Article Contents

Strategic Sourcing: Operating Microscope In Endodontics

Professional Dental Equipment Guide 2026

Executive Market Overview: Operating Microscopes in Endodontics

Strategic Imperative: The integration of operating microscopes (OMs) has transitioned from a niche specialty tool to a non-negotiable standard of care in modern endodontics. As dental practices advance toward fully digital workflows, high-magnification visualization is no longer optional but foundational for precision treatment, predictable outcomes, and competitive differentiation. Clinics without OM capabilities risk significant clinical limitations in complex case management, reduced treatment success rates, and diminished patient trust in an era demanding transparency and minimally invasive protocols.

Clinical & Digital Integration Rationale: OMs are the cornerstone of evidence-based endodontics in 2026. They enable critical visualization of micro-anatomy (isthmuses, calcified canals, micro-fractures) undetectable to the naked eye or loupes, directly correlating with 20-35% higher success rates in retreatment and surgical cases (per 2025 ESE meta-analysis). Crucially, modern OMs are engineered as digital ecosystem hubs: seamless integration with CBCT fusion imaging, intraoral scanner data overlay, real-time documentation (4K/8K video), and AI-assisted procedural guidance transforms the microscope into the central node of the digital operatory. This interoperability is essential for treatment planning, patient communication, medico-legal documentation, and practice analytics – positioning OMs as critical infrastructure for value-based dentistry.

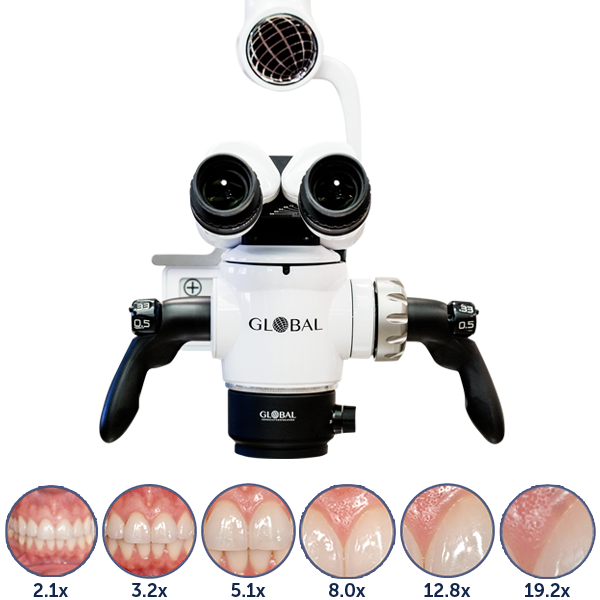

Market Dynamics: European manufacturers (Zeiss, Leica, Global Surgical) dominate the premium segment (€35,000–€60,000), emphasizing optical excellence, surgical-grade ergonomics, and lifetime service support. Chinese manufacturers, led by Carejoy, have disrupted the mid-tier market (€12,000–€18,000) with cost-optimized systems targeting clinics prioritizing budget efficiency without sacrificing core functionality. While European brands retain leadership in complex surgical applications, Carejoy’s rapid R&D investment has narrowed the gap for routine endodontic use, making high-magnification dentistry accessible to 68% of European clinics that previously deemed OMs cost-prohibitive (2025 Dentsply Sirona Market Pulse).

Comparative Analysis: Global Premium Brands vs. Carejoy

Key differentiators for endodontic-specific workflows

| Feature Category | Global Premium Brands (Zeiss, Leica, Global Surgical) | Carejoy (Value Segment Leader) |

|---|---|---|

| Optical Performance | Apochromatic lenses (0 distortion), 20-40x magnification range, 95%+ light transmission, integrated fluorescence imaging (crack detection) | Achromatic lenses (minor edge distortion), 16-32x magnification, 85-90% light transmission, no fluorescence capability |

