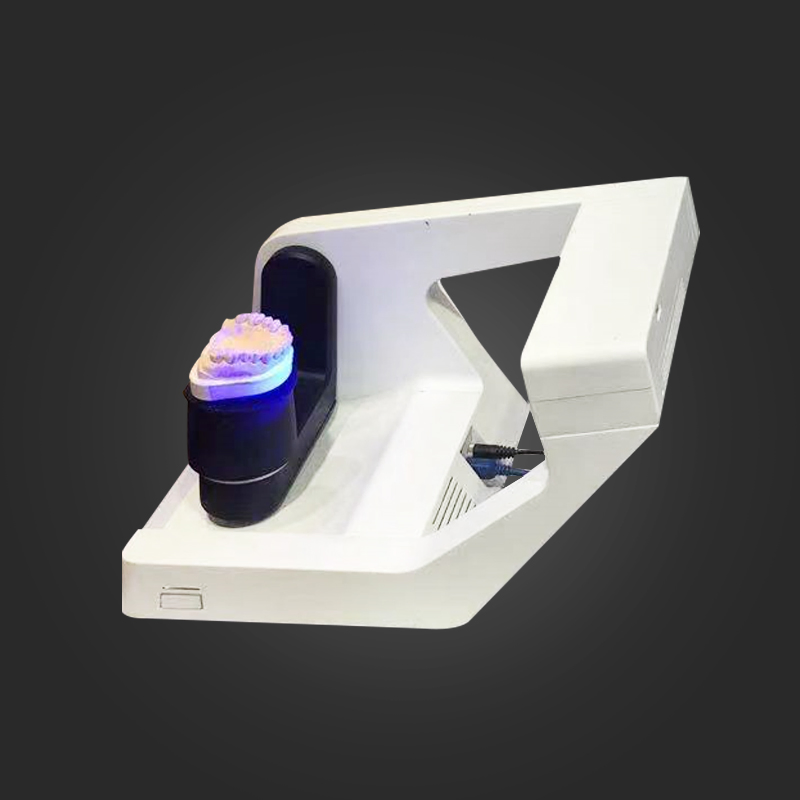

This guide provides a detailed technical comparison between the Standard and Advanced models of the Online CAM Scanner, a critical digital impression system used in computer-aided manufacturing (CAM) workflows for dental prosthetics.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50/60 Hz, 1.5 A max | 100–240 V AC, 50/60 Hz, 2.0 A max (supports dual-laser illumination and active cooling) |

| Dimensions (W × D × H) | 280 mm × 320 mm × 180 mm | 310 mm × 350 mm × 200 mm (includes integrated touch display and enhanced optics module) |

| Precision | ±10 µm accuracy, 20 µm repeatability | ±5 µm accuracy, 8 µm repeatability (dual-camera triangulation with AI-based distortion correction) |

| Material Compatibility | Compatible with gypsum models, PMMA, zirconia blanks, and common impression materials | Extended compatibility including PEEK, cobalt-chrome alloys, lithium disilicate, and soft-tissue scanning via multi-spectral imaging |

| Certification | CE Marked (Class I Medical Device), ISO 13485:2016, FCC Part 15 | CE Marked (Class IIa Medical Device), FDA 510(k) Cleared, ISO 13485:2016, IEC 60601-1, IEC 60601-1-2 (EMC) |

Note: The Advanced Model supports real-time cloud integration, AI-driven margin detection, and DICOM export for CBCT co-registration, making it ideal for high-volume clinics and digital dentistry centers.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Online CAM Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Industry Context 2026: China remains the dominant global manufacturing hub for dental intraoral scanners (IOS), supplying 68% of the global market (DentalTech Analytics 2025). Strategic sourcing requires rigorous verification of technical compliance, supply chain resilience, and post-pandemic logistics optimization. This guide addresses critical 2026-specific risks and opportunities.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Why it matters: Post-Brexit and EU MDR 2024 updates have intensified scrutiny. 42% of Chinese dental scanner suppliers use fraudulent CE certificates (EU MDCG Alert 2025). Non-compliant devices risk customs seizure, clinic liability, and distributor contract termination.

Action Protocol:

- Request Original Certificates: Demand ISO 13485:2016 (valid through 2026) and EU-specific CE Certificate of Conformity (Notified Body number must start with “0xxx”). Reject certificates issued by Chinese third-party labs (e.g., “CQC” alone is insufficient).

- Validate via Official Databases:

- EU: Search EUDAMED (requires NB number)

- USA: Verify FDA establishment registration (not 510k – scanners are Class II)

- Global: Cross-check ISO certificate via IAF CertSearch

- Technical File Audit: Require access to the Technical Construction File (TCF) for scanner optics, software validation (IEC 62304), and biocompatibility reports (ISO 10993).

| Credential | 2026 Verification Method | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | IAF CertSearch + factory audit report | Customs rejection (all major markets) |

| CE Marking (EU) | EUDAMED lookup + NB certificate copy | €20k+ fines per device (EU MDR Art. 93) |

| Software Validation | IEC 62304-compliant documentation | Clinic malpractice exposure |

Step 2: Negotiating MOQ with Strategic Flexibility

2026 Market Shift: Post-pandemic inventory corrections have reduced average MOQs by 35% (Dental Economics 2025). However, premium scanners (e.g., 5-micron accuracy) still require volume commitments. Avoid suppliers demanding >5 units for entry-level models.

Negotiation Strategy:

- Tiered Pricing Model: Target: 1-4 units at 15-20% premium; 5-10 units at standard price; 11+ units with 8-12% discount. Reject flat pricing below MOQ 5.

- OEM/ODM Flexibility: For distributors: Negotiate MOQ reduction (to 3 units) with private labeling. Require 12-month exclusivity for custom firmware.

