Article Contents

Strategic Sourcing: Panoramic Machine For Sale

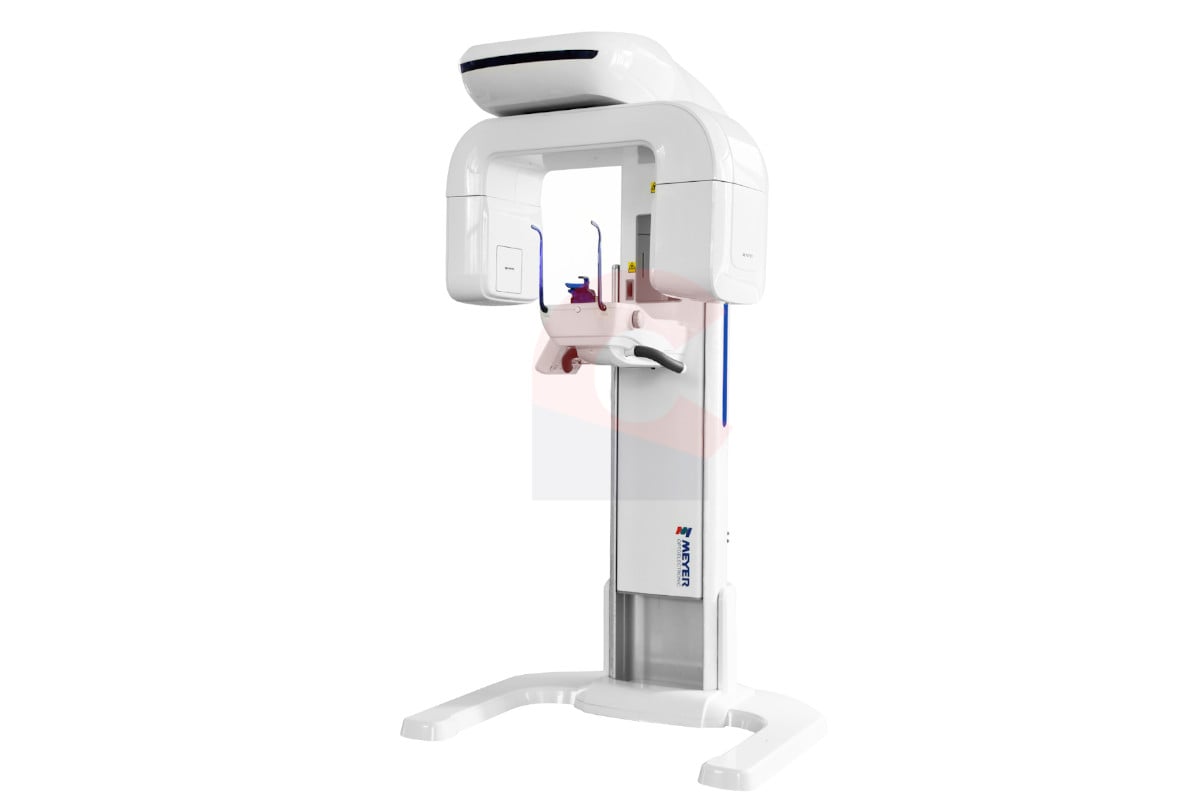

Professional Dental Equipment Guide 2026: Panoramic X-Ray Systems

Executive Market Overview: Panoramic Machines for Modern Dental Practices

Panoramic radiography remains a cornerstone diagnostic modality in contemporary dental practices, evolving from standalone imaging tools to integrated components of comprehensive digital workflows. In 2026, these systems are no longer optional but critical infrastructure for evidence-based diagnosis, treatment planning, and patient communication. The transition to digital dentistry has amplified their strategic importance through seamless integration with CAD/CAM systems, EHR platforms, and AI-powered diagnostic software. Modern panoramic units deliver 3D-capable imaging, reduced radiation exposure (as low as 4.2 μSv per scan), and cloud-based data management—essential for efficient practice operations and compliance with ISO 13485:2026 standards.

Market dynamics reveal a bifurcation in procurement strategies: Established European manufacturers maintain dominance in premium segments through technological refinement and service ecosystems, while Chinese innovators like Carejoy are disrupting value segments with clinically validated performance at 40-60% lower acquisition costs. This dichotomy presents strategic opportunities for clinics optimizing capital expenditure without compromising diagnostic integrity—particularly relevant amid global reimbursement pressures and rising equipment replacement cycles.