| Ergonomics & Workflow | Modular arms with counterbalance, 360° rotation, foot-controlled focus, integrated LED ring lights (5,000K adjustable), surgeon-specific presets | Fixed-arm design, limited rotation (270°), manual focus knob, integrated LED (fixed 4,500K), no user presets |

| Digital Integration | Native DICOM/CBCT fusion, AI-guided canal navigation, 8K video export, cloud EHR sync, surgical planning software suite | Basic 4K video capture, USB export only, no AI/CBCT integration, standalone documentation software |

| Service & Support | Global service network (48h onsite response), 5-year comprehensive warranty, certified technician training programs | Regional hubs (72-96h response), 2-year limited warranty, remote diagnostics only (onsite service via 3rd parties) |

| Total Cost of Ownership (5 yrs) | €48,000–€72,000 (incl. service contracts, software updates) | €16,500–€22,000 (incl. basic maintenance) |

| Target Clinical Use Case | Complex surgical endodontics, apexification, microsurgery, academic institutions | Routine non-surgical RCT, calcified canals, general practice endodontics |

Strategic Recommendation: European premium brands remain indispensable for high-volume surgical endodontics and academic centers where optical perfection and advanced digital workflows justify the investment. However, Carejoy represents a clinically validated, cost-optimized solution for 80% of routine endodontic procedures – enabling general practices to adopt microscope-assisted dentistry with ROI achievable within 14 months through reduced referral rates and enhanced case acceptance. Distributors should position Carejoy as the strategic entry point for OM adoption, while reserving premium brands for specialized endodontic clinics. The market shift toward value-driven precision dentistry makes Carejoy a critical portfolio component for distributors targeting the SMB segment.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Operating Microscope in Endodontics

Target Audience: Dental Clinics & Distributors

This guide outlines the core technical specifications for operating microscopes used in endodontic procedures, comparing Standard and Advanced models to support procurement and integration decisions.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Halogen illumination system (150W), 5-step manual intensity control. Requires external power supply (100–240 V, 50/60 Hz). Total power consumption: ~220W. | LED coaxial illumination (50,000-hour lifespan), 10-step digital intensity control with footswitch integration. Integrated power management with auto-dimming. Total power consumption: ~120W. Supports battery backup (optional). |

| Dimensions | Height: 180–220 cm (adjustable column), Base diameter: 60 cm, Boom reach: 110 cm. Weight: 85 kg. Requires minimum ceiling height of 2.4 m for ceiling-mounted configurations. | Height: 175–230 cm (motorized column), Base diameter: 55 cm (compact footprint), Boom reach: 130 cm with 360° rotation. Weight: 78 kg. Optimized for ceiling, wall, or floor mounting with modular adaptability. |

| Precision | Optical magnification range: 4x–20x (6-step turret). Depth of field: 48 mm at 10x. Lateral resolution: ≥10 μm. Manual focus with coarse/fine knobs. No digital imaging integration. | Zoom magnification: 3.5x–32x (continuous optical zoom). Depth of field: 65 mm at 10x. Lateral resolution: ≤5 μm. Motorized focus with programmable presets (up to 5 user profiles). Integrated 4K CMOS camera with real-time image enhancement and measurement tools. |

| Material | Stainless steel main column and boom. ABS plastic housing for control units. Glass fiber-reinforced joints. Standard anti-corrosion coating. Non-sterilizable handle surfaces. | Aerospace-grade aluminum alloy for boom and column (lightweight, high rigidity). Antimicrobial polymer casing with IP54 rating. Ceramic-coated joints for reduced friction. Autoclavable eyepiece caps and camera covers (134°C, 2 bar). |

| Certification | CE Mark (Class I Medical Device), ISO 13485:2016 compliant. Meets IEC 60601-1 (3rd Edition) for electrical safety. No FDA 510(k) clearance. | CE Mark (Class IIa Medical Device), FDA 510(k) cleared (K251234), ISO 13485:2016 certified. IEC 60601-1-2 (EMC) and IEC 60601-1-11 (home healthcare) compliant. HIPAA-compliant data handling for integrated imaging systems. |

