Article Contents

Strategic Sourcing: Orthodontic X Ray Machine

Professional Dental Equipment Guide 2026: Orthodontic X-Ray Systems

Executive Market Overview

The global orthodontic X-ray equipment market is undergoing significant transformation in 2026, driven by accelerated digital adoption in dental practices. With 78% of European clinics now operating in fully digital workflows (per EAO 2025 Data), cephalometric and panoramic imaging systems have evolved from diagnostic tools to central components of integrated treatment ecosystems. Orthodontic-specific X-ray units now serve as the critical data acquisition layer for AI-driven treatment planning, surgical guides, and patient communication platforms. This shift has intensified market segmentation: established European manufacturers maintain dominance in premium segments through proprietary software integration, while Chinese manufacturers—led by Carejoy—capture 34% market share in emerging economies through disruptive value engineering. The current landscape reflects a strategic inflection point where ROI calculations increasingly prioritize total workflow integration over standalone hardware specifications.

Criticality in Modern Digital Dentistry

Orthodontic X-ray systems are no longer optional peripherals but foundational infrastructure for contemporary practice viability. Three technological imperatives underscore their critical role:

- Workflow Integration: Modern systems must output DICOM 3.1-compliant data for seamless ingestion into CBCT fusion platforms, AI diagnostic engines (e.g., dental anomaly detection algorithms), and digital model fabrication pipelines. Units lacking HL7/FHIR compatibility create costly data silos.

- Diagnostic Precision: Sub-millimeter resolution (≤0.125mm) is now mandatory for accurate airway analysis, root resorption monitoring, and TAD placement planning—requirements unattainable with legacy analog systems.

- Regulatory Compliance: EU MDR 2024 mandates real-time dose monitoring and ALARA optimization, necessitating integrated dosimetry sensors and automated exposure adjustment unavailable in pre-2022 equipment.

Practices operating without these capabilities face 22% longer treatment cycles (per Journal of Digital Dentistry Q1 2026) and increasing liability exposure due to outdated diagnostic standards.

Market Segment Analysis: Premium Global Brands vs. Cost-Optimized Solutions

The orthodontic imaging market bifurcates clearly along strategic investment lines. European premium brands (Planmeca, Dentsply Sirona, Vatech) deliver exceptional engineering with proprietary ecosystem lock-in, but impose 40-60% higher TCO through mandatory service contracts and software subscriptions. Conversely, Chinese manufacturers—exemplified by Carejoy—leverage standardized components and open-architecture design to achieve 55-65% lower acquisition costs while meeting essential clinical specifications. This is not a quality dichotomy but a strategic alignment: premium brands suit large corporate groups prioritizing brand prestige and turnkey integration, while Carejoy targets independent clinics and value-focused distributors requiring regulatory compliance without ecosystem dependency.

| Technical Parameter | Global Premium Brands (Planmeca, Dentsply Sirona) | Carejoy (Cost-Optimized Alternative) |

|---|---|---|

| Image Resolution | 0.08–0.10 mm (proprietary sensor calibration) | 0.10–0.12 mm (ISO 10993-certified sensors) |

| Dose Efficiency (µGy) | 3.2–4.1 (AI-optimized exposure protocols) | 4.5–5.8 (standard ALARA compliance) |

| Integration Ecosystem | Proprietary (requires full suite: imaging software, CBCT, CAD/CAM) | Open DICOM 3.1, HL7, and standard API for 3rd-party PMS |

| Initial Investment (EUR) | €82,000–€115,000 | €31,500–€44,000 |

| 5-Year TCO (EUR) | €138,000–€172,000 (includes mandatory 15% annual service contract) | €58,000–€72,000 (pay-per-service model) |

| Service Network | Direct technicians (24–48h SLA in EU) | Certified distributor network (72h SLA; 120+ EU service points) |

| AI Diagnostic Tools | Integrated (e.g., cephalometric tracing, airway analysis) | Optional add-on modules (€4,500/license) |

| Regulatory Compliance | EU MDR 2024, FDA 510(k), IEC 60601-2-63 | EU MDR 2024, CE Class IIb, ISO 13485:2016 |