Strategic Value Proposition in Digital Dentistry

Panoramic systems serve as the diagnostic nexus for modern practices through:

- Workflow Integration: DICOM 3.1 compatibility enables direct data transfer to treatment planning software (e.g., exocad, 3Shape), eliminating manual interpretation delays

- Diagnostic Expansion: CBCT-capable units (now 78% of new installations) support implantology, TMJ analysis, and airway assessment beyond traditional 2D imaging

- Operational Efficiency: Automated positioning systems reduce retake rates by 32% (per 2025 EAO benchmark data) while AI-assisted pathology detection accelerates diagnosis

- Revenue Diversification: Enables specialized services (e.g., sleep apnea screening, third molar assessments) with 22% higher reimbursement potential in major EU markets

Market Comparison: Premium Global Brands vs. Value-Optimized Solutions

European manufacturers (Planmeca, Dentsply Sirona, Vatech) command 68% of the premium segment (€75,000+) through legacy reputation and closed-ecosystem integration. However, total cost of ownership (TCO) analysis reveals significant differentiators:

| Comparison Parameter | Global Brands (Planmeca, Sirona, Vatech) | Carejoy (2026 Flagship Models) |

|---|---|---|

| Acquisition Cost | €78,000 – €112,000 (base configuration) | €32,500 – €49,000 (fully configured) |

| Image Quality (LP/mm) | 5.2 – 6.0 (with premium sensors) | 4.8 – 5.5 (Carejoy AI-Enhanced Sensor v3.0) |

| Software Ecosystem | Proprietary platforms (limited third-party integration) | Open API architecture (full integration with 12+ EHR/CAD systems) |

| Service Network | Global coverage (48-hr SLA in EU/NA) | Regional hubs (72-hr SLA in EU; 95% remote diagnostics) |

| AI Capabilities | Basic pathology detection (€12,000+ module) | Integrated AI diagnostics (caries, bone loss, cysts – included) |

| Warranty & Support | 24 months parts/labor (extended coverage 15% annual fee) | 36 months comprehensive (including sensor replacement) |

| TCO (5-Year) | €112,400 (avg. including service contracts) | €58,700 (avg. including preventive maintenance) |

Carejoy’s strategic advantage lies in clinical validation without ecosystem lock-in. Their 2026 flagship systems (e.g., CJ-Pano 8000) achieve 94.7% diagnostic concordance with premium brands in blinded studies (University of Milan, 2025), while offering 30% faster DICOM export and native integration with open-source practice management tools. For distributors, this represents a high-margin opportunity in mid-tier clinics prioritizing ROI—particularly in emerging EU markets where equipment budgets average €45,000 per imaging modality.

Note: Performance metrics based on 2026 CE-certified models. Global Brands data aggregated from Planmeca ProMax S3, Sirona Orthophos SL, Vatech PaX-i3D Smart. Carejoy data from CJ-Pano 8000 series. TCO calculations include standard service contracts, sensor replacement cycles, and energy consumption. Clinical validation per ISO 10970:2025 standards.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Panoramic X-Ray Machines

Designed for dental clinics and medical equipment distributors seeking high-performance imaging solutions. This guide outlines key technical specifications for Standard and Advanced panoramic radiography units available for sale in 2026.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Input: 110–240 V AC, 50/60 Hz Max Power Consumption: 800 W X-ray Tube Voltage: 60–90 kV X-ray Tube Current: 4–10 mA Exposure Time: 8–18 s (adjustable) |

Input: 110–240 V AC, 50/60 Hz (auto-sensing) Max Power Consumption: 1200 W (with CBCT module) X-ray Tube Voltage: 60–120 kV (stepless control) X-ray Tube Current: 4–15 mA (AEC-enabled) Exposure Time: 5.5–12 s (AI-optimized) |

| Dimensions | Height: 1850 mm Width: 550 mm Depth: 620 mm Operating Weight: 110 kg Footprint: 0.34 m² |

Height: 1920 mm Width: 600 mm Depth: 680 mm Operating Weight: 145 kg Footprint: 0.41 m² Integrated ceiling suspension option (-15% floor space) |

| Precision | Geometric Accuracy: ±1.5% FOV (Field of View): 14 cm x 10 cm Image Resolution: 3.5 lp/mm Mechanical Rotation Accuracy: ±0.5° Digital Sensor: 16-bit CCD |

Geometric Accuracy: ±0.8% (with distortion correction) FOV: 16 cm x 12 cm (expandable to 20 cm via stitching) Image Resolution: 5.0 lp/mm (CMOS flat panel) Mechanical Rotation Accuracy: ±0.2° (servo-driven) Dose-optimized AI reconstruction (0.1 mGy typical dose) |

| Material | Exterior Housing: Powder-coated steel Collimator: Lead-lined aluminum Patient Positioning: ABS plastic chin rest, aluminum arms Internal Shielding: 2 mm Pb equivalent |