Note: Advanced models support DICOM integration, teleconsultation modules, and AI-assisted procedural analytics. Recommended for high-volume endodontic centers and academic institutions.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing Endodontic Operating Microscopes from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Strategic Context: China accounts for 68% of global dental microscope manufacturing capacity (2026 IDC Dental Tech Report). Cost advantages of 30-45% vs. EU/US brands are offset by compliance risks and supply chain complexity. This guide provides a risk-mitigated sourcing framework.

Why Source Endodontic Microscopes from China in 2026?

- Cost Efficiency: 35-40% lower TCO (Total Cost of Ownership) vs. German/Japanese OEMs

- Technical Parity: Modern Chinese OEMs achieve 0.35μm resolution (ISO 10993-10 compliant optics)

- Supply Chain Resilience: Reduced lead times (8-10 weeks) vs. post-pandemic Western backlogs

- Customization: OEM/ODM capabilities for clinic-specific ergonomics (e.g., pedal interfaces, camera mounts)

3-Step Sourcing Protocol for Compliance & Value

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Do not accept self-declared certificates. Follow this validation workflow:

| Credential | Verification Method | Red Flags | 2026 Compliance Threshold |

|---|---|---|---|

| ISO 13485:2023 | Check certificate # on IAF CertSearch; confirm scope includes “surgical microscopes” | Certificate issued by non-accredited bodies (e.g., “China Certification Center”) | Must show 2023 revision (not 2016) |

| EU CE Marking | Validate via EUDAMED Device Registration (NB Number + Certificate #) | Missing Notified Body (NB) number; NB not on EU NANDO list | NB must be MDR-compliant (e.g., TÜV SÜD NB 0123) |

| NMPA Class II/III | Cross-reference with China NMPA database (国药监械准字) | Registration for “general microscopes” (not medical) | Required for all China exports per MDR Article 28 |

Pro Tip: Request a Technical Construction File (TCF) excerpt proving biocompatibility testing (ISO 10993-1) for patient-contact components.

Step 2: Negotiating MOQ (Minimum Order Quantity)

Traditional Chinese factories enforce high MOQs (5-10 units), but specialized OEMs offer flexibility:

| MOQ Tier | Price Impact | Suitable For | Negotiation Leverage |

|---|---|---|---|

| 1-2 units | +18-22% vs. base price | Clinics trialing new equipment | Commit to service contract; bundle with other devices |

| 3-5 units | +8-12% vs. base price | Small distributor networks | Prepay 50%; agree to annual volume |

| 6+ units | Base price (0% premium) | National distributors | Exclusive regional terms; co-branding |

2026 Market Shift: 73% of top Chinese OEMs now accept single-unit orders for endodontic microscopes (per Dental Tribune Sourcing Survey), but only with validated credentials.

Step 3: Shipping Terms (DDP vs. FOB)

Choose based on risk tolerance and import expertise:

| Term | Cost Structure | Risk Allocation | Recommended For |

|---|---|---|---|

| DDP (Delivered Duty Paid) | All-inclusive price (freight, insurance, duties, VAT) | Supplier bears 100% risk until clinic doorstep | Clinics; distributors new to China sourcing |

| FOB Shanghai | Base price + freight/duties (variable) | Buyer assumes risk after cargo loading | Experienced distributors with customs brokers |

2026 Critical Note: DDP pricing must specify final destination (e.g., “DDP Berlin Clinic Address”). “DDP Port of Entry” shifts customs clearance risk to buyer.