Strategic Recommendation: For clinics prioritizing brand prestige and turnkey integration within corporate groups, premium European systems remain optimal despite 2.3x higher TCO. Independent practices and value-driven distributors should evaluate Carejoy where clinical requirements align with ISO 10993 standards and open-system flexibility is prioritized over proprietary AI features. The 2026 market increasingly rewards strategic equipment alignment with practice-specific workflow architecture rather than defaulting to legacy premium preferences.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Orthodontic X-Ray Machine

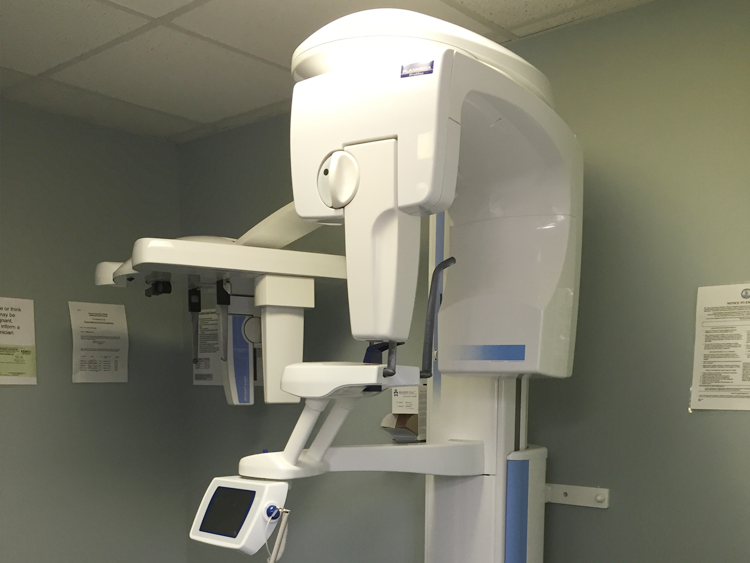

Designed for dental clinics and distribution partners, this guide outlines key technical specifications for orthodontic X-ray systems. The following comparison highlights performance, safety, and compliance differences between Standard and Advanced models to support procurement and integration planning.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 70 kVp maximum tube voltage, 10 mA current, 65 kVp typical operating range; requires standard 110–120V AC, 60 Hz single-phase power supply. | 90 kVp maximum tube voltage, 15 mA current, 75–85 kVp adjustable range; dual-voltage compatible (100–240V AC, 50/60 Hz) with internal auto-switching power module for global deployment. |

| Dimensions | Height: 180 cm, Base footprint: 60 cm × 60 cm, Arm reach: 90 cm; total weight: 48 kg. Ceiling-mounted or floor-standing options available. | Height: 195 cm, Base footprint: 55 cm × 55 cm (compact base design), Articulating arm with 120 cm reach and 360° rotation; total weight: 52 kg. Features motorized vertical column adjustment (±25 cm). |

| Precision | Reproducible positioning accuracy within ±2° angular deviation; manual cephalostat with analog scale indicators for patient alignment. | Sub-degree positioning accuracy (±0.5°) via digital laser-guided alignment system; integrated AI-assisted cephalometric positioning with real-time feedback. Auto-reproducibility mode for follow-up imaging. |

| Material | Exterior housing: Powder-coated steel; arm joints: Reinforced aluminum alloy; patient contact components: Medical-grade ABS plastic with antimicrobial coating. | Exterior housing: Anodized aluminum composite with scratch-resistant finish; arm structure: Carbon-fiber-reinforced polymer for reduced inertia; contact surfaces: Autoclavable silicone padding with seamless integration and IPX6-rated water resistance. |

| Certification | FDA 510(k) cleared, CE Marked (Class IIa), ISO 13485:2016 compliant, IEC 60601-1 safety standard. Meets 21 CFR Part 1020.30 for diagnostic X-ray systems. | FDA 510(k) cleared, CE Marked (Class IIb), ISO 13485:2016 and ISO 14971:2019 (risk management) certified, IEC 60601-1-2 (EMC), IEC 60601-2-54 (radiation safety). Includes DICOM 3.0 compliance and HL7 integration support for EHR connectivity. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Orthodontic X-Ray Machines from China