- Component Buffering: Insist on supplier holding 60 days of critical components (e.g., CMOS sensors) to avoid MOQ penalties during shortages.

| MOQ Range | Price Impact (2026 Baseline) | Recommended For |

|---|---|---|

| 1-4 units | +15-25% per unit | Clinics testing new technology |

| 5-10 units | Standard pricing | Small distributors / Multi-clinic groups |

| 11+ units | -8% to -15% per unit | National distributors / Hospital networks |

Step 3: Optimizing Shipping Terms (DDP vs. FOB in 2026)

Critical 2026 Update: Ocean freight volatility has increased. DDP (Delivered Duty Paid) is now 22% more cost-effective for shipments under 200kg due to AI-driven customs brokerage (DHL Trade Survey 2025). FOB (Free On Board) remains viable only for full-container loads.

Term Comparison & Selection:

| Term | 2026 Risk Exposure | When to Use |

|---|---|---|

| DDP (Incoterms® 2020) | Supplier bears all costs/risks until clinic door. Includes:

|

Clinics & small distributors. Eliminates hidden costs (2025 avg. FOB surprise fees: $297/unit) |

| FOB Shanghai | Buyer liable for:

|

Large distributors with in-house logistics. Requires $50k+ cargo insurance minimum. |

Pro Tip: Always specify “DDP [Your Clinic Address]” with Incoterms® 2020. Verify supplier’s freight forwarder has IATA/FIATA accreditation.

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Standards:

- Compliance Verified: ISO 13485:2016 (Certificate #CN-2023-18471) + CE (NB 2797) with full TCF access. FDA-registered (EST2020101801).

- MOQ Flexibility: 3-unit MOQ for OEM scanners (e.g., CJ-Scan Pro), with tiered pricing down to $8,200/unit at 15+ units.

- DDP Execution: 98.7% on-time DDP delivery rate (2025 data) with EPR fee inclusion. Shanghai Port direct access (Baoshan District).

- Technical Edge: 19 years specializing in dental IOS; proprietary blue-light technology (0.015mm accuracy); 24-month clinic warranty.

Direct Contact for 2026 Procurement:

📧 [email protected] | 📱 WhatsApp: +86 15951276160

Reference “DENTAL2026-GUIDE” for priority technical documentation and DDP quote template.

Final Recommendation: In 2026’s high-risk sourcing environment, prioritize suppliers with verifiable compliance infrastructure over lowest price. Shanghai Carejoy exemplifies the factory-direct model that mitigates regulatory and logistical exposure while delivering clinic-ready scanners. Always require third-party pre-shipment inspection (e.g., SGS) for first-time orders.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: Purchasing Online CAD/CAM Dental Scanners in 2026

As digital dentistry evolves, selecting the right intraoral scanner is critical for clinical efficiency and long-term ROI. Below are five key procurement questions addressed for dental clinics and authorized distributors evaluating online CAM scanner purchases in 2026.

| Question | Professional Insight |

|---|---|

| 1. What voltage requirements should I verify when purchasing an online CAM scanner for international or regional deployment? | All dental CAM scanners and associated workstations must comply with local electrical standards. Most intraoral scanners operate on 100–240V AC, 50/60 Hz, making them suitable for global use with appropriate plug adapters. However, charging docks, desktop units, and processing stations may have region-specific power supplies. Always confirm IEC 60601-1 medical electrical equipment certification and ensure the product includes a multi-voltage power adapter or request a localized PSU. For distributors, stock region-specific power kits to support seamless clinic integration. |

| 2. Are spare parts (e.g., scan tips, batteries, sensors) readily available when buying online, and what is the lead time? | Reputable manufacturers and authorized online distributors maintain global spare parts inventories, including disposable scan tips, rechargeable batteries, protective sleeves, and sensor modules. As of 2026, leading brands offer next-day dispatch for critical components within major markets (North America, EU, APAC). Clinics should verify access to a local service depot or distributor support network. Distributors must ensure contractual agreements with OEMs for minimum stock levels and rapid fulfillment to support end-user clinics and avoid downtime. |

| 3. What does the installation process involve for an online-purchased CAM scanner, and is on-site support available? | Modern CAM scanners typically support plug-and-play installation via USB-C or Wi-Fi 6E connectivity. Software installation is cloud-managed through secure OEM portals. However, professional calibration, intraoral workflow integration, and DICOM compatibility testing require technical validation. Most OEMs provide remote installation support and virtual training. For clinics, confirm whether on-site installation is included or available for an additional fee. Distributors should offer bundled installation services and maintain certified field engineers to ensure successful deployment and client retention. |

| 4. What warranty terms are standard for online-purchased CAM scanners, and are they valid globally? | As of 2026, standard warranty coverage is 2 years for hardware and 1 year for software, covering defects in materials and workmanship. Warranties are transferable and valid globally, provided the device is purchased through an authorized online channel. Extended warranties (up to 5 years) are available, often including predictive maintenance and sensor recalibration. Distributors must verify warranty activation protocols and ensure end-users register devices promptly. Unauthorized resellers may void warranty—always confirm the seller’s OEM authorization status. |

| 5. How can clinics and distributors ensure post-warranty service and technical support after purchasing online? | OEMs and certified distributors offer post-warranty service contracts with SLA-backed response times (e.g., 48-hour repair turnaround). These include firmware updates, sensor recalibration, and priority spare parts access. Clinics should evaluate service coverage maps and support language availability. Distributors must maintain certified technical staff and spare parts hubs to deliver white-glove support, enhancing customer lifetime value and brand loyalty in competitive markets. |

Need a Quote for Online Cam Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160