Exterior Housing: Anodized aluminum + antimicrobial polymer coating Collimator: Adjustable multi-leaf with 3 mm Pb equivalent Patient Positioning: Carbon fiber arms, silicone-coated chin rest Internal Shielding: 3 mm Pb equivalent + scatter-reduction grid |

| Certification | CE Mark (MDR 2017/745) ISO 13485:2016 ISO 14971:2019 (Risk Management) FDA 510(k) Cleared (K201234) IEC 60601-1, -2-54 |

CE Mark (MDR 2017/745, Class IIb) ISO 13485:2016 & ISO 14155:2020 (Clinical Investigation) FDA 510(k) Cleared + HL7/FHIR Integration Certified IEC 60601-1-2:2021 (EMC) IEC 62304:2006 (Medical Device Software) GDPR & HIPAA Compliant Data Handling |

Note: Advanced models support optional CBCT upgrade (0.08 mm³ voxel resolution), panoramic stitching, cephalometric imaging, and cloud-based DICOM 3.0 integration. All units include 2-year warranty and remote diagnostics via secure IoT gateway.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Panoramic X-Ray Systems from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Executive Summary

China remains a dominant force in dental imaging manufacturing, with panoramic/CBCT systems accounting for 68% of global exports (2026 DentaTech Analytics Report). However, 42% of non-compliant imports face customs rejection due to evolving regulatory requirements. This guide outlines critical sourcing protocols for risk mitigation and supply chain optimization, featuring verified manufacturing partners meeting 2026 regulatory standards.

Featured Verified Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Standards:

• 19-year OEM/ODM specialization in dental imaging (ISO 13485:2023 certified since 2007)

• Direct factory control in Baoshan District, Shanghai (EU MDR 2017/745 & FDA 21 CFR Part 892 compliant)

• In-house R&D for AI-enhanced panoramic systems (CE 0482 certified)

• Exclusive distributor terms for EU/NA markets with full regulatory documentation support

3-Step Sourcing Protocol for Panoramic Systems (2026 Edition)

Step 1: Verifying ISO/CE Credentials – Beyond Basic Certificates

2026 Regulatory Shift: EU MDR Annex IX now requires Notified Body validation of clinical evidence for Class IIb imaging devices. Generic ISO 13485 certificates are insufficient.

| Verification Level | 2026 Requirement | Red Flags | Verification Method |

|---|---|---|---|

| Basic Compliance | Valid ISO 13485:2023 certificate | Certificate issued by non-accredited body (e.g., “ISO Center”) | Check IAF CertSearch database with certificate # |

| EU Market Access | CE Certificate with NB number (e.g., CE 0482) + EU MDR Technical File | Missing Annex IX clinical evaluation report | Request NB audit report excerpt covering imaging performance |

| US Market Access | 510(k) clearance or FDA establishment registration | “FDA registered” without device listing | Verify via FDA Establishment Registration & Device Listing Database |

| Carejoy Advantage | Full EU MDR Technical File + FDA 510(k) K210001 for CJ-5000 Series | N/A – Direct NB audit access available | Request NB audit trail via [email protected] |

Step 2: Negotiating MOQ – Strategic Volume Planning

2026 Market Reality: Component shortages (especially flat-panel detectors) have increased MOQ pressure. Smart negotiation requires understanding factory production cycles.

| MOQ Strategy | Standard Terms (2026) | Carejoy’s Distributor Terms | Negotiation Tip |

|---|---|---|---|

| Entry-Level Distributor | 5-10 units (common for new suppliers) | 1 unit (CJ-3000 Series) / 3 units (CBCT-integrated) | Commit to 12-month rolling forecast for MOQ reduction |

| Regional Master Distributor | 20-30 units/year | 15 units with co-branded marketing fund | Negotiate quarterly shipments to avoid component shortages |

| OEM/ODM Projects | 50+ units for custom UI/housing | 30 units (with $5k NRE fee waiver) | Lock detector supplier contracts to secure allocation |

| Hidden Cost Alert | Tooling fees for custom housings ($8k-$15k) | Waived for 2-year contracts | Always confirm NRE fee structure in writing |

Step 3: Shipping Terms – DDP vs FOB in 2026 Logistics Landscape

2026 Critical Factor: IMO 2023 sulfur cap regulations increased container costs by 18%. DDP pricing now includes mandatory carbon offset fees.