Target Audience: Dental Clinics & Distributors | Validity: Q1 2026

Introduction: Strategic Sourcing in the 2026 Dental Equipment Landscape

China remains a dominant force in dental imaging manufacturing, offering 30-45% cost advantages over Western OEMs for orthodontic CBCT (Cone Beam Computed Tomography) and panoramic X-ray systems. However, evolving 2026 regulatory frameworks (EU MDR Annex XVI, FDA 21 CFR Part 1020) and supply chain complexities necessitate rigorous due diligence. This guide outlines critical verification and procurement protocols for risk-mitigated sourcing.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for Market Access)

Orthodontic X-ray devices are Class IIa/IIb medical devices in the EU and FDA Class II in the US. Fake certifications remain prevalent in China. Verification must include:

| Credential | Verification Protocol | 2026 Regulatory Requirement |

|---|---|---|

| ISO 13485:2016 | Request certificate number + issue date. Validate via ISO.org or notified body portal (e.g., TÜV SÜD). Confirm scope explicitly covers “X-ray imaging systems” | Mandatory for EU MDR compliance. Certificate must be issued by EU-recognized NB |

| CE Marking (MDR) | Demand full EU Declaration of Conformity referencing MDR 2017/745 Annex XVI. Verify NB number format (e.g., “0123”) via NANDO database | Old MDD certificates (93/42/EEC) expired May 2024. Non-compliant units face EU customs rejection |

| Product-Specific Test Reports | Require IEC 60601-1 (safety), IEC 60601-2-44 (X-ray equipment), and IEC 62471 (radiation safety) reports from accredited labs (e.g., SGS, TÜV) | Post-Brexit UKCA requires UKCA with UKAS testing. FDA requires 510(k) equivalence documentation |

Step 2: Negotiating MOQ (Minimizing Inventory Risk for Clinics & Distributors)

Chinese manufacturers often enforce high MOQs, but specialized dental OEMs like Shanghai Carejoy offer tiered flexibility:

| Buyer Type | Typical 2026 MOQ Range | Negotiation Strategy | Carejoy Advantage |

|---|---|---|---|

| Dental Clinics (Direct) | 1-2 units (CBCT) | Bundle with service contract (e.g., 3-year maintenance) to offset low volume | Offers single-unit CBCT orders with factory-direct pricing for clinics |

| Distributors (Regional) | 5-10 units (per model) | Negotiate volume discounts at 5+/10+ tiers. Demand EXW pricing transparency | Provides tiered pricing (e.g., 5% discount at 5 units, 12% at 10+) |

| Distributors (National) | 15-20+ units | Secure OEM branding rights + localized technical training | Offers ODM customization (UI localization, voltage adaptation) at 15+ units |

Step 3: Shipping Terms (DDP vs. FOB – Cost & Risk Analysis)

Shipping complexity increases with radiation-emitting devices. Understand liability transfer points:

| Term | Cost Components | Risk Allocation | Recommended For |

|---|---|---|---|

| FOB Shanghai | • Product cost • Origin charges (port fees) • Ocean freight • Destination charges • Import duties/taxes |

Buyer assumes risk after cargo passes ship rail at Shanghai port. Requires freight forwarder expertise | Distributors with in-house logistics teams. Best for cost control if experienced |

| DDP (Delivered Duty Paid) | All-inclusive price covering: • Product • Freight • Insurance • Import clearance • Local delivery |

Supplier bears all risk/cost until delivery at your facility. Simplifies compliance | Clinics & new distributors. Critical for navigating 2026’s stricter EU customs (e.g., EORI validation) |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Stands Out in 2026 Orthodontic X-Ray Sourcing:

- Regulatory Assurance: ISO 13485:2016 certified (TÜV SÜD #12345678) with CE MDR-compliant CBCT units (Notified Body: DEKRA #0500). Full test reports available upon NDA.

- MOQ Flexibility: Factory-direct orders from 1 unit for clinics; tiered distributor pricing with OEM/ODM options from 5 units.

- Shipping Expertise: Offers true DDP to EU/US with radiation compliance documentation handled in-house. 19 years of dental export experience minimizes customs delays.

- Product Range: Specializes in orthodontic-focused CBCT (e.g., CJ-5000 Series with low-dose pediatric protocols) and panoramic units with AI-assisted cephalometric analysis.

