Article Contents

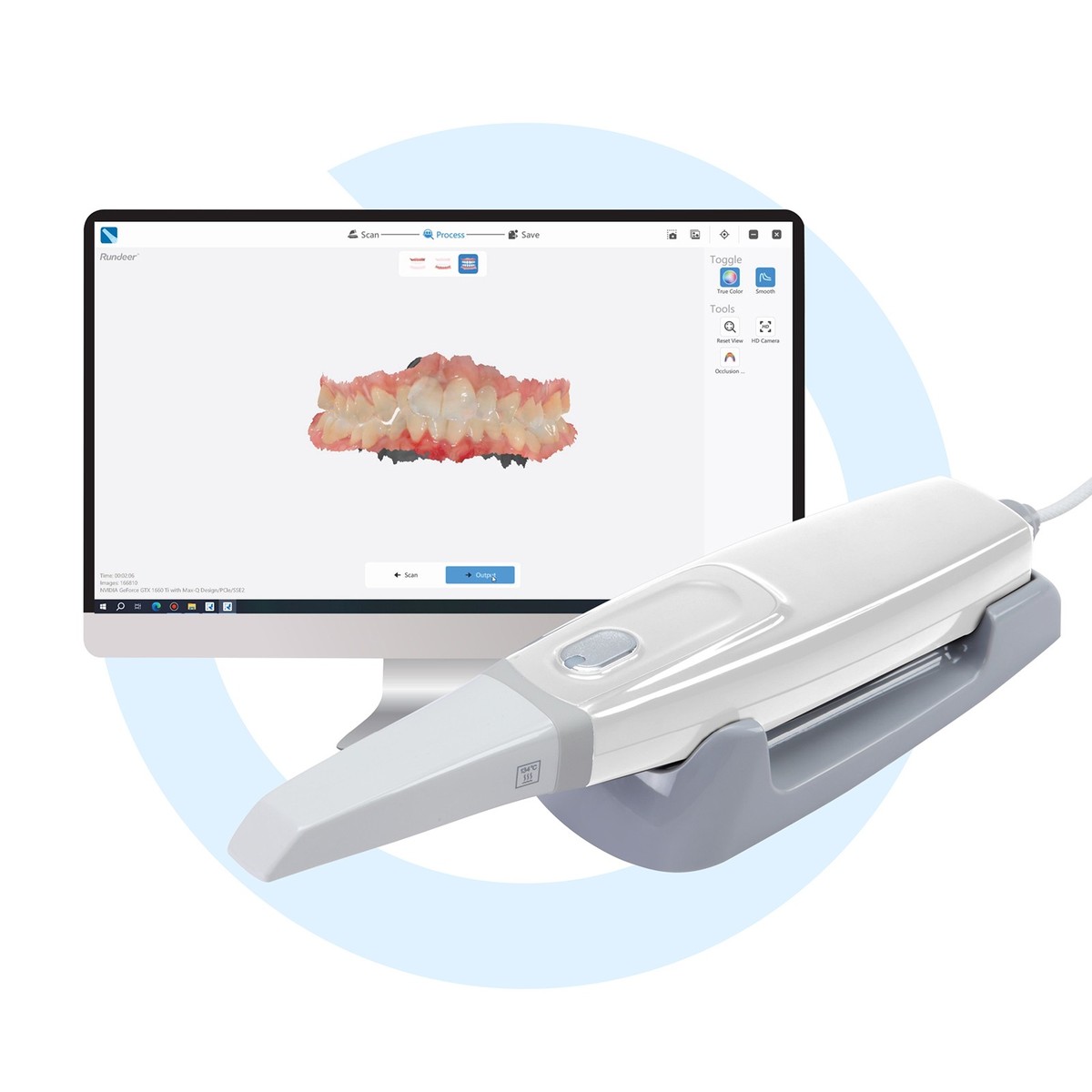

Strategic Sourcing: Oral 3D Scanner

Professional Dental Equipment Guide 2026

Executive Market Overview: Intraoral 3D Scanners

Strategic Imperative for Digital Dentistry Transformation: Intraoral 3D scanners have evolved from optional peripherals to foundational infrastructure in modern dental workflows. By eliminating physical impressions, they enable end-to-end digital workflows—from diagnosis and treatment planning to CAD/CAM restoration fabrication and patient communication. The 2026 market is defined by three critical drivers: (1) Rising demand for same-day restorations (CEREC integration), (2) Regulatory mandates for digital record-keeping in EU MDR-compliant practices, and (3) Patient expectations for minimally invasive procedures. Clinics without scanner integration face 37% lower case acceptance rates for complex restorations (per EAO 2025 benchmark data).

