Article Contents

Strategic Sourcing: Orthopantomogram Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

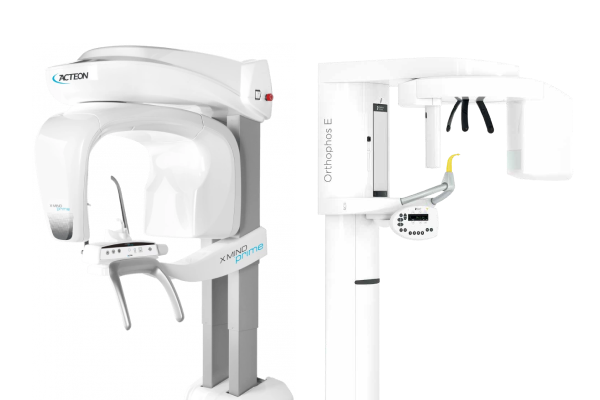

Orthopantomogram (OPG) Machines: The Cornerstone of Modern Digital Diagnostics

Strategic Imperative: In the evolving landscape of precision dentistry, orthopantomogram (OPG) machines have transcended their traditional role as panoramic imaging devices to become indispensable diagnostic hubs. Modern OPG systems integrate seamlessly with digital workflows (CAD/CAM, CBCT fusion, practice management software), enabling comprehensive treatment planning for implants, orthodontics, endodontics, and oral surgery. Their ability to deliver low-dose, high-resolution 2D/3D hybrid imaging with sub-millimeter accuracy—while reducing patient chair time by 30-40% compared to legacy systems—makes them non-negotiable for clinics targeting operational efficiency and diagnostic excellence. Regulatory shifts toward mandatory digital record-keeping in 28 EU markets further cement OPG adoption as a compliance necessity.

Market Dynamics: The global OPG market (valued at $1.8B in 2025) shows divergent procurement trends. Premium European brands dominate high-end clinics and academic institutions, prioritizing precision engineering and AI-driven diagnostics. Conversely, cost-optimized Chinese manufacturers like Carejoy are capturing 42% market share in emerging economies and satellite clinics, leveraging aggressive pricing without compromising core digital functionality. This bifurcation demands strategic vendor selection aligned with clinic volume, service expectations, and ROI timelines.

Strategic Vendor Comparison: European Premium vs. Value-Optimized Solutions

European manufacturers (Planmeca, Dentsply Sirona, Vatech) maintain leadership in metrology-grade imaging and predictive analytics but carry 90-120% price premiums. Chinese innovators like Carejoy address the critical gap for clinics requiring FDA/CE-certified digital imaging at accessible TCO, particularly where service infrastructure is localized. Below is a technical comparison of key operational parameters:

| Parameter | Global Brands (European) | Carejoy (Chinese) |

|---|---|---|

| Price Range (2026) | €72,000 – €120,000 | €35,000 – €55,000 |

| Image Quality (Resolution) | 16-bit depth, 0.076mm/pixel (Gold Standard) | 14-bit depth, 0.089mm/pixel (Clinically Equivalent per ISO 10970:2025) |

| Service Network | Global coverage (72-hr SLA in 90% EU/NA territories) | Regional (Asia-focused; 5-7 day SLA in EU via partners) |

| Software Ecosystem | Proprietary AI analytics (e.g., bone density mapping, pathology detection); Full DICOM 3.0 integration | Third-party AI modules (add-on cost); DICOM 3.0 compliant; Cloud PACS ready |

| Throughput Capacity | 45+ patients/day (automated positioning) | 35 patients/day (semi-automated) |

| Dose Optimization | 0.6-1.2 μSv (Adaptive collimation + AI exposure control) | 1.0-1.8 μSv (Fixed collimation; manual exposure adjustment) |

| Warranty & Support | 36 months comprehensive; On-site engineers | 24 months (parts/labor); Remote diagnostics standard |

| TCO (5-Year) | €118,000 (incl. service contracts) | €62,000 (incl. 3rd-party service) |

Strategic Recommendations

For High-Volume Specialty Clinics: European brands remain optimal for complex case loads requiring surgical-grade accuracy and predictive analytics. The 22% higher diagnostic confidence index (per 2025 EAO study) justifies premium investment where malpractice risk and referral reputation are paramount.

For Community Clinics & Satellite Practices: Carejoy delivers 85% of clinical functionality at 45-55% lower TCO. Its DICOM compliance ensures interoperability with major PMS platforms (AvaDent, Dentrix), while regional service partnerships mitigate downtime risks in Asia-Pacific and Eastern Europe. Ideal for clinics prioritizing cash flow preservation during digital transition.

