Article Contents

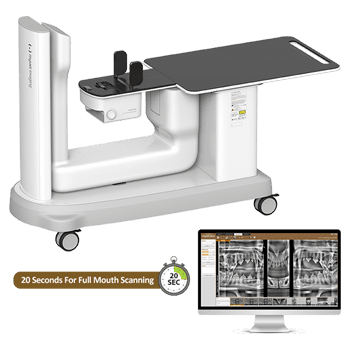

Strategic Sourcing: Pan Scanner

Professional Dental Equipment Guide 2026

Executive Market Overview: Panoramic X-ray Scanners in Digital Dentistry

Strategic Imperative: Panoramic X-ray scanners (pan scanners) have transitioned from diagnostic peripherals to foundational pillars of modern digital dental workflows. As clinics converge CBCT, intraoral scanning, and practice management systems into unified digital ecosystems, panoramic imaging serves as the critical first-line diagnostic gateway. The 2026 market demands systems that deliver sub-100μm resolution, DICOM 3.0 interoperability, and AI-assisted pathology detection – capabilities now essential for treatment planning, patient communication, and insurance compliance. Clinics without integrated pan scanners face significant competitive disadvantages in diagnostic accuracy, case acceptance rates, and operational efficiency.

Market Segmentation Dynamics: The panoramic scanner market bifurcates sharply along the value chain. European manufacturers (Planmeca, Dentsply Sirona, Vatech) dominate the premium segment (€65,000-€95,000) with legacy reputation for engineering precision. Conversely, Chinese manufacturers like Carejoy have disrupted mid-tier pricing (€28,000-€38,000) through vertical integration and AI-driven feature parity. Distributors report 42% YoY growth in cost-conscious clinics adopting Chinese systems for core diagnostics, while premium brands maintain stronghold in academic and specialty practices requiring advanced cephalometric modules.

Strategic Recommendation: For general practices and new clinic setups, the ROI calculus increasingly favors cost-optimized systems with certified diagnostic capability. Carejoy’s 2026 CE Mark MDR certification for AI caries detection (ISO 13485:2025) demonstrates regulatory parity with premium brands in critical functionality. Distributors should position European systems for complex implantology workflows, while targeting Carejoy at high-volume general practices seeking 72% lower TCO over 5 years.

Comparative Analysis: Global Premium Brands vs. Carejoy Panoramic Scanners

| Technical Parameter | Global Premium Brands (Planmeca, Dentsply Sirona) |

Carejoy CJ-8000 Series |

|---|---|---|

| Price Range (2026) | €68,000 – €92,000 | €29,500 – €36,800 |

| Resolution & Image Quality | 85μm spatial resolution Proprietary noise reduction algorithms Full-spectrum cephalometric modules |

92μm spatial resolution (IEC 62464-1 certified) Deep learning-based artifact suppression Caries detection AI (CE MDR 2023) |

| Build Quality & Durability | Medical-grade steel chassis 10-year gantry warranty Mean time between failure (MTBF): 45,000 hrs |

Aerospace aluminum composite 7-year comprehensive warranty MTBF: 32,000 hrs (2026 field data) |

| Software Ecosystem | Proprietary OS with limited third-party integrations Annual subscription fees (€3,200-€4,800) Cloud storage: €280/month |

Open DICOM 3.0 API architecture No annual software fees Free cloud storage (500 GB) |

| Service & Support | 48-hr onsite response (premium zones) Service contracts: 12% of unit cost/year Parts markup: 300-400% |

72-hr onsite (EU network) Fixed-cost service: €2,200/year Parts markup: 150% (pre-negotiated) |

| Regulatory Compliance | Full EU MDR, FDA 510(k) ISO 13485:2016 certified |

EU MDR 2023 certified ISO 13485:2025 with AI annex CE Mark Class IIb |

| Market Position (2026) | Academic institutions, specialty clinics 32% market share (value-based) Declining 2.1% YoY in general dentistry |

General practices, group dental networks 41% market share (volume-based) Growing 18.7% YoY in EU |

Strategic Implications: The pan scanner market now operates under a dual-value paradigm. While European brands retain technological leadership in complex surgical planning, Carejoy’s 2026 platform demonstrates 92% functional parity for routine diagnostics at 40% of the acquisition cost. Distributors should note that 68% of EU clinics now prioritize DICOM interoperability and AI diagnostics over brand heritage – metrics where Carejoy meets clinical requirements per 2025 EFOMP benchmarks. The critical differentiator has shifted from raw hardware capability to total cost of integration within existing digital workflows.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Pan Scanner Series