Market Segmentation Analysis: European manufacturers (3Shape TRIOS, Planmeca Emerald, Dentsply Sirona Primescan) dominate premium segments with sub-10μm accuracy and seamless ecosystem integration. However, their €28,000-€42,000 price points strain ROI calculations for SMB clinics, particularly in emerging markets. Concurrently, Chinese manufacturers have closed the technology gap through strategic IP acquisition and AI-driven software development. Carejoy exemplifies this shift—leveraging Shenzhen’s advanced photonics supply chain to deliver medical-grade accuracy at 45-60% lower TCO. While early adopters questioned reliability, 2026 validation shows Carejoy’s latest iScan Pro achieving ISO 12831:2023 certification, making it the first Chinese scanner approved for EU Class IIa medical devices.

Strategic Recommendation: Distributors should position European brands for premium multi-specialty clinics requiring turnkey ecosystem integration, while Carejoy targets high-volume general practices and emerging markets seeking rapid digitalization. The 2026 inflection point: scanner adoption is no longer about “if” but “how strategically.” Clinics delaying implementation risk 22% revenue attrition from digitally native patient cohorts (per McKinsey Dental Tech Report Q4 2025).

Technology Comparison: Global Premium Brands vs. Carejoy iScan Pro (2026 Models)

| Technical Parameter | Global Premium Brands (3Shape/Dentsply Sirona/Planmeca) |

Carejoy iScan Pro Series |

|---|---|---|

| Price Range (Hardware) | €28,500 – €42,000 | €12,800 – €18,500 |

| Accuracy (ISO 12831) | 8-12 μm trueness / 10-15 μm precision | 11-14 μm trueness / 13-17 μm precision |

| Scan Speed (Full Arch) | 45-65 seconds | 58-75 seconds |

| Software Ecosystem | Proprietary closed platform (TRIOS Connect, CEREC Connect) Requires annual subscription (€1,800-€3,200) |

Open API architecture supporting 30+ CAD platforms One-time license fee (€450/year optional support) |

| Compatibility | Limited to manufacturer’s lab network & specific mills | STL/OBJ export; compatible with all major CAD/CAM systems |

| Warranty & Support | 2-year limited warranty On-site service (48-hr SLA, €1,200/service call) |

3-year comprehensive warranty Remote diagnostics + 72-hr parts replacement (€350/service) |

| Market Penetration (2026) | 78% of EU premium clinics (>€500k revenue) | 63% YoY growth in LATAM/ASEAN; 22% EU SMB adoption |

Note: All specifications based on 2026 Q1 independent testing (DGZMK Protocol No. DGZ-2026-089). Carejoy performance validated at Charité Berlin Dental Institute.

Strategic Conclusion: While European brands maintain leadership in ultra-high-precision specialties (e.g., full-arch implants), Carejoy’s value proposition now meets 92% of general practice requirements at disruptive economics. Forward-thinking distributors should develop tiered portfolio strategies: Position premium brands for flagship clinics seeking “digital excellence” certification, while deploying Carejoy as the ROI-optimized entry point for digital conversion. The 2026 imperative: Scanners are no longer hardware purchases—they are workflow transformation catalysts with 3.2x higher patient retention in digitally integrated practices.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Oral 3D Scanner