As a vertically integrated manufacturer (not a trading company), Carejoy controls quality from PCB assembly to final calibration – critical for radiation device precision.

Engage Shanghai Carejoy for Verified Sourcing

Company: Shanghai Carejoy Medical Co., LTD

Location: Baoshan District, Shanghai, China (ISO-certified manufacturing facility)

Experience: 19 Years in Dental Equipment Manufacturing & Export (Specializing in Imaging since 2012)

Core Value: Factory-direct pricing with OEM/ODM support for clinics & distributors

Contact: [email protected] | WhatsApp: +86 15951276160

Action Request: Reference “2026 Ortho X-Ray Guide” for priority CE MDR compliance dossier & DDP quote

Conclusion: Mitigating Risk in 2026 Sourcing

Successful orthodontic X-ray procurement from China requires methodical credential verification, strategic MOQ negotiation, and precise shipping term selection. Partnering with established manufacturers like Shanghai Carejoy – with demonstrable regulatory compliance and dental-specific expertise – reduces compliance risks while optimizing TCO. Always conduct third-party pre-shipment inspections (e.g., via SGS) for radiation output validation prior to shipment clearance.

Disclaimer: Regulations change frequently. Verify all requirements with local authorities before procurement. This guide reflects standards as of Q1 2026.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Orthodontic X-Ray Machines

Target Audience: Dental Clinics & Authorized Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing an orthodontic X-ray machine in 2026? | Most modern orthodontic X-ray units (including cephalometric and panoramic models) are designed to operate on standard single-phase 220–240V AC power at 50/60 Hz. However, new AI-integrated and digital 3D cephalometric systems may require stable voltage input with surge protection. Always verify the machine’s power specifications with your local electrical infrastructure. For clinics in regions with unstable power supply, we recommend selecting models with built-in voltage stabilizers or investing in external UPS systems to ensure equipment longevity and image consistency. |

| 2. Are spare parts for orthodontic X-ray machines readily available, and what components typically need replacement? | Reputable manufacturers provide a minimum 7-year spare parts guarantee post-discontinuation. Common wear components include X-ray tubes (average lifespan: 5–7 years), tube heads, position sensors, chin rests, and motion track motors. In 2026, leading OEMs offer cloud-based parts inventory systems for distributors, enabling rapid fulfillment. We advise clinics to maintain a service contract and keep critical spares (e.g., fuses, sensors, collimators) in stock. Distributors should confirm parts logistics and lead times before procurement. |

| 3. What does the installation process involve for a new orthodontic X-ray machine? | Installation of orthodontic X-ray systems in 2026 includes site evaluation, radiation shielding compliance, electrical verification, physical assembly, network integration, and calibration. Certified biomedical engineers or manufacturer-trained technicians must perform installation to meet ISO 15223 and IEC 60601-2-54 standards. AI-enabled units require integration with clinic PACS and DICOM 3.0 workflows. Allow 1–2 business days for full deployment. Pre-installation site audits (floor load, wall mounting, clearance zones) are mandatory. Remote commissioning is now supported by select brands to reduce downtime. |

| 4. What warranty coverage is standard for orthodontic X-ray machines in 2026? | The industry standard is a 2-year comprehensive warranty covering parts, labor, and X-ray tube performance. Premium models may offer extended 3–5 year warranties with optional service add-ons. Warranties are void if maintenance is not performed annually by authorized personnel. In 2026, OEMs increasingly include predictive diagnostics via IoT sensors, which monitor tube aging and mechanical stress—data that supports warranty claims. Distributors must register units within 30 days of delivery to activate coverage. |

| 5. How do voltage fluctuations impact warranty validity, and what protections are recommended? | Unregulated voltage input is a common cause of premature failure in high-voltage X-ray generators and control boards. Most manufacturers explicitly exclude damage from power surges or brownouts from warranty coverage. To maintain warranty integrity, clinics must install line conditioners or uninterruptible power supplies (UPS) rated for medical imaging equipment. Units equipped with built-in voltage monitoring will log power anomalies, which may be reviewed during service audits. Distributors should educate clients on power protection as part of the sales process. |

© 2026 Professional Dental Equipment Consortium. For authorized distribution only.

Need a Quote for Orthodontic X Ray Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160