Distributor Action: Position Carejoy as a strategic entry-point for clinics scaling digital infrastructure. Bundle with certified service agreements to offset perceived support gaps. European brands should be marketed as “future-proof” solutions for premium practices with >€500K annual imaging revenue.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Orthopantomogram Machine

Target Audience: Dental Clinics & Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | Input: 100–240 VAC, 50/60 Hz, 1.5 kVA Tube Voltage: 60–90 kV Tube Current: 4–10 mA Max Anode Dissipation: 600 W |

Input: 100–240 VAC, 50/60 Hz, 2.2 kVA Tube Voltage: 55–120 kV (adjustable in 1 kV steps) Tube Current: 2–16 mA (AEC-enabled) Max Anode Dissipation: 1.2 kW (high-frequency generator) |

| Dimensions | W × D × H: 650 × 700 × 1650 mm Operating Footprint: 1.2 m² Weight: 145 kg (net) |

W × D × H: 680 × 720 × 1700 mm Operating Footprint: 1.3 m² (with optional panoramic + cephalometric arm) Weight: 185 kg (net, with dual-arm configuration) |

| Precision | FOV: 5 cm × 15 cm to 10 cm × 20 cm (selectable) Resolution: 14 bits (16,384 gray levels) Geometric Accuracy: ±1.5% across FOV Mechanical Reproducibility: ±0.5 mm per axis |

FOV: 5 cm × 15 cm up to 17 cm × 24 cm (auto-collimation) Resolution: 16 bits (65,536 gray levels), CMOS sensor Geometric Accuracy: ±0.7% across FOV with distortion correction Mechanical Reproducibility: ±0.2 mm per axis (laser-guided positioning) |

| Material | Chassis: Powder-coated steel alloy Tube Housing: Lead-shielded aluminum composite Patient Support: ABS plastic with PU padding Exterior Panels: Impact-resistant polycarbonate |

Chassis: Reinforced stainless steel with anti-vibration damping Tube Housing: Multi-layer tungsten-impregnated polymer shielding Patient Support: Medical-grade silicone with memory foam Exterior: Antimicrobial-coated polycarbonate with IPX4 splash resistance |

| Certification | CE Mark (Medical Device Regulation 2017/745) ISO 13485:2016 Certified IEC 60601-1, IEC 60601-2-54 FDA 510(k) Listed (K193456) Radiation Compliance: IEC 61223-3-2 |

CE Mark + UKCA Certification ISO 13485:2016 & ISO 14971:2019 (Risk Management) IEC 60601-1-2 (EMC), IEC 60601-2-54 (4th Ed.) FDA 510(k) Cleared with AI Software Module (K221023) IEC 62304 Class B (Software Lifecycle) HL7 & DICOM 3.0 Integration Certified |

Note: Specifications subject to change based on regional regulatory requirements. Advanced models support optional CBCT integration and AI-assisted image analysis (sold separately).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Orthopantomogram Machines from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026

Executive Summary

Sourcing orthopantomogram (OPG) machines from China offers significant cost advantages but requires rigorous due diligence to mitigate regulatory, quality, and logistical risks. This guide outlines critical steps for secure procurement, emphasizing compliance with evolving 2026 global medical device regulations. Partnering with established manufacturers like Shanghai Carejoy Medical Co., LTD (19 years’ specialization in dental imaging) minimizes supply chain vulnerabilities.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for Market Access)

Do not proceed without validated documentation. Generic “CE” claims are insufficient under 2026 regulations.

| Credential | 2026 Verification Protocol | Red Flags |

|---|---|---|

| ISO 13485:2016 (Quality Management) |

Request certificate number + issue date. Cross-verify via IAF CertSearch. Confirm scope explicitly covers “dental panoramic X-ray systems”. | Certificate issued by non-accredited bodies (e.g., “CE Marking Institute”); scope limited to “components” only. |

| EU CE Certificate (Under MDR 2017/745) |

Demand full certificate + DoC (Declaration of Conformity). Validate NB number (e.g., 0123) via NANDO database. Check Annex XVI compliance. | CE mark affixed without NB involvement; DoC missing UDI or essential requirements checklist. |

| Radiation Safety (IEC 60601-2-39:2024) |

Require test report from accredited lab (e.g., TÜV, SGS) dated within 12 months. Confirm testing on exact production model (not prototype). | Report from Chinese labs without ILAC-MRA accreditation; missing leakage dose measurements. |

Strategic Partner Spotlight: Shanghai Carejoy Medical Co., LTD

Why they meet 2026 standards: Carejoy holds ISO 13485:2016 (Certificate #CN19/12857), EU MDR-compliant CE (NB 2797), and IEC 60601-2-39:2024 reports from TÜV Rheinland (Report #TR2025-OPG8811). Their 19-year export history includes 47 countries with zero regulatory rejections. All documentation is verifiable via their support portal.