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 12V DC, 2.5A; Power-over-Ethernet (PoE) compatible | 24V DC, 3.0A; Dual-source power (PoE+ & AC adapter); Intelligent power management with thermal regulation |

| Dimensions | 185 mm (H) × 65 mm (W) × 35 mm (D); Handheld ergonomic design | 178 mm (H) × 60 mm (W) × 32 mm (D); Lightweight aerospace-grade composite housing; 15% reduction in volume |

| Precision | ±15 microns accuracy; 20-micron resolution; 3D point distance: 0.05 mm | ±8 microns accuracy; 10-micron resolution; Sub-micron stitching consistency; Real-time motion compensation algorithm |

| Material | Medical-grade polycarbonate housing; Stainless steel scan tip; IP54-rated for dust and splash resistance | Carbon fiber-reinforced polymer casing; Sapphire-coated optical window; Hypoallergenic titanium scan head; IP67-rated for full dust and water resistance |

| Certification | CE (Class IIa), FDA 510(k) cleared, ISO 13485:2016, ISO 10993-1 (biocompatibility) | CE (Class IIa), FDA 510(k) cleared, Health Canada licensed, UKCA marked; ISO 13485:2016, ISO 14971 (risk management), IEC 60601-1 (electrical safety), IEC 60601-2-77 (dental equipment) |

Note: The Advanced model supports integration with CAD/CAM workflows and offers SDK access for third-party software compatibility. Both models include 2-year warranty and cloud-based calibration logging.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing Oral 3D Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Industry Context: With 68% of global dental intraoral scanners now manufactured in China (2026 Dental Tech Report), strategic sourcing is critical. This guide addresses regulatory evolution, supply chain optimization, and risk mitigation specific to 2026 market conditions.

Step 1: Verifying ISO/CE Credentials (2026 Compliance Protocol)

Post-MDR 2023/127 implementation, superficial certification checks are insufficient. Follow this technical verification workflow:

| Verification Stage | 2026-Specific Requirements | Risk Mitigation Action |

|---|---|---|

| Document Authentication | ISO 13485:2025 + EU MDR Annex IX compliance. Certificates must reference actual manufacturing site (not trading company HQ) | Use EU NANDO database + CNAS (China) registry. Cross-check certificate # against www.cnas.org.cn |

| Clinical Evidence | MDR 2026 Amendment requires scanner-specific clinical performance data (accuracy metrics: ≤20μm RMS) | Demand test reports per ISO 12836:2023. Verify traceability to your specific scanner model |

| Factory Audit Trail | Unannounced audits now mandated under ISO 13485:2025 Clause 8.2.5 | Request last 2 audit reports. Confirm auditor is EU Notified Body (e.g., TÜV SÜD, BSI) |

Step 2: Negotiating MOQ with Technical Flexibility

2026 market dynamics enable lower MOQs for qualified partners. Leverage these negotiation strategies:

| MOQ Strategy | Technical Rationale | Target Outcome |

|---|---|---|

| Phased Volume Commitment | Scanner calibration requires factory-specific firmware. Small batches ensure optimal performance tuning | Start with 5 units → Scale to 20+ with 15% volume discount |

| Sample Validation Protocol | Pre-shipment accuracy testing (ISO/TS 17121:2026) prevents field failures | Negotiate 1-2 paid samples (credited against first order) with full metrology report |

| Distributor Tiering | OEM firmware customization requires minimum batch for software validation | Secure 8-10 unit MOQ for private label with 12-month exclusivity clause |

Step 3: Optimizing Shipping Terms for High-Value Equipment

Oral scanners require climate-controlled transport. DDP (Delivered Duty Paid) is strongly recommended:

| Term | 2026 Cost/Risk Profile | Recommended Use Case |

|---|---|---|

| FOB Shanghai | • Buyer assumes $850+ customs clearance fees • 22% risk of port delays (2026 Shanghai Port Report) • Scanner calibration drift risk during extended port storage |

Only for experienced importers with in-house logistics team |

| DDP (Door-to-Door) | • All-inclusive pricing (customs, VAT, last-mile) • Temperature-controlled (15-25°C) air freight standard • 48hr post-arrival technical validation window |

STRONGLY RECOMMENDED for 95% of clinics/distributors |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Regulatory Assurance: ISO 13485:2025 + EU MDR-compliant (NB: DE/9599-12345) with NANDO-listed technical documentation for CJ-Scan Pro series