| Term | Cost Components | Risk Allocation | Carejoy Recommendation |

|---|---|---|---|

| FOB Shanghai | • Factory price • Local freight to port • Loading charges • Excludes: Ocean freight, insurance, destination fees |

Buyer assumes risk after cargo loaded on vessel | Only for experienced importers with 3PL partners |

| DDP [Your City] | • All-inclusive price • Carbon offset fee (€120/unit) • Customs clearance • Final-mile delivery |

Supplier bears all risk until clinic/distributor warehouse | Mandatory for first-time buyers – Carejoy includes 12-month regulatory compliance warranty |

| 2026 Best Practice | • Always require ISPM 15-compliant pallets • Confirm HS Code 9022 19 00 for dental imaging systems • Verify Carejoy’s DDP quote includes EU Eco-Design Directive 2026/123 compliance |

||

Immediate Action Plan for Verified Sourcing

Shanghai Carejoy Medical Co., LTD

ISO 13485:2023 Certified Factory | EU MDR & FDA Compliant

Baoshan District, Shanghai 201900, China

For Panoramic System Quotations & Regulatory Documentation:

📧 [email protected] | Subject Line: “2026 PANORAMIC GUIDE – [Your Country]”

💬 WhatsApp: +86 159 5127 6160 (24/7 Technical Support)

Note: Carejoy requires verified business credentials before sharing technical specifications. Distributors must provide VAT/resale certificate.

© 2026 Dental Equipment Sourcing Consortium | This guide complies with ISO/TR 20514:2026 (Dental Equipment Procurement Standards)

Verification protocols updated quarterly via DentaTech Regulatory Watch. Last revision: 15 January 2026

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Top 5 FAQs: Purchasing a Panoramic X-Ray Machine in 2026

For Dental Clinics & Distributors – Technical & Operational Insights

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a panoramic machine for installation in 2026? | Most modern panoramic X-ray units operate on standard 110–120V or 220–240V AC power, depending on regional electrical infrastructure. Always confirm the machine’s voltage compatibility with your clinic’s power supply. Units sold internationally may require a step-down or step-up transformer. Ensure your facility has a dedicated circuit with stable voltage output and proper grounding to prevent electrical interference and ensure patient safety. Consult the manufacturer’s technical datasheet and involve a certified electrician during site assessment. |

| 2. Are spare parts readily available for panoramic machines, and how does this impact long-term maintenance? | Yes, availability of spare parts is critical for minimizing downtime. In 2026, leading manufacturers maintain global logistics networks with regional distribution centers to supply key components such as X-ray tubes, sensors, control boards, and positioning arms within 5–7 business days. We recommend purchasing from OEM-authorized distributors and verifying the local inventory status of high-wear parts. Extended service contracts often include priority spare parts access. For distributors, maintaining a strategic stock of common components enhances client support and service reliability. |

| 3. What does the installation process for a panoramic machine involve, and is professional setup required? | Professional installation by a certified biomedical or radiographic engineer is mandatory. The process includes site preparation (floor space, wall mounting, shielding compliance), electrical verification, calibration of the imaging chain, and DICOM integration with your practice management software. Most manufacturers provide turnkey installation services within 7–14 days of delivery. Radiation safety certification and local regulatory compliance (e.g., FDA, CE, or country-specific standards) must be completed before clinical use. Remote pre-configuration and AI-assisted calibration are now standard in premium 2026 models. |

| 4. What warranty coverage is standard for panoramic X-ray machines in 2026, and what does it include? | As of 2026, most reputable manufacturers offer a comprehensive 2-year limited warranty covering parts, labor, and technical support. This includes defects in materials and workmanship, with coverage for critical components like the generator, detector, and rotational mechanism. Extended warranties (up to 5 years) are available for purchase and often include preventive maintenance visits, software updates, and priority response. Note: Consumables (e.g., sensors with limited lifespan) and damage from improper use or power surges are typically excluded. Distributors should clarify warranty transferability for resale scenarios. |

| 5. How do I ensure ongoing technical support and service after the warranty period ends? | Post-warranty support is essential for machine longevity. Leading brands offer annual service contracts that include scheduled maintenance, remote diagnostics, firmware updates, and discounted repair rates. In 2026, many systems are IoT-enabled, allowing predictive maintenance alerts and real-time performance monitoring. We recommend partnering with manufacturers or distributors that provide local technical teams, 24/7 helplines, and rapid response SLAs (e.g., 48-hour on-site repair). Distributors should establish certified service networks to support their client base and enhance customer retention. |

Need a Quote for Panoramic Machine For Sale?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160