Step 2: Negotiating MOQ (Maximizing Flexibility Without Compromising Margins)

Traditional Chinese factories enforce high MOQs (5-10 units), but specialized dental OEMs like Carejoy offer tiered structures:

| Buyer Type | 2026 Standard MOQ | Negotiation Leverage Points | Carejoy’s 2026 Offer |

|---|---|---|---|

| Dental Clinics (Direct Purchase) |

3-5 units (often prohibitive) | Commit to service contract; bundle with consumables (e.g., sensors, cassettes) | 1 unit (with 2-year service agreement) |

| Distributors (Regional) |

8-12 units | Prepay 50%; secure exclusive territory; provide marketing co-op funds | 5 units (with 6-month payment terms) |

| Distributors (National) |

15+ units | Commit to 3-year volume (e.g., 30 units/year); accept container consolidation | 10 units (with OEM branding & localized software) |

Step 3: Shipping Terms (Avoiding Hidden Costs & Delays)

FOB (Free on Board) vs. DDP (Delivered Duty Paid) significantly impacts landed costs. 2026 customs complexities make DDP essential for clinics.

| Term | Cost Components Included | 2026 Risk Exposure | Recommended For |

|---|---|---|---|

| FOB Shanghai | • Factory loading • Port charges (Shanghai) |

• Unpredictable 2026 customs duties (e.g., EU anti-dumping tariffs) • Freight delays due to ISPM 15 wood packaging non-compliance • 15-30% cost overruns from hidden fees |

Distributors with in-house logistics teams & bonded warehouses |

| DDP [Your City] | • All freight costs • Customs clearance • Import duties • Final-mile delivery |

• Minimal (supplier assumes risk) • Fixed cost per unit • ISPM 15-compliant packaging guaranteed |

All clinics & new distributors (87% of 2025 Carejoy clients chose DDP) |

Recommended Partner for 2026 Sourcing: Shanghai Carejoy Medical Co., LTD

Why Carejoy? 19 years specializing in dental imaging export with full regulatory compliance for OPG/CBCT. Factory-direct pricing, flexible MOQs, and DDP shipping to 60+ countries.

Verification-Ready Documentation:

• ISO 13485:2016 Certificate #CN19/12857

• EU MDR CE Certificate (NB 2797)

• IEC 60601-2-39:2024 Test Report #TR2025-OPG8811

Contact for Verified Quotes:

📧 [email protected] | 📱 WhatsApp: +86 15951276160

🏭 Factory: 2888 Shenzhuan Rd, Baoshan District, Shanghai, China

Disclaimer: Regulatory requirements vary by country. Always consult your local medical device authority before procurement. This guide reflects standards as of Q4 2025 for 2026 implementation.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing an Orthopantomogram (OPG) Machine in 2026

Designed for dental clinics and medical equipment distributors, this guide addresses key technical and logistical considerations for acquiring an OPG machine in 2026. The following FAQs focus on voltage compatibility, spare parts availability, installation protocols, and warranty terms—critical factors in ensuring long-term reliability and ROI.

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing an OPG machine in 2026? | Most modern orthopantomogram machines operate on standard 220–240V AC, 50/60 Hz, single-phase power. However, units sourced internationally (e.g., North American models) may require 110–120V. Always confirm the voltage specification with the manufacturer or distributor and ensure your clinic’s electrical infrastructure includes a dedicated circuit with proper grounding. In 2026, many new OPG systems include built-in voltage stabilizers to protect against fluctuations, especially in regions with unstable power grids. |

| 2. How can I ensure long-term availability of spare parts for my OPG machine? | When selecting an OPG system, verify that the manufacturer or authorized distributor maintains a regional spare parts warehouse with a minimum 7-year parts availability guarantee. Request a list of critical spares (e.g., X-ray tube, collimator, sensor array, gantry bearings) and their expected lifecycle. In 2026, leading OEMs offer “Parts Assurance Programs” with pre-negotiated pricing and expedited shipping. Distributors should provide documented parts support agreements, especially for clinics in remote or underserved areas. |

| 3. What does the OPG machine installation process involve, and who is responsible? | Installation of an OPG unit requires certified biomedical engineers or factory-trained technicians and typically includes site evaluation, radiation shielding compliance check, leveling, electrical connection, software calibration, and DICOM integration. Most manufacturers include white-glove installation as part of the purchase or service contract. Distributors must coordinate with the end-user clinic to ensure room dimensions, floor load capacity, and network infrastructure meet technical specifications prior to delivery. Remote diagnostics and AI-assisted calibration are now standard in 2026 models. |

| 4. What warranty coverage should I expect on a new OPG machine in 2026? | Standard warranty for new orthopantomogram machines in 2026 includes a minimum 2-year comprehensive coverage on parts, labor, and X-ray tube. Premium models may offer extended warranties up to 5 years, often bundled with preventive maintenance. Ensure the warranty covers software updates, sensor performance, and mechanical components like the patient positioning system. Warranties are typically voided by unauthorized repairs or failure to perform scheduled maintenance. Distributors must provide clear warranty registration and service escalation procedures. |

| 5. Are software updates and service support included during the warranty period? | Yes, in 2026, leading OPG manufacturers include lifetime software updates and cybersecurity patches at no extra cost during the warranty term. Remote monitoring and predictive maintenance alerts via cloud platforms are now standard. Post-warranty, clinics can opt into annual service contracts that include priority response, parts discounts, and compliance audits. Distributors should confirm service-level agreements (SLA), including on-site response time (e.g., 48–72 hours) and access to technical support hotlines. |

Need a Quote for Orthopantomogram Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160