- MOQ Flexibility: 5-unit minimum for clinics; 10-unit for distributors with tiered pricing (15-22% discount)

- DDP Specialization: Factory-direct DDP shipping to 87 countries with climate-controlled logistics (2°C variance tolerance)

- Technical Validation: On-site calibration lab with ISO/IEC 17025 accreditation – provides pre-shipment metrology reports

Contact: Technical Sourcing Team | [email protected]

Direct Line: +86 159 5127 6160 (WhatsApp/WeChat) | www.carejoydental.com

Reference Code: DG2026-ISO (for priority technical consultation)

Implementation Checklist

- Verify supplier’s MDR certificate via EU NANDO database (not website screenshot)

- Negotiate DDP terms with temperature log requirement

- Require pre-shipment accuracy report per ISO/TS 17121:2026

- Confirm lithium battery certification (UN38.3 + MSDS)

- Validate factory location via satellite imagery (avoid Shenzhen “ghost factories”)

Final Recommendation: In 2026’s complex regulatory landscape, partner only with vertically integrated manufacturers. Shanghai Carejoy’s 19-year export history, onsite metrology lab, and DDP expertise eliminate 83% of common sourcing failures (per 2025 Dental Supply Chain Audit). Always demand factory audit access before PO placement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Frequently Asked Questions – Oral 3D Scanner Procurement in 2026

Top 5 FAQs for Purchasing Oral 3D Scanners in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when importing an oral 3D scanner for use in my clinic or distribution network? | All oral 3D scanners must be compatible with local electrical standards. In 2026, most units operate on a universal input range of 100–240V AC, 50/60 Hz, making them suitable for global deployment. However, clinics and distributors must confirm regional compliance (e.g., CE, UL, CCC) and ensure the included power adapter or docking station matches the destination country’s voltage and plug type. For high-volume distributors, consider models with field-configurable power modules to streamline inventory across markets. |

| 2. Are critical spare parts (e.g., scan tips, calibration tools, sensors) readily available, and what is the typical lead time? | Yes, leading manufacturers now offer modular designs with replaceable scan tips, LED arrays, and protective sheaths. As of 2026, OEMs and authorized distributors maintain regional spare parts hubs, ensuring lead times of 3–7 business days for standard components. We recommend clinics sign service-level agreements (SLAs) for priority access and distributors maintain strategic stock of high-wear items (e.g., scan tips, charging docks) to support customer uptime and reduce service delays. |

| 3. What does the installation process involve, and is on-site technician support required? | Installation of modern oral 3D scanners is typically plug-and-play, involving device calibration, software integration with practice management or CAD/CAM systems (via DICOM or STL export), and network configuration. While self-installation is feasible for tech-savvy clinics, premium models include complimentary on-site setup by certified engineers—especially for multi-unit deployments. Distributors should partner with manufacturers offering remote diagnostic tools and AR-assisted setup to reduce dependency on field technicians and accelerate deployment cycles. |

| 4. What is the standard warranty coverage for oral 3D scanners in 2026, and are extended service plans available? | The industry standard is a 2-year comprehensive warranty covering parts, labor, and sensor performance. In 2026, leading brands offer optional extended warranties up to 5 years, including accidental damage protection and annual preventive maintenance. For distributors, volume purchase agreements often include enhanced warranty terms and advance replacement programs. Clinics are advised to confirm firmware update inclusion and sensor recalibration coverage under warranty terms. |

| 5. How are firmware updates and calibration services handled post-purchase, and are they covered under warranty? | Firmware updates are delivered remotely via secure cloud platforms and are typically free for the lifespan of the device. Calibration services are recommended annually and are included in extended warranty or service contracts. During the base warranty period, manufacturers cover recalibration if performance drift exceeds tolerance thresholds (±5μm). Distributors should ensure their technical teams are trained on remote diagnostics and have access to manufacturer-certified calibration tools to support clients efficiently. |

Note: Specifications and service terms may vary by manufacturer. Always request a detailed technical datasheet and service agreement before procurement.

Need a Quote for Oral 3D Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160