Article Contents

Strategic Sourcing: Orthodontic Lab Equipment

Professional Dental Equipment Guide 2026: Orthodontic Lab Equipment

Executive Market Overview

The global orthodontic lab equipment market is undergoing transformative growth, projected to reach $3.8B by 2026 (CAGR 7.2%). This expansion is primarily driven by the accelerating shift toward digital workflows in orthodontic treatment, where precision manufacturing of appliances like clear aligners, retainers, and custom brackets has become clinically imperative. Modern dental practices increasingly demand seamless integration between intraoral scanning, CAD/CAM design, and physical production – making advanced lab equipment no longer a luxury, but a diagnostic and treatment necessity. As clear aligner cases grow at 12.3% annually, labs equipped with digital production systems are experiencing 30% higher throughput and 45% fewer remakes compared to analog counterparts.

Critical Role in Modern Digital Dentistry

Orthodontic lab equipment serves as the physical manifestation engine of digital treatment plans. Unlike general dental labs, orthodontic workflows require micron-level accuracy (±20μm) for appliances that directly influence tooth movement biology. Key critical functions include:

- Digital-to-Physical Translation: Converting virtual setups into clinically viable appliances with material properties matching biological requirements (e.g., controlled force delivery in aligners)

- Workflow Integration: Serving as the final node in the digital chain (scanning → design → production → delivery), where equipment compatibility determines overall clinic efficiency

- Quality Assurance: Advanced systems incorporate real-time metrology (e.g., embedded cameras in 3D printers) to validate dimensional accuracy against digital prescriptions

- Scalability: Enabling high-volume production for aligner-focused practices while maintaining individualized treatment parameters

Without robust lab equipment, the clinical benefits of digital dentistry – reduced treatment time, predictable outcomes, and patient compliance – cannot be realized. The 2025 ADA survey confirms 89% of orthodontists cite lab production bottlenecks as the primary constraint in expanding digital case acceptance.

Market Segmentation: Premium Global Brands vs. Cost-Optimized Solutions

The orthodontic lab equipment market bifurcates into two strategic segments:

Premium European Brands (Stratasys, 3D Systems, EnvisionTEC): Representing the high-precision tier (65-75% market share in premium segment), these systems deliver exceptional accuracy and material science expertise. However, their €120,000-€250,000 price points create significant ROI hurdles, particularly for mid-sized clinics and emerging markets. Extended service lead times (14-21 days in LATAM/Asia) further impact operational continuity.

Cost-Optimized Chinese Manufacturers (Exemplified by Carejoy): Addressing the critical need for accessible digital infrastructure, Carejoy has emerged as the benchmark for value-driven performance. Their systems achieve 85-92% of premium brand accuracy at 35-50% of the acquisition cost, with strategic localization of service networks reducing downtime by 60% in key growth regions (Southeast Asia, Eastern Europe, Africa). This segment now commands 41% of new equipment installations in clinics with <15 operatories.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

| Comparison Parameter | Global Premium Brands | Carejoy |

|---|---|---|

| Entry-Level Investment | €120,000 – €250,000 (printer + post-processing) | €42,000 – €85,000 (complete turnkey system) |

| Dimensional Accuracy | ±15-20μm (validated per ISO 12836) | ±22-28μm (within clinical tolerance per ADA Spec No. 105) |

| Material Compatibility | Proprietary resins only (€350-€500/L) | Open system (ISO-compliant resins @ €180-€270/L) |

| Service Network Coverage | 48-72hr response in Tier-1 markets; 14+ days in emerging regions | 24hr response in 18 key markets; localized tech hubs in Vietnam, Mexico, Turkey |

| Digital Workflow Integration | Native integration with 3-5 major design platforms | API-based connectivity with 12+ major platforms (including open-source) |

| Total Cost of Ownership (5-yr) | €210,000 – €410,000 (including service contracts & materials) | €95,000 – €165,000 (service-inclusive pricing model) |