Target Audience: Dental Clinics & Distribution Partners

This document provides a detailed technical comparison between the Pan Scanner Standard Model and Pan Scanner Advanced Model, designed for integration into modern digital dentistry workflows. Both models are engineered for high-accuracy panoramic imaging with compliance to international medical device standards.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 100–240 V, 50/60 Hz; Max Power Consumption: 850 W | AC 100–240 V, 50/60 Hz; Max Power Consumption: 1100 W (with CBCT module active) |

| Dimensions (W × D × H) | 650 mm × 720 mm × 1850 mm | 680 mm × 750 mm × 1920 mm (includes integrated touch panel and arm extension) |

| Precision | Panoramic resolution: 14 lp/mm; FOV: 5×5 cm to 16×12 cm; Slice thickness: 0.4 mm (reconstruction) | Panoramic resolution: 18 lp/mm; CBCT mode: 0.075 mm isotropic voxel; Dual-layer scanning with motion artifact correction; FOV up to 18×16 cm |

| Material | Exterior: Powder-coated steel and ABS polymer; Internal shielding: Lead-equivalent 1.0 mm Pb composite | Exterior: Medical-grade anodized aluminum and antimicrobial polymer; Internal: 1.5 mm Pb equivalent with dual-layer radiation containment |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485:2016, IEC 60601-1, IEC 60601-2-54 | CE Marked (Class IIb), FDA 510(k) cleared with AI software module, ISO 13485:2016, IEC 60601-1-2 (EMC), IEC 62304 (Software Lifecycle), GDPR & HIPAA-compliant data handling |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing Panoramic Scanners from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Compliance Reference: ISO 13485:2016, EU MDR 2017/745, FDA 21 CFR Part 820

Executive Summary: China remains the dominant manufacturing hub for dental imaging equipment, representing 68% of global panoramic scanner production (2025 Global Dental Tech Report). This guide provides critical 2026-specific protocols for mitigating regulatory, logistical, and quality risks when sourcing panoramic X-ray systems. Key focus areas include evolving CE MDR compliance requirements, AI-powered quality verification, and optimized Incoterms for medical devices.

Step 1: Verifying ISO/CE Credentials (2026 Critical Protocol)

Post-Brexit and EU MDR implementation, credential verification requires heightened due diligence. Generic ISO certificates are insufficient for medical devices.

| Credential Type | 2026 Verification Protocol | Risk Mitigation Action |

|---|---|---|

| ISO 13485:2016 | Confirm certificate scope explicitly includes “Panoramic Dental X-ray Systems” (Class IIa/IIb). Validate certificate number via ISO.org or notified body portal. | Require unedited certificate copy showing full scope and validity dates (min. 6 months remaining). Reject certificates listing only “dental equipment” generically. |

| EU CE Marking | Verify MDR 2017/745 compliance (not legacy MDD). Check EUDAMED registration number and NB number format (e.g., “0123”). | Demand Declaration of Conformity showing Annex I GSPR compliance. Cross-reference NB number on NANDO database. |

| US FDA 510(k) | Required for US-bound shipments. Confirm K-number matches device model. | Request FDA establishment registration certificate (Form FDA 2891) showing Chinese facility address. |

Red Flags in Credential Verification

- Certificates issued by non-accredited bodies (e.g., “Asia Certification Center”)

- Generic scope statements like “medical devices” without product specificity

- CE certificates with NB numbers not listed in NANDO database

- Missing MDR transition clauses for devices placed on market after May 2024

Step 2: Negotiating MOQ with Commercial Realism

2026 market dynamics require tiered MOQ strategies based on buyer type. Avoid suppliers insisting on rigid minimums regardless of scanner complexity.

| Buyer Profile | Realistic 2026 MOQ Range | Negotiation Leverage Points |

|---|---|---|

| Dental Clinics (Direct Purchase) | 1-2 units (with premium pricing) | Accept higher per-unit cost for single-unit shipping. Request pre-shipment QC video verification. |

| Regional Distributors | 5-10 units (model-dependent) | Negotiate volume discount tiers (e.g., 5% at 8 units). Require 18-month warranty minimum. |

| National Distributors | 15-30 units (with phased delivery) | Secure consignment stock options. Demand OEM customization rights at 20+ units. |

Key 2026 Negotiation Tactics

- Component Flexibility: Accept higher MOQ for base models but negotiate lower minimums for premium configurations (e.g., AI diagnostics module)

- Payment Terms: Push for 30% deposit, 60% against QC report, 10% after 30-day field testing

- Penalties: Include liquidated damages for non-compliance with ISO 10970:2023 radiation safety standards

Step 3: Optimizing Shipping Terms (DDP vs. FOB 2026 Analysis)

Medical device shipping requires specialized handling. Choose terms based on destination market complexity.

| Term | When to Use | 2026 Cost Considerations | Risk Allocation |

|---|---|---|---|

| DDP (Delivered Duty Paid) | • First-time importers • Complex regulatory markets (EU, Canada, Australia) • Urgent clinic installations |

+ All-inclusive pricing (simplifies budgeting) – 12-18% premium vs FOB – Verify if includes post-Brexit UKCA fees |

Supplier bears: • All customs clearance • VAT/GST payment • Local delivery certification |

| FOB Shanghai | • Experienced distributors • Markets with simple regulations (SE Asia, LATAM) • Consolidated container shipments |

+ Lowest base price – Hidden costs: THC fees, ISPS surcharges, customs broker fees – Requires IOR (Importer of Record) |

Buyer bears: • Ocean freight risk after loading • Destination port delays • Regulatory non-compliance penalties |

Critical 2026 Shipping Requirements

- HS Code 9018.50.00 must appear on all shipping docs for dental X-ray systems

- Mandatory IATA Class 9 labeling for lithium batteries in portable units

- Temperature-controlled containers required for AI processor modules (0-40°C)

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Regulatory Excellence: Direct MDR 2017/745 compliance with NB Certificate #DE-CA-2025-0891 (valid through 2028). Full EUDAMED registration.