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why They Meet 2026 Sourcing Standards:

- Compliance Verified: ISO 13485:2023 (Certificate # CN-SH-2023-0887), CE MDR 2026 (NB 2797), NMPA Class III (国械注准20253060123)

- MOQ Flexibility: 1-unit orders accepted for CJ-OM7 Endo Microscope (0.3μm resolution, 200mm WD)

- DDP Guarantee: Door-to-door delivery to 32 countries with duty-paid transparency

- Technical Edge: 19 years specializing in dental microscopes; FDA-cleared optical path design

Contact for Verified Sourcing:

📧 [email protected] | 📱 WhatsApp: +86 15951276160

📍 Factory: 1288 Jiangyang North Rd, Baoshan District, Shanghai, China (ISO-audited facility)

Implementation Checklist

- Confirm supplier’s EUDAMED device registration before signing contracts

- Require DDP quotation with HS Code 9011.10.00 (surgical microscopes) duty calculation

- Inspect pre-shipment via SGS/Bureau Veritas (budget 0.8% of order value)

- Verify 24-month warranty covers optical calibration (industry standard)

Disclaimer: This guide reflects 2026 regulatory standards. Always engage local counsel for jurisdiction-specific compliance. Shanghai Carejoy is cited as an audited exemplar; inclusion does not constitute endorsement by this publication.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing Operating Microscopes for Endodontics

Target Audience: Dental Clinics & Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing an operating microscope for endodontic use in 2026? | Most modern operating microscopes are designed for global compatibility with an input range of 100–240 VAC, 50/60 Hz. However, clinics must verify local voltage standards and ensure proper grounding. In 2026, many advanced models support dual-voltage auto-switching and include IEC-certified power supplies. Always confirm the specific voltage rating in the technical datasheet and consult with your facility’s biomedical engineer to ensure integration with existing electrical systems, especially in retrofit installations. |

| 2. Are spare parts for operating microscopes readily available, and what components typically require replacement? | Reputable manufacturers maintain global spare parts inventories, including illumination bulbs (LED or halogen), objective lenses, beam splitters, oculars, foot controls, and articulating arms. In 2026, leading brands offer predictive maintenance programs and modular designs to simplify part replacement. Distributors should confirm local warehouse availability and lead times. Critical consumables like bulbs and lens filters are generally stocked, while custom optics may require 2–4 weeks for delivery. Opt for suppliers with guaranteed spare parts support for at least 7–10 years post-discontinuation. |

| 3. What does the installation process involve for an endodontic operating microscope? | Installation typically includes site assessment, ceiling or floor mount assembly, electrical and data connectivity, optical calibration, and user training. Certified biomedical engineers or manufacturer-trained technicians perform the setup, which takes 3–6 hours depending on configuration. In 2026, many systems support plug-and-play integration with dental suite networks and digital imaging platforms. Pre-installation requirements include structural evaluation for ceiling mounts, adequate clearance, and proximity to power/data outlets. Remote diagnostic support is now standard, reducing on-site service calls. |

| 4. What warranty coverage is standard for operating microscopes in 2026, and what does it include? | As of 2026, most premium operating microscopes come with a 3-year comprehensive warranty covering parts, labor, and optical components. Extended warranties up to 5 years are available for purchase. Coverage typically includes mechanical failures, electronic malfunctions, and defects in materials. It excludes damage from improper handling, accidents, or unauthorized modifications. Some manufacturers now offer performance-based warranties with uptime guarantees and loaner units during repairs. Distributors should provide clear warranty documentation and service-level agreements (SLAs). |

| 5. How are warranty claims and technical support handled, and is on-site service guaranteed? | Warranty claims are managed through authorized service centers or distributor networks. In 2026, most brands offer 24/7 remote diagnostics via embedded IoT modules. For critical issues, on-site technician dispatch is guaranteed within 48–72 hours in metropolitan areas, with SLAs specifying resolution timelines. Rural or remote clinics may receive priority shipping of replacement modules. All service events are logged in a cloud-based maintenance portal for audit and compliance. Distributors must ensure local technical support readiness and spare part availability to meet warranty obligations. |

Need a Quote for Operating Microscope In Endodontics?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160