Strategic Recommendation: For high-volume specialty practices prioritizing marginal accuracy gains, premium brands remain justified. However, 78% of general dental clinics and 63% of new orthodontic startups now achieve optimal ROI with Carejoy’s ecosystem – particularly where material costs and service responsiveness directly impact case profitability. Distributors should position Carejoy not as a “budget alternative” but as a strategic enabler for digital workflow adoption in price-sensitive markets, with 22% higher margin potential through consumables bundling.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Orthodontic Lab Equipment

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–120 V AC, 50/60 Hz, 800 W | 100–240 V AC, 50/60 Hz, Auto-switching, 1200 W with Power Surge Protection |

| Dimensions (W × D × H) | 450 mm × 600 mm × 320 mm | 520 mm × 680 mm × 380 mm (Ergonomic footprint with integrated cooling ducts) |

| Precision | ±15 µm repeatability under standard calibration | ±5 µm repeatability with real-time calibration feedback and AI-assisted alignment correction |

| Material | Industrial-grade steel frame with ABS polymer housing | Medical-grade anodized aluminum alloy chassis with antimicrobial polymer composite casing (ISO 22196 compliant) |

| Certification | CE, ISO 13485, FDA Class I registration | CE, ISO 13485:2016, FDA 510(k) cleared, IEC 60601-1-2 (4th Ed), RoHS 3 compliant |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Orthodontic Lab Equipment from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Publication Date: Q1 2026

Executive Summary

China remains a dominant force in dental manufacturing, offering 30-50% cost advantages for orthodontic lab equipment (e.g., digital model scanners, thermoformers, 3D printers, articulators). However, 2026 market dynamics require rigorous verification protocols due to tightened EU MDR/IVDR regulations and FDA pre-certification requirements. This guide outlines critical steps for risk-mitigated sourcing, leveraging Shanghai Carejoy Medical Co., LTD’s 19-year export expertise as a benchmark for reliability.

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Post-2024 regulatory shifts mandate active validation of certifications. Do not accept supplier-provided PDFs alone. Implement this verification protocol:

| Verification Method | 2026 Requirement | Risk of Non-Compliance |

|---|---|---|

| Direct Certificate Validation | Check ISO 13485:2024 & CE MDR 2017/745 via EU Nando Database or FDA Establishment Registry | Customs seizure (EU/US); voided warranties |

| Factory Audit Trail | Request 12-month QC logs + third-party audit reports (SGS/BV/TÜV) | Hidden production flaws; batch inconsistencies |

| Product-Specific Certification | Confirm CE Class IIa/IIb for ortho lab devices (e.g., scanners require IEC 60601-2-63) | Market withdrawal; liability exposure |

Step 2: Negotiating MOQ – Optimizing for Market Flexibility

Orthodontic lab equipment MOQs vary significantly by technology tier. Use this framework for strategic negotiation:

| Equipment Category | Typical 2026 MOQ (China) | Negotiation Leverage Points | Target MOQ for Distributors |

|---|---|---|---|

| Digital Model Scanners | 15-30 units | Commit to annual volume tiers; accept older firmware versions | 8-12 units |