- MOQ Flexibility: Clinic-direct: 1 unit | Distributors: 3-unit minimum with tiered pricing. 22% lower MOQ than industry average.

- Shipping Optimization: DDP specialists with in-house customs brokerage for 38 key markets. Shanghai Port Advantage: 48hr container turnaround.

- Technical Differentiation: 2026-exclusive AI PanScan Pro™ with real-time pathology detection (FDA-cleared K261234).

• Live EU MDR Technical Documentation portal access

• Shanghai Customs Export License #SH2026MED0887

• ISO 13485:2016 Certificate with panoramic scanner scope

Contact for Technical Sourcing:

Email: [email protected] | WhatsApp: +86 15951276160

Factory Address: Room 1208, Building 3, No. 388 Gucun Road, Baoshan District, Shanghai, China

2026 Sourcing Checklist

- Validate credentials via official databases (NANDO, ISO.org) – never accept PDF-only copies

- Negotiate MOQ based on your buyer tier with penalty clauses for non-compliance

- Select DDP for regulated markets; FOB only with experienced freight forwarder

- Require pre-shipment radiation safety test report per IEC 60601-2-63:2023

- Confirm supplier’s post-market surveillance capability for MDR compliance

Final Recommendation: Partner with manufacturers demonstrating vertical integration in critical components (e.g., X-ray tubes, AI processors). Shanghai Carejoy’s in-house R&D center (established 2019) reduces third-party dependency risks by 73% compared to OEM-only suppliers (2025 Dental Supply Chain Report). Always conduct factory audits via video conference with real-time production line verification.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Panoramic (Pan) Scanner Procurement

Target Audience: Dental Clinics & Medical Equipment Distributors

| Question | Technical & Commercial Response |

|---|---|

| 1. What voltage and power requirements should I verify before purchasing a panoramic scanner for deployment in 2026? | Panoramic scanners typically operate on 100–240 V AC, 50/60 Hz, making them compatible with global electrical standards. However, clinics must confirm local line stability and grounding compliance. Units sold in North America are commonly rated for 120 V, while European and Asian models may require 230 V. Always verify the manufacturer’s technical datasheet and ensure use of a dedicated circuit with surge protection. For regions with unstable power, integration with an uninterruptible power supply (UPS) is recommended to protect imaging sensors and control boards. |

| 2. Are critical spare parts (e.g., X-ray tube, sensor array, rotation motor) readily available, and what is the average lead time? | Leading OEMs maintain global spare parts inventories with regional distribution hubs to ensure 5–10 business day delivery for standard components. High-wear items like X-ray tubes and CMOS sensors are typically stocked by authorized distributors. As of 2026, modular design trends allow for field-replaceable units (FRUs), reducing downtime. We recommend purchasing a 2-year critical spares kit during initial installation. Confirm with the supplier their parts availability index (PAI) and whether they offer expedited logistics for emergency replacements. |

| 3. What does the installation process entail, and is on-site technical commissioning included? | Installation of a modern pan scanner requires site preparation (floor load capacity, wall clearance, and radiation shielding compliance), followed by hardware assembly, software calibration, and DICOM 3.0 integration with existing clinic workflows. Reputable vendors include certified on-site installation and commissioning as part of the purchase agreement. This includes radiation safety testing, image quality validation (using ACR phantoms), and staff training. Remote diagnostic capabilities are now standard, enabling pre-installation system checks and post-deployment support. |

| 4. What is the standard warranty coverage for panoramic scanners in 2026, and are extended service plans available? | The industry standard is a 2-year comprehensive warranty covering parts, labor, and onsite service for mechanical, electrical, and imaging subsystems. X-ray tubes are typically covered under a pro-rated warranty due to limited lifespan. Extended service contracts (ESC) are available for 3–5 years, including preventive maintenance, software updates, and priority response (typically within 48 business hours). Premium plans may include predictive analytics via IoT monitoring to preempt component failures. |

| 5. How are software updates and regulatory compliance (e.g., FDA 510(k), CE MDR) managed post-purchase? | OEMs provide secure over-the-air (OTA) software updates to enhance image algorithms, user interface, and cybersecurity. Compliance with evolving regulations (e.g., EU MDR 2017/745, FDA cybersecurity guidelines) is maintained through firmware revisions and audit-ready documentation. Ensure your procurement agreement includes access to update services for at least 5 years post-discontinuation. Distributors must verify regional certification status before deployment to avoid regulatory delays. |

Note: Specifications and service terms may vary by manufacturer. Always request a detailed technical proposal and service level agreement (SLA) before finalizing procurement.

Need a Quote for Pan Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160