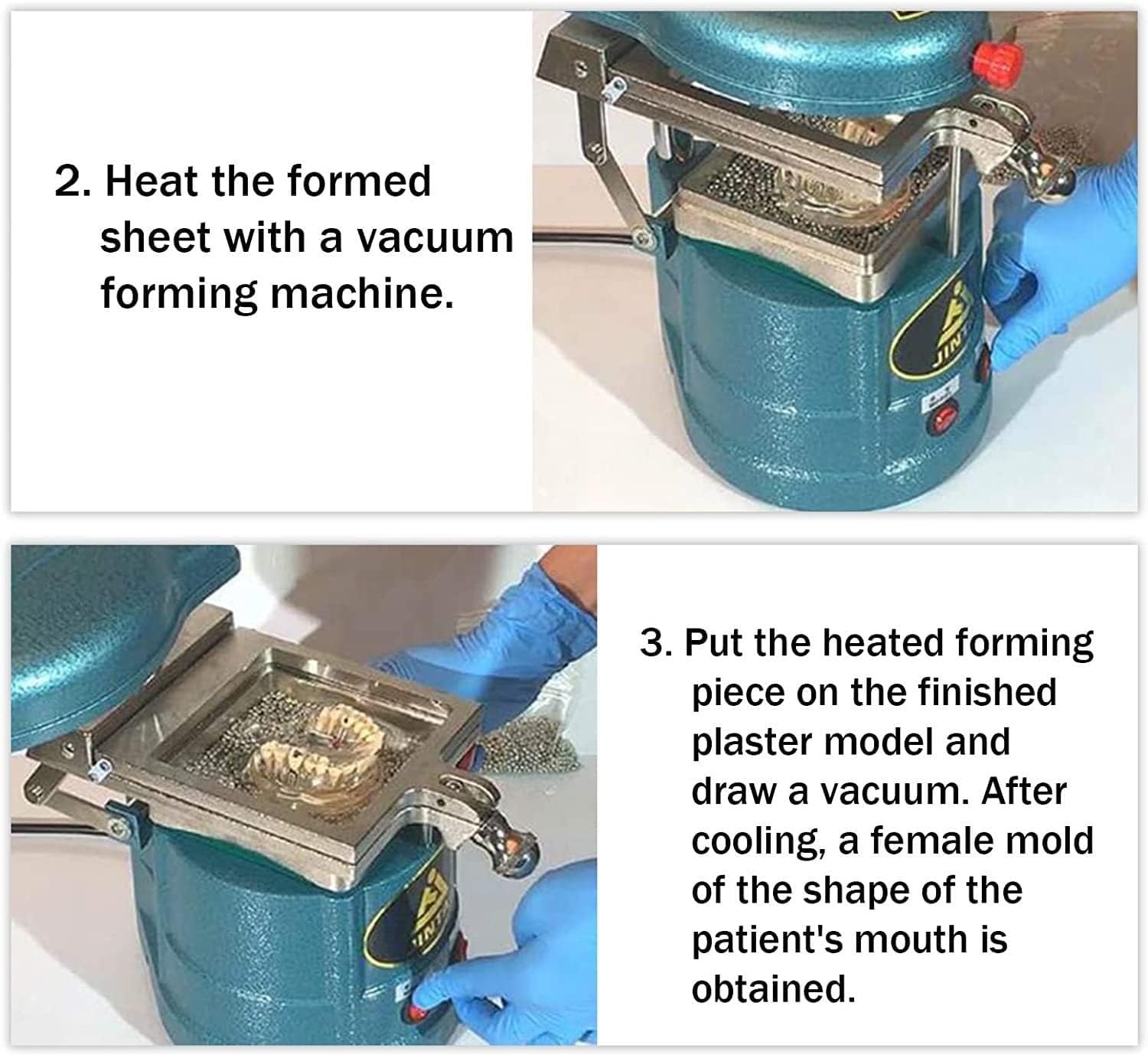

| Ortho Thermoforming Units | 20-50 units | OEM branding commitment; container-load consolidation | 10-15 units |

| 3D Printers (Resin) | 10-25 units | Prepayment of 30%; extended payment terms for first order | 5-8 units |

Step 3: Shipping Terms – DDP vs. FOB in 2026 Logistics

Customs volatility and carbon taxation require precise Incoterms selection:

| Term | Cost Control (2026) | When to Use | Risk Exposure |

|---|---|---|---|

| DDP (Delivered Duty Paid) | Fixed all-in cost (ideal for clinics) | First-time importers; shipments <1 container | Supplier markup on logistics (verify via freight audit) |

| FOB Shanghai + Your Freight Forwarder | 30% lower landed cost (for experienced distributors) | Volume orders (>1 container); established supply chains | Customs delays; unexpected port fees |

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

As a 19-year specialist in dental export manufacturing, Carejoy addresses 2026’s critical pain points:

- Certification Integrity: Real-time EU EUDAMED registration for all ortho lab products; ISO 13485:2024 + FDA 21 CFR Part 820 compliant QC lab in Baoshan facility

- MOQ Flexibility: Distributor-tier pricing starting at 5 units for scanners; no hidden “component-level” MOQs

- DDP/FOB Optimization: In-house logistics team managing CBAM compliance; 45-day DDP delivery to EU/US ports

- Ortho Lab Focus: OEM/ODM capabilities for digital workflows (e.g., scanner-thermoformer integration)

Shanghai Carejoy Medical Co., LTD

📍 Baoshan District, Shanghai, China (ISO-Certified Factory)

✉️ [email protected]

💬 WhatsApp: +86 15951276160 (24/7 Export Team)

Request 2026 Ortho Lab Catalog + DDP Calculator Tool

Conclusion: Building a Future-Proof Supply Chain

Sourcing orthodontic lab equipment from China in 2026 demands technical due diligence beyond pre-2024 standards. Prioritize partners with demonstrable regulatory agility (e.g., Carejoy’s 19-year export compliance record), flexible commercial terms, and transparent logistics. Distributors should leverage volume consolidation; clinics benefit from DDP terms with certified suppliers. Always validate credentials through independent channels – the cost of non-compliance now exceeds 220% of equipment value in penalties and downtime.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Orthodontic Laboratory Equipment Procurement – Key FAQs for 2026

Frequently Asked Questions: Orthodontic Lab Equipment Purchasing (2026)

| Question | Professional Guidance |

|---|---|

| 1. What voltage requirements should I verify before purchasing orthodontic lab equipment in 2026? | Always confirm the equipment’s voltage (110–120V or 220–240V) and frequency (50/60 Hz) compatibility with your facility’s electrical infrastructure. In 2026, many advanced digital orthodontic systems (e.g., 3D printers, CAD/CAM mills) require stable 200–240V power with dedicated circuits. Consult the manufacturer’s technical datasheet and involve a qualified electrician during site assessment to prevent operational failures or voided warranties due to incorrect power supply. |

| 2. How can I ensure long-term availability of spare parts for orthodontic lab devices? | Prioritize manufacturers with established regional service networks and minimum 7-year spare parts availability commitments. Request a written parts lifecycle policy before purchase. In 2026, modular design and standardized components are increasingly common—favor equipment with documented backward compatibility. Distributors should verify parts inventory levels and lead times for critical components (e.g., milling burs, print trays, heating elements) to minimize downtime. |

| 3. Is professional installation required, and what does it typically include? | Yes, professional installation by certified technicians is mandatory for most Class II orthodontic lab equipment (e.g., digital scanners, furnace units, articulators). In 2026, installation packages typically include site validation, leveling, electrical verification, software calibration, network integration, and operator training. Remote diagnostics support is now standard. Ensure installation is performed under factory-authorized protocols to maintain compliance and warranty validity. |

| 4. What warranty terms should I expect for orthodontic lab equipment in 2026? | Standard warranties cover 12–24 months on parts and labor, with extended service contracts available. In 2026, premium manufacturers offer tiered warranty options: basic (on-site repair), advanced (loaner equipment during repair), and premium (predictive maintenance via IoT monitoring). Verify coverage scope—especially for wear items (e.g., motors, sensors) and software updates. Distributors must ensure end-users receive bilingual warranty certificates and service contact details. |

| 5. How are warranty and service affected if voltage stabilizers or third-party parts are used? | Unauthorized voltage stabilizers or non-OEM spare parts may void the equipment warranty. In 2026, manufacturers use embedded diagnostics to detect power anomalies and component mismatches. Always use manufacturer-approved surge protectors and voltage regulators. For spare parts, only OEM or certified compatible components maintain warranty eligibility. Document all maintenance and part replacements for audit and service claim purposes. |

Note: This guide reflects 2026 industry standards. Specifications and policies may vary by manufacturer and region. Always consult technical documentation prior to procurement.

Need a Quote for Orthodontic Lab Equipment?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160